Decoding Fed Minutes: How AI Legalese Decoder Reveals Hawkish Signals and Influences Market Reactions

- February 18, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin’s Underperformance and Market Dynamics

Bitcoin has emerged as the most significant underperformer in the financial markets following the release of the minutes from the FOMC meeting that occurred on January 28. In stark contrast, the US dollar index and bonds have experienced a substantial rally, leading to a complex narrative for cryptocurrency investors.

This dynamic situation has left many pondering the implications of the Federal Reserve’s policy decisions on digital currencies like Bitcoin. Investors are closely monitoring these developments, which indicate a complex interplay between traditional finance and the burgeoning cryptocurrency market.

Insights on the January FOMC Meeting

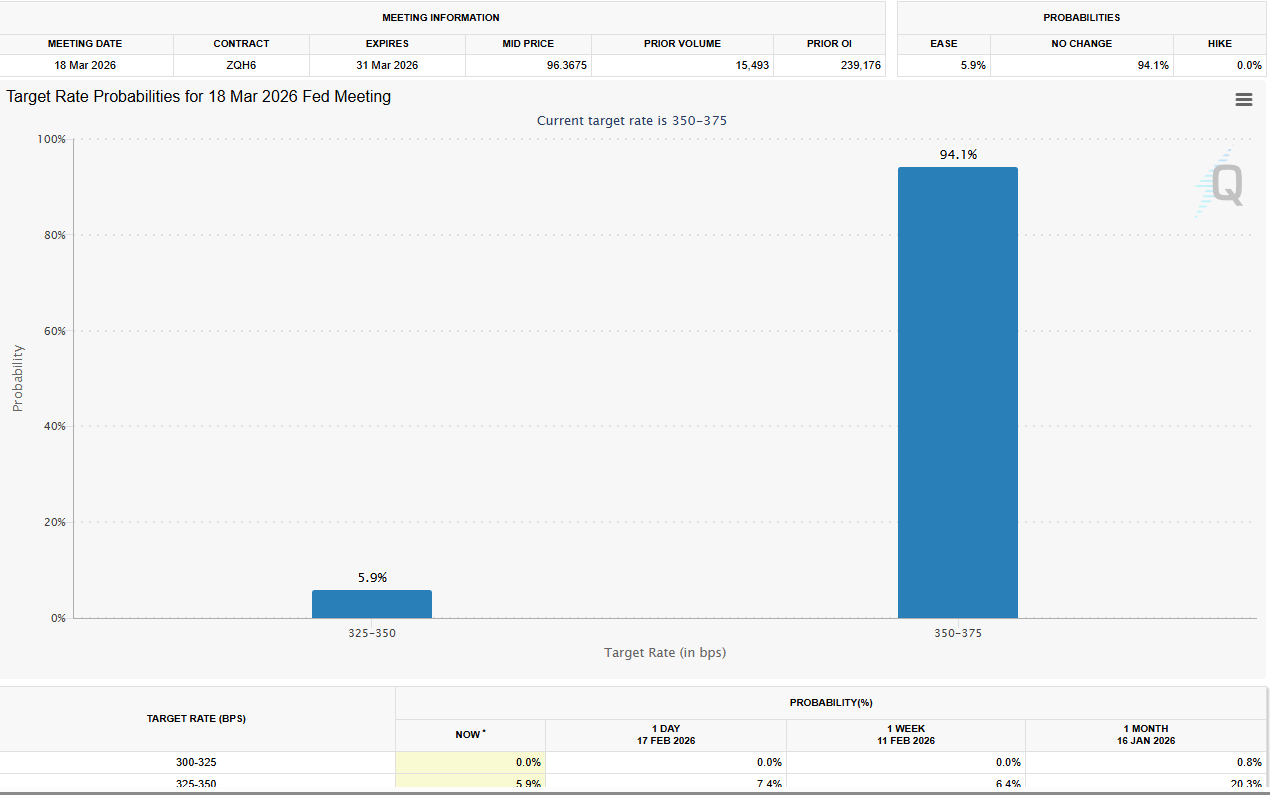

The January FOMC meeting was particularly noteworthy due to the presence of two dovish dissents, revealing a stark divide among Federal Reserve policymakers. Almost all members supported maintaining the federal funds rate consistently within the range of 3.50% to 3.75%. However, a couple of officials favored a modest cut of 25 basis points. They cited concerns surrounding the restrictive nature of the current policy and potential risks in the labor market.

Furthermore, some participants indicated that further rate cuts could be appropriate if inflation trends downward as expected. Meanwhile, several others cautioned against the dangers of easing too soon, highlighting that maintaining the Fed’s 2% inflation target is crucial in a landscape where inflation remains elevated. There were advocates for a “two-sided” approach to guidance, suggesting that rates might need to rise again if inflation continues to surpass the target level.

Key Statements from Fed Officials

Recent discussions from Fed officials have heightened this divide. A notable statement emphasized that several members would have preferred a framework that allows for adjustments in both directions based on future economic indicators. Such sentiments underscore the ongoing uncertainty regarding inflation and its effects on monetary policy.

Economic Indicators and Future Expectations

Recent macroeconomic data have provided a cautiously optimistic backdrop for Fed Chair Jerome Powell’s outlook. Growth metrics have consistently surprised on the upside, inflation appears to be moderating, and the job market shows signs of stability. However, elevated expectations for 2026 rate cuts have been complicated by last week’s stronger-than-expected payroll report, which effectively ruled out a rate cut in March.

This evolving economic landscape also highlights market vulnerabilities. Multiple participants noted risks associated with private credit and broader systemic concerns, which may have contributed to a ‘safe-haven’ buying trend in bonds and the dollar, while Bitcoin continues to face downward pressure.

Equity Market Developments

Despite Bitcoin’s struggles, equities have demonstrated modest gains. The Dow Jones Industrial Average rose by 0.24%, the S&P 500 increased by 0.59%, and the NASDAQ saw a 1.00% uptick. These modest improvements reflect a cautious optimism among investors, informed by the Fed’s latest signals.

“The minutes show a Fed still divided but attentive to both inflation risks and growth momentum,” remarked a senior market strategist. “Bitcoin’s underperformance is partly a reflection of risk-off sentiment and the dollar’s continued strength.”

The Role of AI legalese decoder in Navigating the Financial Landscape

In this complex environment, navigating the intricacies of legal language and financial regulations can be a daunting task for investors. The AI legalese decoder can serve as a vital tool in this context. By converting complex legal jargon into clear, understandable language, it helps investors interpret the implications of Fed announcements and financial documents more effectively. This tool can empower individuals to make informed decisions by demystifying the language surrounding monetary policy and its potential impacts on investment strategies.

Moving Forward with Caution

As we look ahead, investors are advised to remain vigilant and monitor further commentary from Fed officials. This will be crucial as markets digest the recent FOMC minutes and weigh the balance between hawkish vigilance and dovish optimism. The trajectory for monetary policy in 2026 will likely hinge on these discussions, which could significantly influence both traditional and crypto markets.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a