Unlocking Investment Insights: How AI Legalese Decoder Could Have Helped You Achieve a 163% Gain in Brambles (ASX: BXB) Over Five Years

- February 14, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Understanding Stock Investments and AI’s Role

The Risks and Rewards of Stock Investing

When you engage in stock trading, there’s always an inherent risk involved. The possibility exists that the stock you invest in could fall to zero—essentially a complete loss of your investment. However, the flip side is equally enticing. By carefully selecting companies that show promising growth and stability, investors can reap significant rewards, often exceeding 100% returns. For example, the stock price of Brambles Limited (ASX: BXB) has experienced an impressive surge of 128% over the past five years. This stark contrast between risk and reward highlights the complexities of stock investing.

Evaluating Company Fundamentals

To truly understand whether the performance you see in a stock aligns with the underlying fundamentals of the business, a deep dive into the company’s financial health is essential. Analyzing critical metrics will give investors a clearer picture of whether long-term shareholder returns could indeed mirror or surpass the actual stock price gains.

The Future of Healthcare Investments

Artificial Intelligence (AI) is set to revolutionize the healthcare sector, and investors have a unique opportunity. Numerous stocks—specifically 20 of them—are working diligently on advancements ranging from early diagnostic techniques to innovative drug discovery solutions. Notably, all these stocks are currently priced under $10 billion in market capitalization, suggesting that early investment could yield substantial future benefits.

Valuation Insights Through Market Discrepancies

Investment mogul Warren Buffett aptly stated, "Ships will sail around the world but the Flat Earth Society will flourish." This commentary perfectly illustrates a prevalent reality in stock trading—significant discrepancies often exist between a company’s price and its intrinsic value. By comparing earnings per share (EPS) with share price fluctuations over time, investors can discern how market perceptions and investor sentiment toward a company have evolved.

Brambles’ Impressive Growth Metrics

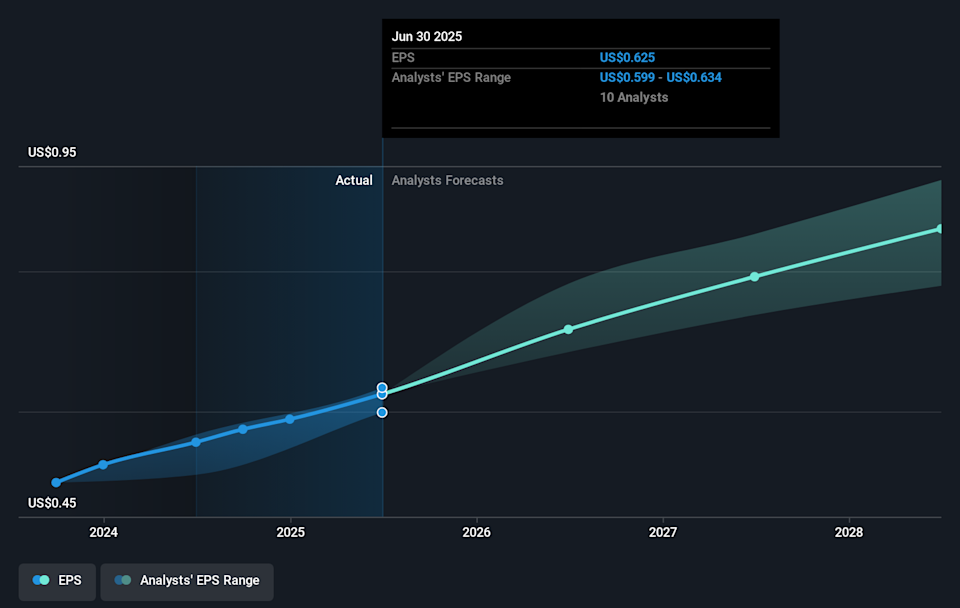

Over a five-year period, Brambles not only experienced a notable share price increase but also achieved a compound EPS growth rate of 14% annually. In contrast, the stock price growth stood at 18% per year during this time. This disparity suggests that investors currently hold a more favorable view of the company’s prospects compared to five years ago. This shift in sentiment is not surprising when you consider Brambles’ solid track record of earnings growth during this period.

Tracking EPS: A Window into Business Health

Examining the changes in EPS over time can offer insightful perspectives about a company’s growth. To gain a more detailed understanding, interested parties can explore specific values by accessing the accompanying image that illustrates this trend.

ASX: BXB Earnings Per Share Growth February 15, 2026

Insider Activity as a Positive Signal

One positive indicator is the activity of company insiders, particularly their decision to buy shares in the past twelve months. While this is a good sign, most investors place greater emphasis on analyzing trends in earnings and revenue growth as they provide a more holistic view of the company’s operational health. It’s always prudent to conduct a thorough examination of historical growth trends before making any decisions about buying or selling stocks.

Total Shareholder Return: A Broader Perspective

Total shareholder return (TSR) offers a comprehensive calculation that factors in not just the change in stock price but also the value of dividends received—assuming these dividends were reinvested. For companies that maintain a robust dividend policy, the TSR can significantly outpace the simple share price return. In the case of Brambles, the TSR over the last five years stands at an impressive 163%, which is markedly higher than the stock price returns previously mentioned. This indicates that the dividends paid by Brambles have substantially enhanced overall shareholder value.

Recent Performance Illustrates Positive Trends

As of the last twelve months, Brambles shareholders enjoyed a total shareholder return of 24%, including dividends. This figure is particularly noteworthy as it surpasses the five-year TSR of 21% per year. The data suggests that the stock’s performance has indeed improved recently, especially given its continued upward price momentum. This trend highlights the importance of seizing investment opportunities promptly.

Beyond Price Movement: A Comprehensive Analysis

While examining share price trends can provide a useful proxy for evaluating business performance, it’s imperative to consider a broader range of information for thorough investment analysis. For instance, it’s essential to identify any potential pitfalls affecting a stock. For Brambles, we have flagged one particular warning sign that investors should pay close attention to.

Insider Purchases: A Potential Growth Indicator

Interestingly, Brambles is not the only company experiencing insider buying activity; investors keen on discovering lesser-known companies may find value in our free list of growing firms that have seen recent insider purchases. This could potentially uncover valuable investment opportunities.

AI legalese decoder: Ensuring Informed Investment Decisions

Understanding the legal complexities surrounding investments can be challenging, making it crucial for investors to seek clarity in documentation and reports. This is where tools like the AI legalese decoder come into play. By simplifying intricate legal contracts and agreements, this AI-powered tool aids investors in navigating the dense legal landscape. It enhances your ability to make informed decisions, empowering you to understand the implications of potential investments thoroughly.

Final Remarks

Investing in the stock market, particularly in dynamic sectors like healthcare and companies like Brambles, requires a careful balance of risk assessment and reward analysis. As always, it’s essential to conduct thorough research and consider various factors, including historical performance and future potential, before making investment decisions. Remember, while our insights are based on sound methodologies, they do not constitute formal financial advice and should be tailored to fit your individual financial situation and objectives.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a