AI Legalese Decoder: Unlocking Tech Growth Potential in 2026

- February 11, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Navigating Volatility: Identifying High-Growth Tech Stocks for a Resilient Portfolio

The global financial landscape is currently experiencing a period of significant volatility, impacting various sectors and asset classes. Amidst this uncertainty, investors are keenly focused on identifying resilient and high-growth opportunities, particularly within the small-cap and value-oriented stocks. These investments have demonstrated a notable degree of stability amidst mixed performance across major stock market indices, even as larger technology companies have faced headwinds. The S&P MidCap 400 and the Russell 2000 indices have shown positive gains, suggesting a shift in investor sentiment and an opportunity to capitalize on emerging trends. This backdrop of evolving investor preferences and macroeconomic indicators, including cooling labor markets in the United States and rebounding manufacturing activity, underscores the importance of strategic stock selection. Identifying high-growth technology stocks that are poised to benefit from innovation while proactively managing associated risks is a crucial aspect of any investment strategy aimed at balancing potential returns with current market dynamics.

The Rise of High-Growth Technology: A Closer Look at Promising Companies

To gain a deeper understanding of the current high-growth technology sector, we’ve compiled a list of 220 companies across various sub-sectors. This selection, meticulously analyzed by our team, highlights businesses demonstrating strong potential for future expansion and innovation. Here’s a glimpse into some of the top performers:

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 35.61% | 41.64% | ★★★★★★★ |

| Shengyi TechnologyLtd | 24.78% | 35.24% | ★★★★★★★ |

| Shengyi Electronics | 30.66% | 38.51% | ★★★★★★★ |

| Hacksaw | 28.53% | 33.50% | ★★★★★★★ |

| Gold Circuit Electronics | 33.23% | 39.06% | ★★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★★ |

| KebNi | 26.69% | 73.00% | ★★★★★★★ |

| CD Projekt | 32.71% | 43.20% | ★★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★★ |

For a more exhaustive list of 220 high-growth tech stocks, we invite you to explore our dedicated Global High Growth Tech and AI Stocks screener. This tool provides in-depth data and analysis to help you make informed investment decisions.

Spotlight on Key Players: Detailed Company Overviews

Let’s delve into a few of the companies highlighted in our screener to illustrate the potential within this dynamic sector.

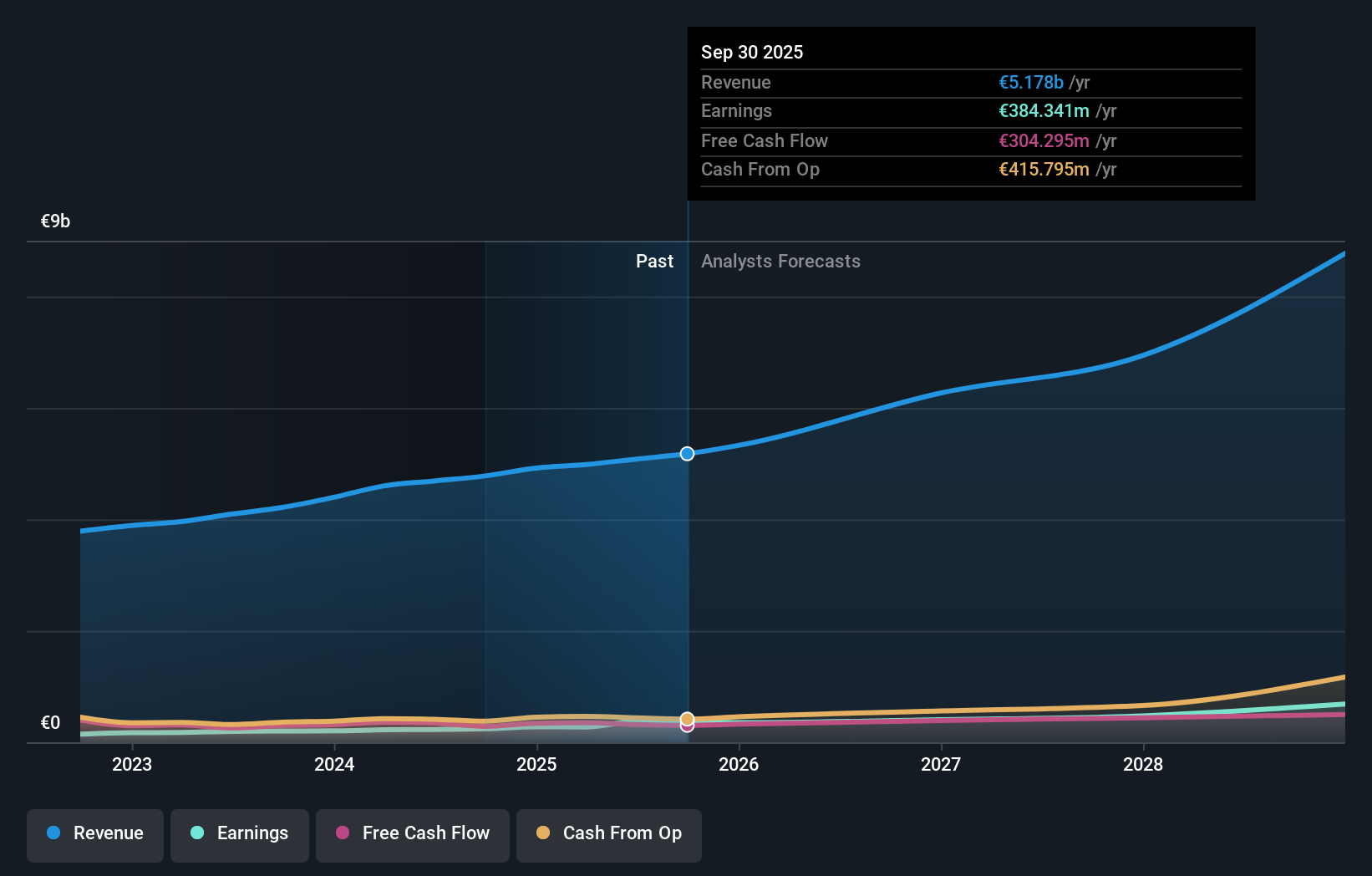

Indra Sistemas, S.A.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Indra Sistemas, S.A. is a global technology and consulting firm specializing in aerospace, defense, and mobility solutions. With a substantial market capitalization of approximately €8.75 billion, the company plays a crucial role in modernizing critical infrastructure and enhancing operational efficiency across diverse sectors.

Operations: Indra Sistemas primarily generates revenue from its Minsait (IT) segment (€3.07 billion), followed by the Defense segment (€1.12 billion). The Air Traffic and Mobility segments contribute significantly with €520.38 million and €364.45 million respectively.

Recent Developments & Financial Performance: Indra Sistemas recently secured a significant GBP 524 million contract with Transport for London, positioning them as a key partner in the development of London’s public transportation ticketing system through 2034. This deal underscores their capabilities in delivering advanced urban transport solutions and aligns with their strategic focus on expanding in the UK and North American markets. Financially, Indra Sistemas exhibits strong performance, with an impressive earnings growth of 57.5% in the past year, significantly outperforming the IT industry average of 0.5%. Furthermore, their revenue growth forecast of 13.2% annually is projected to surpass the broader Spanish market growth of 5.6%. This robust financial trajectory, coupled with strategic expansion initiatives, demonstrates Indra Sistemas’ strong potential within the high-growth technology sector, despite fluctuating share price performance in recent months.

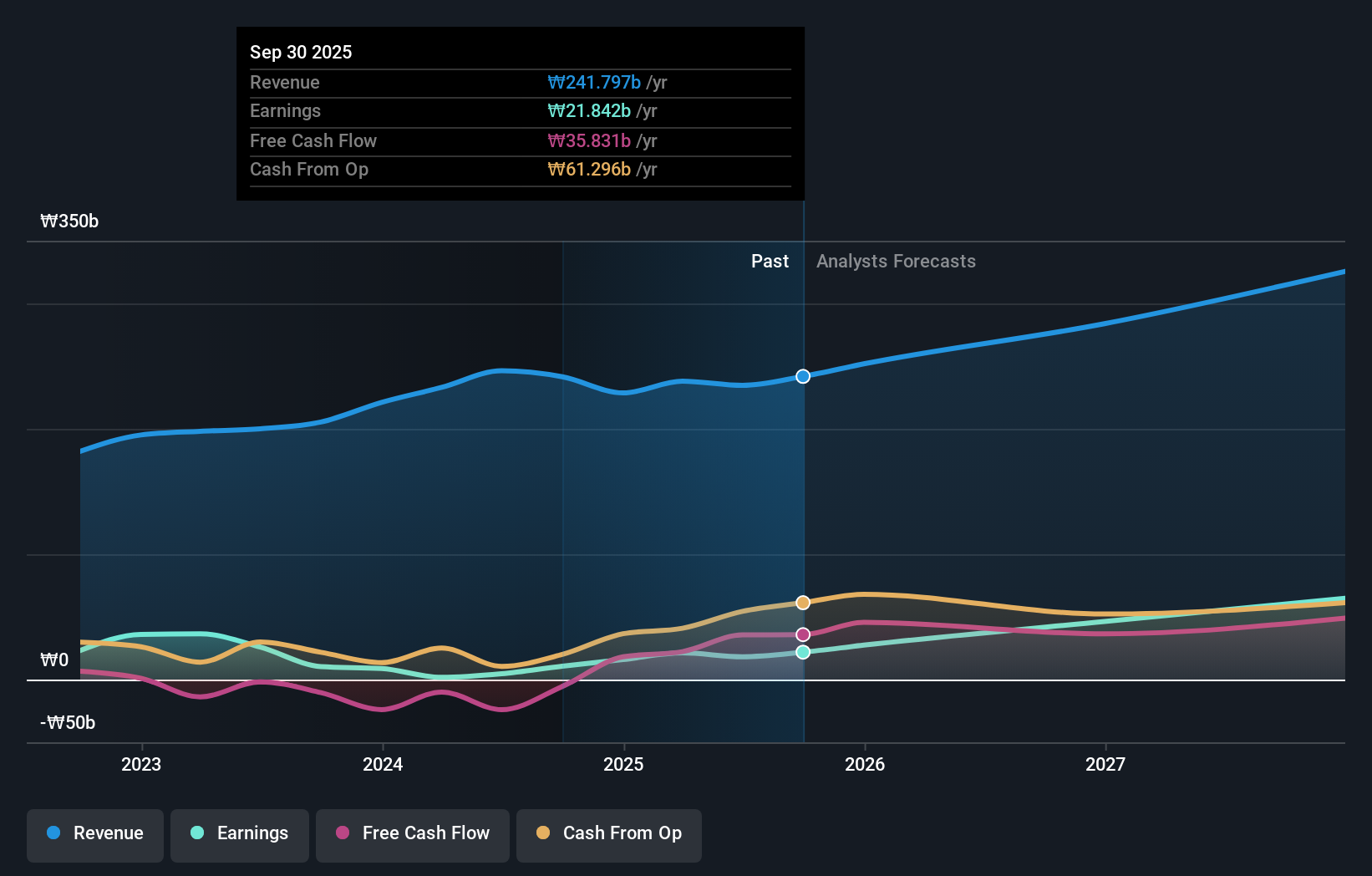

Medy-Tox Inc.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medy-Tox Inc. is a South Korean biopharmaceutical company with a market capitalization of approximately ₩924.50 billion. The company focuses on the research, development, and commercialization of various medical products, contributing to advancements in healthcare.

Operations: Medy-Tox’s revenue is primarily derived from its biotechnology segment, which accounts for approximately ₩241.80 billion.

Recent Developments & Financial Performance: Medy-Tox is demonstrating strong growth in the biotech sector, with an annual revenue growth of 13.4%, outpacing the Korean market average of 12.6%. This growth is further supported by an impressive earnings increase of 47.5% per year, significantly exceeding the market norm of 29.9%. Recent strategic actions include a share repurchase program aimed at enhancing shareholder value, with 23,930 shares bought back for KRW 2.99 billion. Despite facing occasional one-off losses, Medy-Tox’s aggressive growth strategies and recent financial maneuvers underscore its potential within a highly competitive landscape.

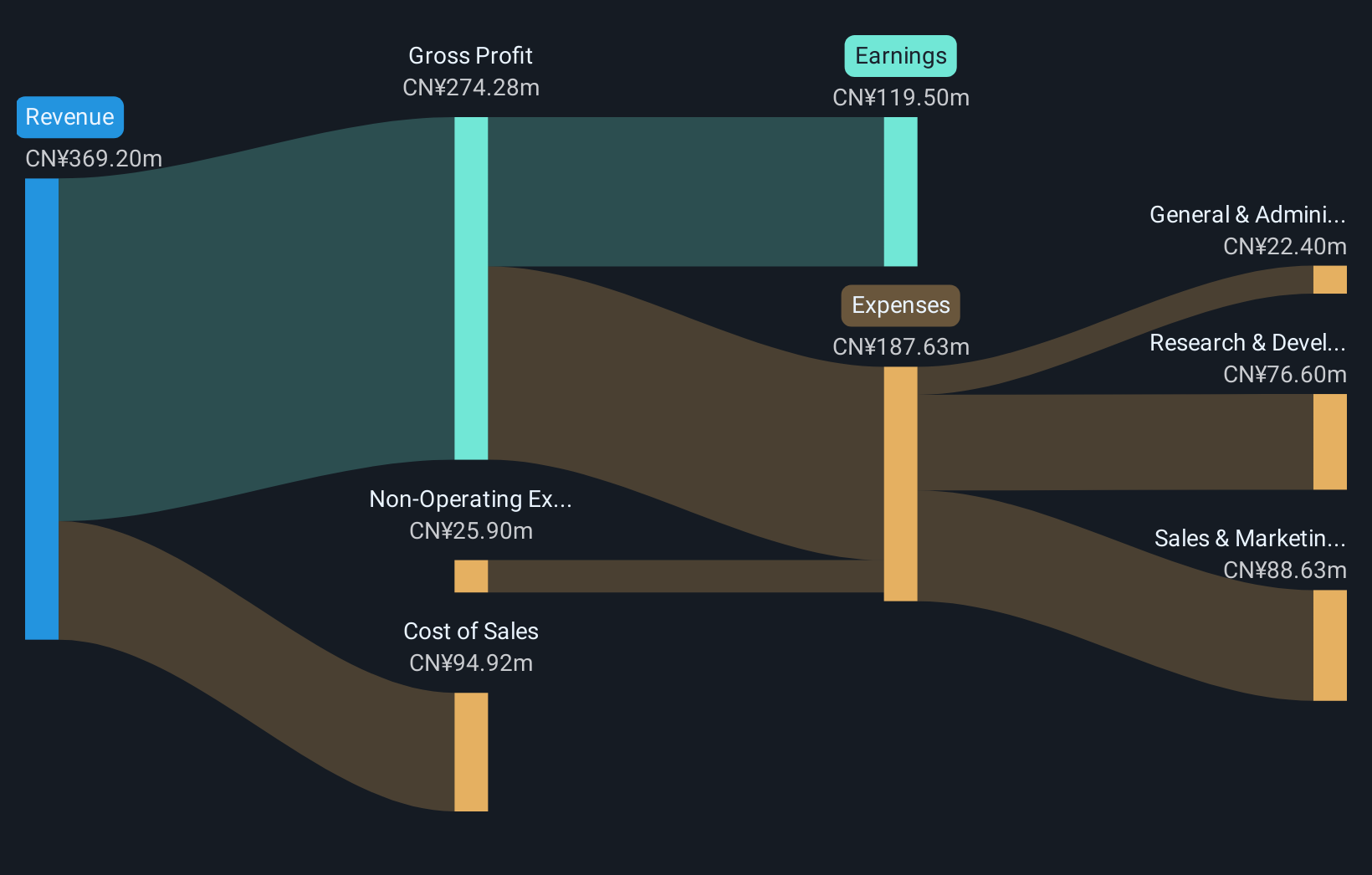

Scantech (HANGZHOU) Co., Ltd.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Scantech (HANGZHOU) Co., Ltd. specializes in providing 3D vision digital products and automated 3D vision inspection systems within China. With a market capitalization of approximately CN¥13.75 billion, the company is a key player in the rapidly evolving 3D vision technology market.

Operations: Scantech (HANGZHOU) generates revenue primarily from its 3D vision digital products and automated inspection systems, focusing on the burgeoning Chinese market.

Recent Developments & Financial Performance: Scantech (HANGZHOU) is navigating a competitive tech landscape with a robust annual revenue growth of 28.3%, significantly exceeding the Chinese market average of 14.7%. While experiencing a slight earnings contraction of 2.1% in the past year, projections indicate a promising turnaround with earnings expected to surge by 24.7% annually. The company’s recent shareholder meeting highlights its strategic focus, and its substantial investment in R&D aligns with a proactive push for innovation and market expansion, positioning it for future technological advancements and industry demands.

Make It Happen: Unlock Deeper Insights with AI legalese decoder

Navigating the complexities of financial information, especially when dealing with numerous companies and intricate financial metrics, can be overwhelming. This is where AI legalese decoder can be a valuable asset. This powerful tool utilizes artificial

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a