Decoding the Legal Jargon: How AI Legalese Decoder Can Guide Your Decision on Zicom Group (ASX:ZGL) for Your Watchlist

- February 7, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Understanding Investment Risks

Investors continuously seek the elusive ‘next big thing,’ often leading them to purchase ‘story stocks.’ These stocks typically lack any significant revenue and often operate at a loss. The inherent risk in these types of investments cannot be overstated; many investors pay dearly, both financially and emotionally, only to learn a valuable lesson far too late. When investing in loss-making companies, the path to profitability remains uncertain, raising concerns about the sustainability of external capital inflows. As a result, investors should exercise caution and take time to understand their options carefully.

Evaluating Revenue-Generating Companies

If high-risk ventures aren’t aligned with your investment style, you may be inclined towards companies that consistently generate revenue and, ideally, profits. In this category, Zicom Group (ASX:ZGL) stands out as a noteworthy option. While a company’s profitability alone doesn’t automatically indicate it is undervalued, the consistent earnings growth of Zicom Group suggests a strong potential for appreciation, particularly if it continues on its current trajectory.

Current Market Dynamics

Recent political pledges, such as Trump’s intention to "unleash" American oil and gas, have significant implications for various U.S. stocks poised to benefit from these developments. Investors seeking opportunities in such sectors may want to shift their focus toward companies that fit the bill, ensuring they are not left behind as market conditions evolve.

Impressive Earnings Growth

Zicom Group has witnessed remarkable growth in its earnings per share (EPS) over the past three years. However, evaluating the company’s future based solely on historical performance might not paint a complete picture. Focusing instead on the more recent growth rates reveals a more accurate landscape. Over the last 12 months, Zicom Group’s EPS surged from S$0.031 to S$0.036, marking a commendable 17% increase—an encouraging sign for existing and potential shareholders alike.

Sign of Sustainable Growth

In assessing a company’s long-term prospects, top-line growth acts as a critical indicator of sustainability. When coupled with a significant earnings before interest and taxation (EBIT) margin, it positions the company to maintain a competitive edge in the marketplace. For Zicom Group shareholders, the recent uptick in EBIT margins—from 1.1% to an impressive 7.2%—alongside robust revenue growth is an excellent sign of the company’s ongoing development.

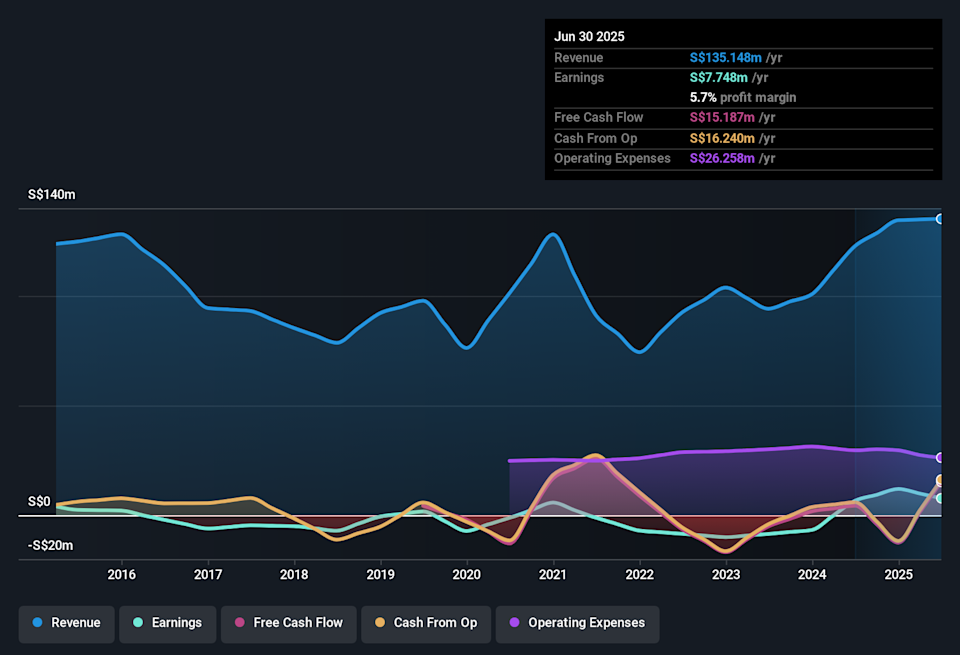

Visualizing Growth

To better understand these trends, review the chart below. It illustrates how Zicom Group’s earnings and revenue have evolved over time.

ASX:ZGL Earnings and Revenue History February 7th, 2026

Analyzing Cash and Debt

Given that Zicom Group is relatively small, with a market capitalization of AU$34 million, it’s advisable to scrutinize its cash reserves and debt levels before becoming overly enthusiastic about future prospects. Such due diligence is essential in identifying any potential risks that could impact the company’s growth trajectory.

Insider Confidence and Market Sentiment

Within the investing community, insider buying often serves as a barometer of confidence in a company. Investors frequently interpret these purchases as a sign of bullish sentiment from insiders, thus creating optimism about the stock’s future performance. However, it is essential to note that small purchases do not always signify strong conviction, and insiders can misjudge market directions.

Insider Activities at Zicom Group

Over the past year, there have been no recorded insider sales of Zicom Group shares, which could be a positive sign for investors. Additionally, Lak Sim Giok, the Executive Chairman of the company, made a noteworthy investment of S$55,000 at around S$0.076 per share. This kind of insider activity could indicate that management believes the company is currently undervalued, potentially providing a further incentive for shareholders to remain invested.

Ongoing Growth in Profits

One of Zicom Group’s most encouraging attributes is its ability to grow profits during a time when many companies struggle with EPS growth. This capability, combined with insider buying, adds layers of reassurance for potential investors. However, prudent investors should remain vigilant about potential risks, as evidenced by one warning sign for Zicom Group that warrants attention.

Broader Investment Opportunities

For those intrigued by Zicom Group, consider exploring other companies with similar attractive valuations alongside recent insider buying activity. Such insights can help diversify your portfolio while capitalizing on emerging trends in the market.

legal Insights with AI legalese decoder

Navigating the intricate world of investing comes with its own set of legal ramifications. This is where the AI legalese decoder can be particularly beneficial. This innovative tool simplifies complex legal jargon, making it easier for investors to understand company disclosures, agreements, and other pertinent legal documents. Having a clearer grasp of these documents can help you make more informed investment decisions, ensuring that you are fully aware of the potential risks and rewards associated with your investments.

Conclusion and Final Thoughts

In summary, Zicom Group’s trajectory indicates a promising potential for growth, although investors must remain cautious and informed. The combination of insider buying and consistent profit growth provides a solid foundation for potential investment. Nevertheless, always consider the inherent risks and utilize tools like AI legalese decoder for clarity in understanding your investments. Always proceed with the understanding that these discussions are not financial advice but rather a basis for informed decision-making.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a