Unlocking Clarity: How AI Legalese Decoder Empowers Investors Navigating the Decline of ITV (LON:ITV) Earnings

- February 5, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Understanding ITV plc’s Stock Performance

The Pursuit of Market-Beating Stocks

The primary goal of stock picking is to identify stocks that will outperform the market averages. Despite the expertise of even top-tier stock pickers, success is rarely guaranteed. Investors may currently be re-evaluating their position in ITV plc (LON:ITV), especially considering that the recent five-year period has seen a decline in the share price by 26%. This creates a strategic dilemma for shareholders as they analyze their investment choices.

Recent Positive Developments

On a brighter note, ITV’s market capitalization has recently increased by UK£91 million in just a week, prompting an investigation into the factors that contributed to the five-year loss experienced by shareholders. Understanding these dynamics can provide clarity and help stakeholders make more informed decisions.

Emerging Technologies Reshaping Markets

The discussion around ITV isn’t limited to its current performance. There’s buzz surrounding disruptive technologies, such as quantum computing, which could potentially transform entire markets. Many stocks are actively pursuing this futuristic technology, and understanding these trends can offer additional investment insights.

Market Dynamics and Investor Behavior

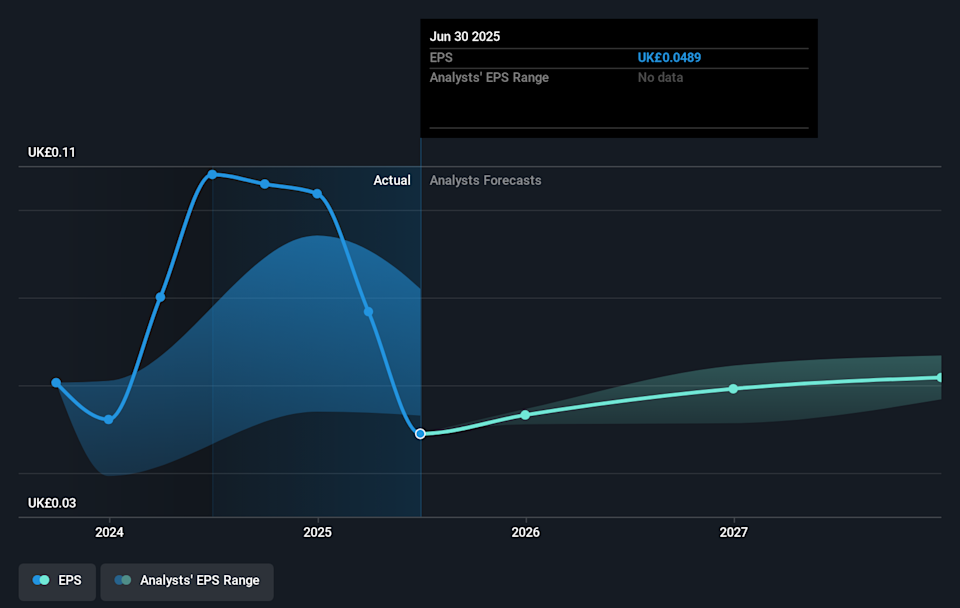

While traditional financial theories like the efficient markets hypothesis suggest that stock markets are rational, extensive evidence indicates that markets often overreact and that investor behavior can be irrational. A rudimentary method to gauge how market perceptions of a company have evolved is by analyzing the relationship between the

earnings per share (EPS) changes and share price movements.

Evaluating ITV’s Historical Performance

Reviewing ITV’s performance over the last five years shows a decline in both share price and EPS. Specifically, EPS fell at an annual rate of 7.9%, which notably outpaces the 6% annual decline in share price. This disparity leads investors to wonder whether the decline in EPS was a surprise or a well-anticipated event.

LSE: ITV Earnings Per Share Growth February 6th, 2026

Comprehensive Analysis of Stock Performance

For those looking to delve deeper into ITV’s financial health, a free interactive report detailing the company’s earnings, revenue, and cash flow represents an excellent starting point. This resource can provide shareholders with valuable insights to make well-informed investment decisions.

Importance of Total Shareholder Return (TSR)

While examining any stock’s performance, it’s crucial to evaluate not only the share price returns but also the total shareholder return (TSR). TSR accounts for additional factors such as spin-offs, capital raises, and dividends, under the assumption that dividends are reinvested. A thorough assessment of TSR often reveals a more accurate picture, especially for dividend-paying stocks. In ITV’s case, the TSR stands at -3.0% over the past five years, which signifies a more pronounced downturn than indicated by share price movements. Dividends play a significant role in this divergence.

Positive Short-term Outlook

Interestingly, ITV has managed to deliver a TSR of 21% over the past year, including dividends, which is comparable to broader market returns. This positive outcome stands in stark contrast to the annualized TSR loss of 0.6% experienced over the previous five-year timeframe. Although past performance has been tumultuous, signs of recovery can be seen. However, it’s essential to recognize that market conditions can have varied impacts, and potential risks remain. Interestingly, ITV currently has two warning signs that investors ought to closely monitor.

Monitoring Insider Activity

For the investment community, insider buying can be a key indicator of a company’s future potential. There’s an anticipation that ITV will become more appealing if significant insider purchases occur. Meanwhile, investors might find value in exploring a free list of undervalued stocks, especially small caps that have recently seen insider buying activity.

Final Notes on Investment Considerations

Please note that the market returns mentioned in this article represent market-weighted average returns for stocks actively traded on British exchanges.

Your feedback on this analytical piece is valued. If you’re concerned about any aspects of the content, do not hesitate to reach out directly to us. Alternatively, you may contact the editorial team at simplywallst.com for inquiries.

This analysis is provided by Simply Wall St and is intended for informational purposes only. It leverages historical data and analyst forecasts through an unbiased lens. It should not be construed as financial advice or a recommendation to either buy or sell any stock, and it does not consider your specific objectives or financial context. We strive to deliver long-term focused analyses based on fundamental data, but please be advised that our evaluations may not capture the latest price-sensitive announcements or qualitative insights. Simply Wall St does not hold any positions in the stocks discussed.

Role of AI legalese decoder

Navigating the complexities of financial reports and investment documents can be overwhelming. The AI legalese decoder can assist investors by simplifying intricate legal jargon into clear, understandable language. By providing straightforward summaries of key information, the tool helps investors fully comprehend the risks and opportunities associated with their investments, enabling more informed decision-making in situations like those surrounding ITV.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a