Navigating U.S. Small Business Loans: How AI Legalese Decoder Can Assist While the Korean Community Raises Concerns Over Exclusionary Practices

- February 5, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Changes in SBA Loan Eligibility: Impact on Immigrants and the Community

![Navigating U.S. Small Business Loans: How AI Legalese Decoder Can Assist While the Korean Community Raises Concerns Over Exclusionary Practices 1 U.S. President Donald Trump delivers remarks at his "Make America Great Again" rally in Pickens, South Carolina, July 1, 2023. [REUTERS/YONHAP]](https://legalesedecoder.com/wp-content/uploads/2026/02/1770280612_584_6f0f452a-a473-4795-9cc0-533801f19df6.jpg)

Caption: U.S. President Donald Trump delivers remarks at his "Make America Great Again" rally in Pickens, South Carolina, July 1, 2023. [REUTERS/YONHAP]

Introduction

For many years, loans backed by the U.S. Small Business Administration (SBA) have provided critical support to immigrants, enabling them to transform corner shops into thriving businesses. However, starting March 1, the Trump administration will tighten the eligibility requirements for these loans, a move that critics argue may signal a more extensive financial exclusion of noncitizens from various services.

Growing Concerns in the Korean American Community

As the midterm elections loom, tension is mounting within the Korean American community. Critics speculate that the Trump administration’s recent policy changes may just be the beginning, ultimately expanding financial restrictions on noncitizens to encompass all types of financial services, including home mortgages.

Stricter Ownership Criteria: Only U.S. Citizens

New Guidelines Effective March 1

Under the revised guidelines, the SBA will now require that 100% of all direct and indirect owners of small business applicants be U.S. citizens or U.S. nationals, who must also have their principal residence in the United States and its territories. This new directive effectively excludes lawful permanent residents — individuals who, despite holding green cards, do not possess voting rights, from accessing vital SBA programs.

How the 7(a) Program Functions

The 7(a) loan program has long served as a lifeline for those seeking to start self-employment or small businesses, particularly individuals who may lack a solid U.S. credit history or economic footing. It facilitates bank financing by providing a government guarantee that covers 75% to 85% of the loan amount. Should permanent residents be barred from this avenue, the consequences could be dire: many would find themselves effectively shut out of essential financial resources.

![Navigating U.S. Small Business Loans: How AI Legalese Decoder Can Assist While the Korean Community Raises Concerns Over Exclusionary Practices 2 Steve Kang, director of the Korean American Federation of Los Angeles, speaks during an interview. [KANG TAE-HWA]](https://legalesedecoder.com/wp-content/uploads/2026/02/1770280612_666_c1ba64a8-f9ce-4f6e-893d-3400ab2d1af1.jpg)

Caption: Steve Kang, director of the Korean American Federation of Los Angeles, speaks during an interview with the JoongAng Ilbo at the federation office in Los Angeles in June 2025. [KANG TAE-HWA]

Statement from SBA Officials

"The SBA is committed to driving economic growth and job creation for American citizens," stated Maggie Clemmons, an SBA spokesperson. "Effective March 1, the agency will no longer guarantee loans for small businesses owned by foreign nationals. We aim to ensure every taxpayer dollar goes to support U.S. job creators and innovators."

Legislative Backlash

In response, voices from within Congress are expressing sharp criticism. Senator Edward J. Markey and Representative Nydia Velázquez released a joint statement emphasizing that the Trump SBA is instilling fear and confusion among immigrant communities. Their message resounded: "This administration is choosing hatred by excluding legal immigrants from essential financial support."

A Lifeline Cut: Impact on Koreatown Businesses

The Experience of the Community

Steve Kang, a board member of the Korean American Federation of Los Angeles, emphasized that SBA loans serve as a vital lifeline for Korean American neighborhoods. He reflected on his family’s history, noting that many in the community have successfully settled in the U.S. thanks to SBA support.

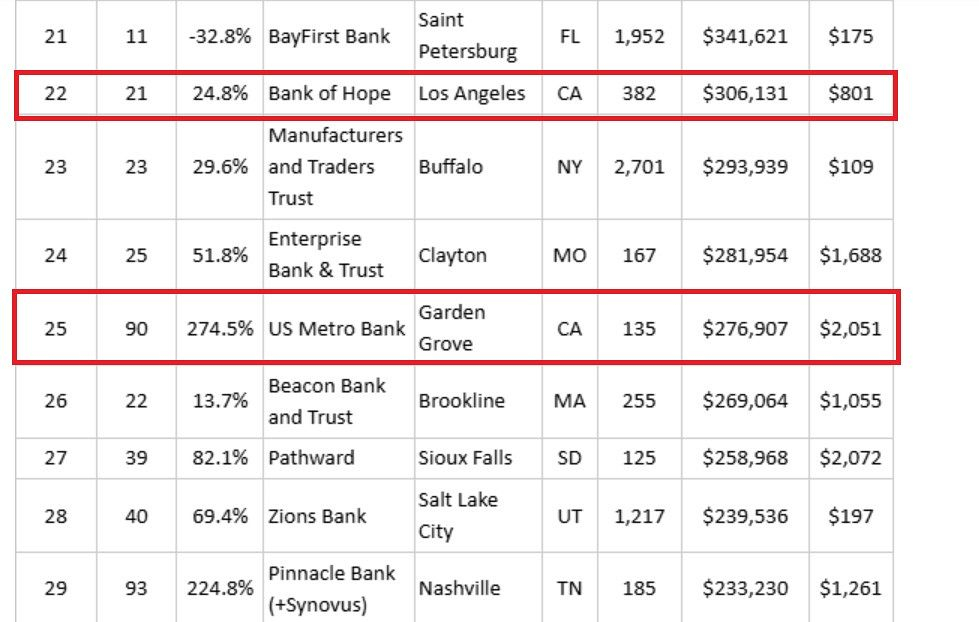

Caption: The U.S. Small Business Administration (SBA) fiscal year 2025 report. Korean American banks rank among the top lenders by SBA loan standards. [KANG TAE-HWA]

The Potential Fallout

While hard statistics are unavailable, Kang estimates that 40% to 50% of Korean American small business owners in Los Angeles might be permanent residents. If these individuals lose access to SBA-backed loans, not only will existing businesses be challenged to expand, but aspiring entrepreneurs may find it increasingly difficult to break into the market. As Kang pointedly noted, without bank loans, many might be forced into high-interest private lending.

Potential Impacts on Korean American Banks

The revised SBA guidelines could have significant consequences not only for small business owners but also for Korean American banking institutions. These entities have historically relied on SBA loans as an essential revenue channel.

Lending Statistics

An analysis of SBA loan data for fiscal 2025 shows that numerous Korean American banks excelled in lending. For instance, the Bank of Hope ranked 22nd among all U.S. banks with over $306 million in SBA lending, highlighting the importance of these loans to their operations. Other notable lenders included US Metro Bank and Hanmi Bank.

The Risk of Losing Clientele

As a result of the policy shift, smaller lenders might sustain a devastating loss of their customer base, which could, in turn, undermine cash flows from the self-employed business owners central to the Korean American ecosystem. This could evoke broader economic implications within the community.

The Beginning of a Broader Financial Exclusion

Fears of Extending Financial Exclusion

Beyond immediate implications, there are concerns that the Trump administration may widen the net of financial exclusion beyond SBA loans. Discussions are surfacing among banking professionals suggesting that this is merely a precursor to further restrictions.

Ryan Kim, a vice president at Centerstone SBA Lending, commented, "The conversation in banking circles hints that this is only the tip of the iceberg." There are fears that noncitizens could face growing venture exclusions from all financial services, which could include conventional real estate mortgages.

Delays in Verification

Even before the recent announcements, the verification process for permanent residents was already taking longer than usual, primarily hindering many from accessing new financial opportunities. Kim noted that delays, initially attributed to a government shutdown, have now revealed an underlying intent to exclude permanent residents entirely.

The Role of AI legalese decoder

In navigating the complexities surrounding these evolving policies, the AI legalese decoder can prove particularly beneficial. This innovative tool simplifies legal language, making it more accessible for non-experts. By breaking down the specific implications of new guidelines, it helps small business owners and community leaders fully understand their rights and options.

Assisting the Community

By providing clear interpretations of legal jargon and offering guidance on potential applications for the SBA programs, the AI legalese decoder empowers individuals to make informed decisions. It can serve as a valuable resource in discussions with financial institutions or legal advisors, ensuring that community members can advocate for their rights effectively.

Conclusion

The recent changes to SBA lending policies represent a significant challenge, not only for individual immigrants but also for entire communities that depend on these resources for economic mobility. Addressing these issues requires continuous advocacy and support, alongside tools like the AI legalese decoder to help individuals understand and navigate the impending complexities. The reshaping of financial landscapes calls for collective action, and it’s vital to ensure that all members of the community remain informed and equipped to uphold their rights.

This article was translated from Korean and refined using generative AI tools; it has been carefully reviewed by a skilled English-speaking editor.

BY KANG TAE-HWA

[[email protected]]

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a