Unraveling Polymarket Prices: How AI Legalese Decoder Can Navigate Bitcoin’s $70K February Surge

- February 4, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin experienced a brief dip below the $72,000 mark on Thursday morning during early Asian trading hours, reaching its lowest level in almost 16 months. As the ongoing sell-off intensifies, prediction market traders on Polymarket are rapidly adjusting their strategies and predictions. The data emerging from these activities presents a rather somber outlook for the short term, despite the fact that longer-term optimism seems to still linger among some investors.

Polymarket’s real-money contracts suggest that the market currently finds itself at a crossroads: battling to support the $70,000 level as a critical floor while simultaneously yearning for a bounce back to $100,000 in potential annual returns. This dichotomy reflects the heightened uncertainty that traders face in the current environment.

Sponsored

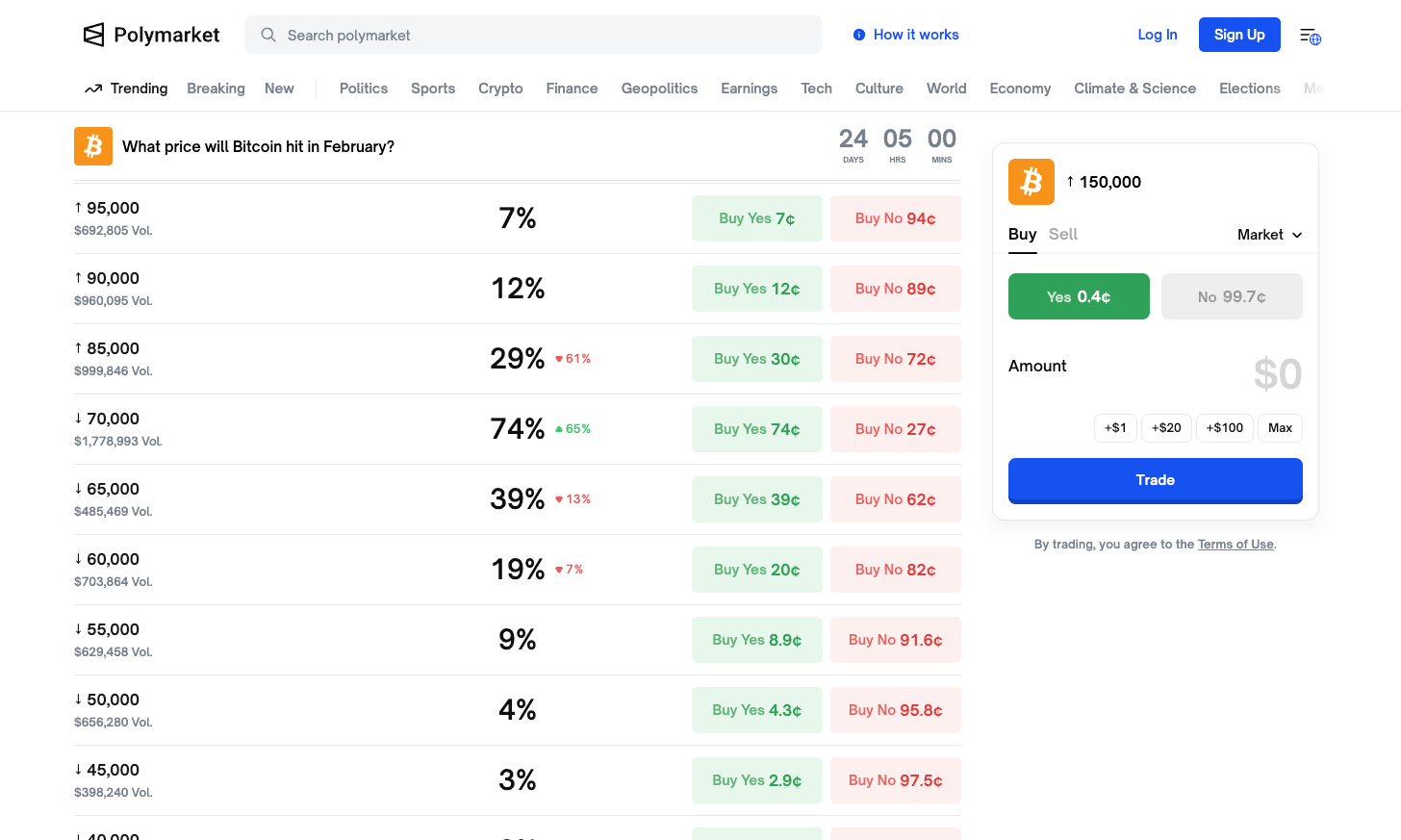

February Outlook: $70K Is the Line in the Sand

The ongoing dynamics in Polymarket’s February Bitcoin price contract, which has just 24 days remaining and boasts nearly $1.78 million in trading volume centered on the $70,000 target alone, tell a compelling story. The $70,000 contract surged to a 74% probability—an impressive 65% increase—making it the most actively traded target for the month. Conversely, upside expectations appear to have crumbled; the $85,000 contract plunged 61% to a mere 29%, while $90,000 is sitting at just 12% and $95,000 is even more fragile at a lowly 7%.

Looking toward the downside, the $65,000 contract has fallen 13% to 39%, while the $60,000 level holds steady at 19%. Projections of a crash below $55,000 are now in the single digits. Consequently, the implied price range for February now hovers between $65,000 and $85,000, with $70,000 emerging as the most likely point of focus.

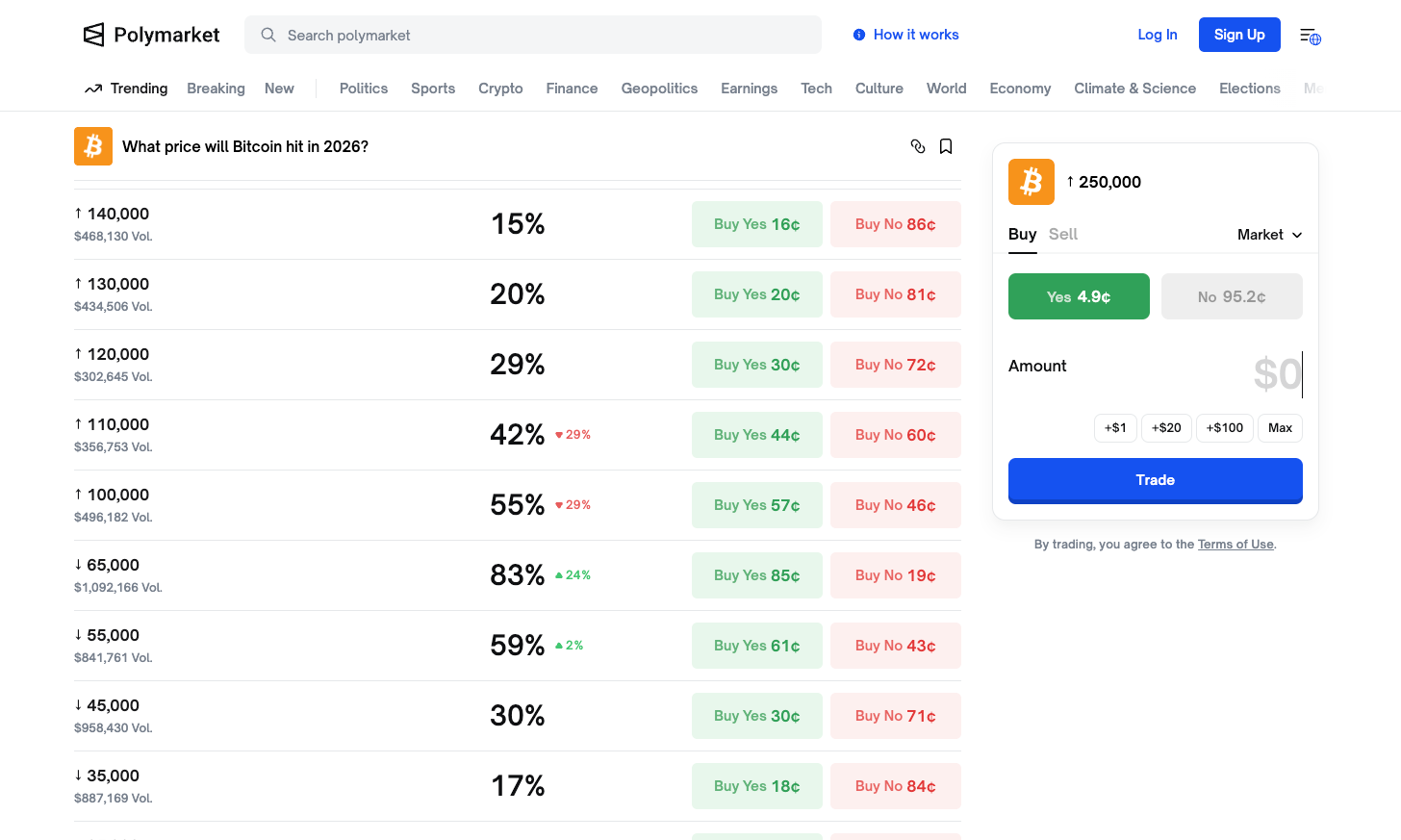

2026 Annual Contract: Still Bullish, but Fraying

The longer-term view presented by Polymarket’s annual contract paints a more complex picture. The expectation for a $100,000 Bitcoin price level holds steady at 55%, yet this figure is down 29%. Meanwhile, the $110,000 level stands at 42%, also reflecting a notable decline of 29%. These declines are particularly significant given that just a few weeks ago, traders felt more optimistic, anticipating a continuation of the impressive rally experienced in 2025.

On the contrary, the $65,000 contract for 2026 has surged by 24% to a notable 83%, with over $1 million in trading volume — the highest recorded on the platform. This indicates that traders are increasingly prioritizing downside protection over speculative upside risks. The upper end of the price spectrum shows a sharp decline, with only 20% probability assigned to $130,000, followed by 15% for $140,000, and a mere 5% for a remarkable $250,000.

Sponsored

What’s Driving the Selloff

At the time of writing, Bitcoin was trading at approximately $73,199, having briefly dipped below $72,000 earlier on Thursday. Year-to-date, the token has plummeted by 16% and roughly 40% from its all-time high of $126,000 reached in October 2025. A multitude of factors have been implicated in this downturn: escalating geopolitical tensions, unresolved issues stemming from last fall’s unprecedented 43-day government shutdown, and a hawkish nomination for the Federal Reserve chair that has strengthened the U.S. dollar.

The technical damage inflicted in recent weeks has been severe. Since late January, over $5.4 billion in liquidations have occurred, pushing Bitcoin open interest to its lowest point in nine months. Additionally, U.S. spot Bitcoin ETFs have suffered significant capital outflows for the majority of the past three weeks, with notable outflows recorded at $817 million on January 29, $509 million on January 30, and $272 million on February 3, accented by just one day of inflow totaling $561 million on February 2. As a result, total net assets across spot Bitcoin ETFs have plummeted from over $128 billion in mid-January to a mere $97 billion.

The Crypto Fear and Greed Index has plummeted to 12, categorizing it deep within “Extreme Fear” territory—its lowest reading since November 2025. Meanwhile, gold has soared past $5,000 per ounce, highlighting a broader trend of investment rotating into safer assets amidst uncertain times.

The Bottom Line

Polymarket’s data presents a real-time snapshot of how traders with money on the line are positioning themselves. Current February expectations center around a price range of $65,000 to $85,000, with hardly any hopes of reclaiming the $95,000 mark in the near future. On the annual contract front, a slim majority of traders still harbor hopes for a $100,000 Bitcoin valuation sometime in 2026, although even this optimism appears to be waning as the market reacts to external pressures. For now, the $70,000 level remains the key point of focus for traders.

How AI legalese decoder Can Help

In the rapidly shifting landscape of cryptocurrency trading and associated legal considerations, tools like the AI legalese decoder can prove invaluable for traders and investors alike. This powerful tool helps decode complex legal documents and terms often associated with financial instruments, allowing users to better understand what they’re signing or investing in. As the market fluctuates and regulations evolve, having clarity on the legal implications can empower traders to make informed decisions, minimize risks, and capitalize on opportunities without getting ensnared in legal technicalities. Whether you’re dealing with contracts on Polymarket or navigating other cryptocurrency platforms, leveraging AI legalese decoder can help safeguard your investments and provide a clearer roadmap in uncertain times.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a