Unlocking Clarity: How AI Legalese Decoder Can Simplify MSTR and BMNR Discussions Post-Bitcoin Selloff Amid GME Stock Surge

- February 1, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Trending Stocks in the Wake of Bitcoin’s Weekend Crash

MSTR and BMNR stocks emerged as top trending tickers on Stocktwits following a dramatic crash in Bitcoin’s price over the weekend. This market volatility spurred intense speculation among traders regarding potential moves from crypto treasury firms.

Traders’ Speculation on Digital Asset Purchases

- The community on Stocktwits is buzzing with discussions on whether crypto treasury firms might be poised to announce new digital asset purchases in the wake of recent price shifts.

- Michael Saylor’s insightful weekend post seemed to fuel expectations among traders about possible Bitcoin accumulations, sparking further interest in both MSTR and BMNR stocks.

- Notably, GameStop outperformed other stocks correlated with the cryptocurrency market, achieving an impressive rise of over 4% in overnight trading.

Tom Lee’s Bitmine Immersion Technologies (BMNR) and Michael Saylor-backed MicroStrategy (MSTR) captured the spotlight as top trending stocks on Stocktwits. Traders are anticipating that these digital asset treasuries (DATs) may report new cryptocurrency purchases on the following Monday, particularly in light of Bitcoin’s (BTC) sudden drop.

The broader cryptocurrency market has seen a decline of 4.1% in the last 24 hours, now hovering around a market capitalization of $2.6 trillion. According to Coinglass, over $500 million in liquidations were recorded in a single day, with forced unwinds approaching $3 billion over the weekend.

Crypto Treasury Firms: A Focus for Retail Traders

Bitmine, known as the largest corporate Ethereum (ETH) treasury globally, was the most talked-about ticker on Stocktwits on Sunday evening. A substantial number of users reported engaging in dip-buying, with many others speculating whether the company would announce any major acquisitions come Monday.

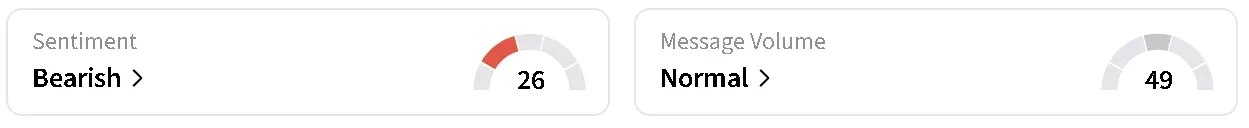

BMNR’s stock experienced a flat trading session overnight following a significant drop of nearly 6% on Friday, reaching levels last seen in November. While retail sentiment around BMNR stock remains within a ‘bearish’ framework, there was a noticeable increase in conversation levels, elevating from ‘low’ to ‘normal’ over the course of the day.

BMNR retail sentiment and message volume on February 1 as of 10:00 p.m. ET | Source: Stocktwits

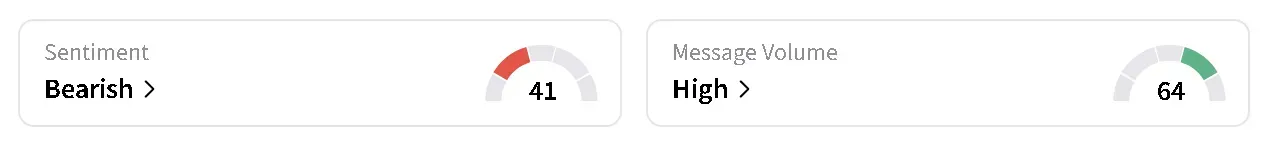

Conversely, MSTR’s stock dipped slightly by 0.27% during overnight trading after recording a robust 4.5% rise during regular trading hours on Friday. On Stocktwits, the retail sentiment around MSTR transitioned from ‘normal’ to ‘bearish’ as overall engagement remained at ‘high’ levels.

MSTR retail sentiment and message volume on February 1 as of 10:10 p.m. ET | Source: Stocktwits

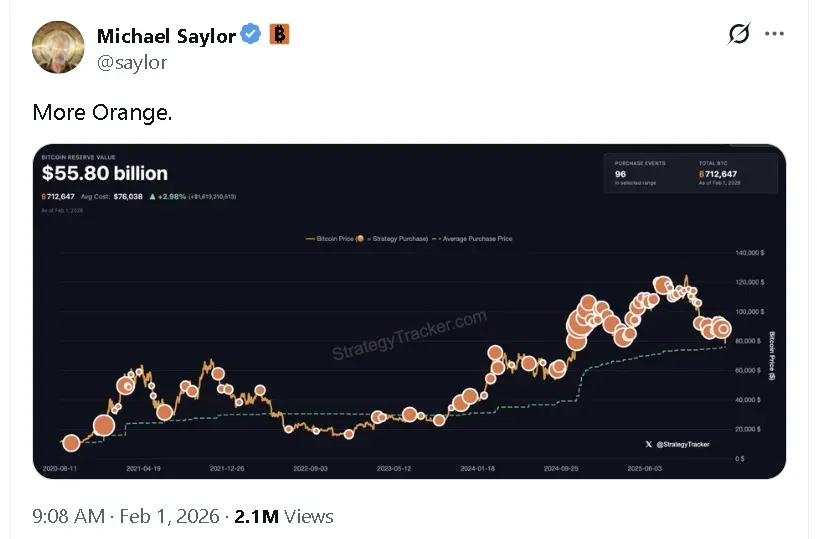

In the midst of this, Saylor hinted at potential new Bitcoin acquisitions coming soon, with a post on X suggesting "more orange" in the days ahead.

Source: @saylor/X

In after-hours trading, Strive (ASST) took the lead in losses among crypto equities, down 2.35%, followed closely by Forward Industries (FWDI) which fell by 1.23%. Retail sentiment around both these stocks has remained in the ‘bearish’ range over the last day.

GameStop Defies the Decline in Crypto Stocks

In an interesting twist, GameStop (GME) managed to outperform other crypto-linked equities, showing gains of over 4% in overnight trading following an announcement by CEO Ryan Cohen. He indicated potential plans for significant new acquisitions.

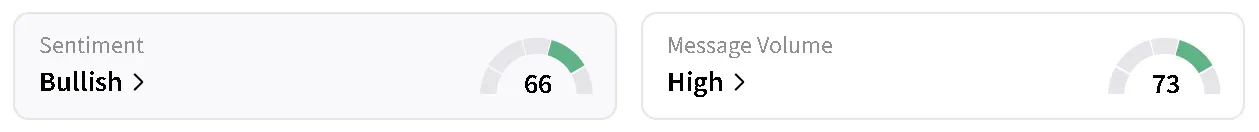

Investor Michael Burry, known for his foresight in the markets, disclosed that he is long on GameStop, supporting Cohen’s long-term strategy for revitalization. Despite this, retail sentiment around GME has dipped from ‘extremely bullish’ to ‘bullish,’ and engagement levels have decreased from ‘extremely high’ to ‘high.’

GME retail sentiment and message volume on February 1 as of 10:15 p.m. ET | Source: Stocktwits

Understanding the Decline of Crypto-Linked Stocks

Bitcoin’s price endured a substantial drop of 3.5% in the last 24 hours, sinking below the $75,900 mark. The cryptocurrency has seen a staggering decline of nearly $15,000 since Friday, hitting lows of $74,420, levels not witnessed since November 2024.

On Stocktwits, retail sentiment for Bitcoin remains in ‘extremely bearish’ territory, marking its lowest point in over a year. Despite this bearish sentiment, trader engagement is at ‘extremely high’ levels as discussions regarding Bitcoin’s next moves proliferate.

For those concerned about the complexities of trading in volatile markets, AI legalese decoder can provide invaluable assistance. This tool helps clarify legal and financial jargon to ensure traders are well-informed and can navigate their investment strategies with greater confidence.

For the latest developments and any necessary corrections, please contact the newsroom at Stocktwits.

Stay Informed and Engaged

Subscribe to our daily newsletter, "Chart Art," and remain updated on market trends.

Your email is the key to fun and insightful market engagement!

(Disclaimer: Always perform due diligence before making investments.)

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a