Unlocking the Potential: How AI Legalese Decoder Can Clarify the YieldMax MSTR Option Income Strategy ETF as an Underrated Crypto Play

- February 1, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Understanding Dividend Investing and Cryptocurrency Exposure

If you’re a dividend investor, the idea of delving into cryptocurrencies may not seem appealing at first glance. However, the YieldMax MSTR Option Income Strategy ETF (NYSEMKT: MSTY) presents a unique opportunity to gain exposure to Bitcoin while still receiving dividends. At first, this sounds like an excellent deal, but it’s essential to look beyond the surface, particularly regarding the dividend yield. While it may not be that the yield is too low, there are other factors to consider before jumping headfirst into this investment.

What Is the YieldMax MSTR Option Income Strategy ETF?

From a broader perspective, the YieldMax MSTR Option Income Strategy ETF functions as an option-income exchange-traded fund (ETF). The strategy it employs is focused on a single entity: Strategy (NASDAQ: MSTR). This company provides AI-powered enterprise analytics software, but many investors are more intrigued by its assertion of being “the world’s first and largest Bitcoin treasury company.” Thus, this fund can be seen as a way to invest in Bitcoin indirectly, circumventing the necessity of purchasing Bitcoin directly.

Exploring the ETF’s Structure

It’s crucial to note that the YieldMax MSTR Option Income Strategy ETF does not actually hold any shares of Strategy. Instead, it utilizes a complex options strategy designed to generate income and offer investors indirect exposure to the performance of Strategy’s stock. The ETF has made it clear that its strategy may limit potential gains if the stock’s value increases. What this amounts to is an effort to create income from a stock connected to the cryptocurrency market.

A Closer Look at the Yield

At first glance, the dividend yield seems impressive. If you annualize the weekly dividend discussed for January 21, 2026, the yield clocks in at a staggering 75%. Such a number is likely to raise eyebrows among seasoned dividend investors, who typically approach yields of this magnitude with a degree of skepticism.

Image source: Getty Images.

Why This ETF May Not Be the Right Fit for Most Investors

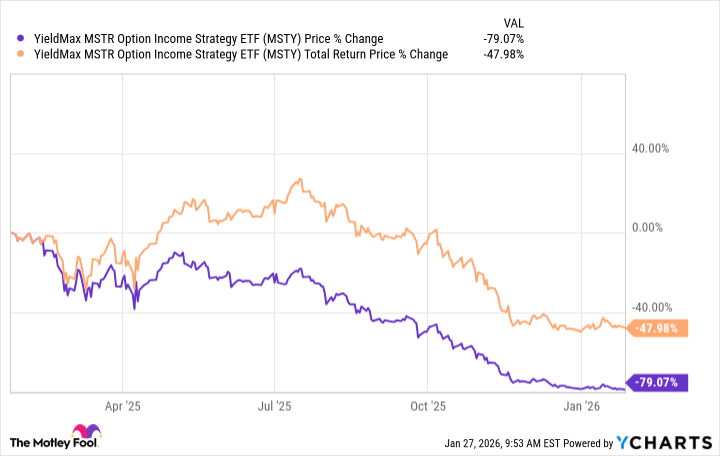

Such caution is justified for several reasons. The ETF has stated: “Previous distributions have included a blend of ordinary dividends, capital gains, and a return of investor capital. This combination may erode a fund’s NAV and trading price over time.” Consequently, this could lead investors to suffer significant losses on their initial investments. The ETF’s total return over the past year has been a disappointing negative 42%. While one year might not be an overwhelmingly long stretch for a long-term investor, that figure is alarming nonetheless.

The Grim Picture Enhances

Things deteriorate further when you consider that the total return figure factors in reinvested dividends. If you had opted to utilize the dividends as income, you would have seen the ETF’s value dip by nearly 80%. Moreover, the dividend amounts can fluctuate vastly from one payment to the next. Overall, the YieldMax MSTR Option Income Strategy ETF may come off as an overrated vehicle for crypto investment, particularly if you’re aiming for a dependable and sustainable income stream.

Should You Invest in the Tidal Trust II – YieldMax MSTR Option Income Strategy ETF?

Before proceeding to buy shares in the Tidal Trust II – YieldMax MSTR Option Income Strategy ETF, it’s essential to weigh your options carefully. The Motley Fool Stock Advisor analyst team has recently analyzed and identified what they consider the 10 best stocks for investment right now—and the YieldMax ETF did not make the cut. These selected stocks have the potential to deliver substantial returns in the upcoming years.

For instance, consider when Netflix featured on this list on December 17, 2004. If you had invested $1,000 at that point, you would have seen that grow to an astounding $450,256! Similarly, when Nvidia was included on April 15, 2005, a $1,000 investment could now be worth $1,171,666!

It’s notable that Stock Advisor’s average return stands at a remarkable 942%, significantly outpacing the S&P 500, which recorded a growth rate of just 196%. This performance underscores the importance of investing in well-researched stocks and not getting distracted by high yields that may come at a steep risk.

How Can AI legalese decoder Help?

In the complex landscape of investing, understanding the terms and conditions set forth by financial products is crucial. This is where AI legalese decoder comes into play. By simplifying intricate legal language, it can help investors decipher the terms associated with the YieldMax MSTR Option Income Strategy ETF and other investment vehicles. By offering clarity on the potential pitfalls and nuances buried within legal jargon, AI legalese decoder empowers investors to make informed decisions based on a thorough understanding of their investments.

Conclusion

In summary, while the YieldMax MSTR Option Income Strategy ETF may seem attractive to those wanting exposure to Bitcoin with the added benefit of dividends, the associated risks and historical returns must not be overlooked. Careful consideration and a well-informed approach, possibly supported by tools like AI legalese decoder, can assist you in navigating this investment landscape effectively. It’s paramount to focus on established stocks that can offer sustainable returns instead of being lured by high-yield promises that may prove unsustainable in the long run.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a