Unlocking Clarity: How AI Legalese Decoder Can Make Sense of Bitcoin’s $87k Slip and Bear Market Signals

- January 26, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin Market Trends: Current Situation and Future Outlook

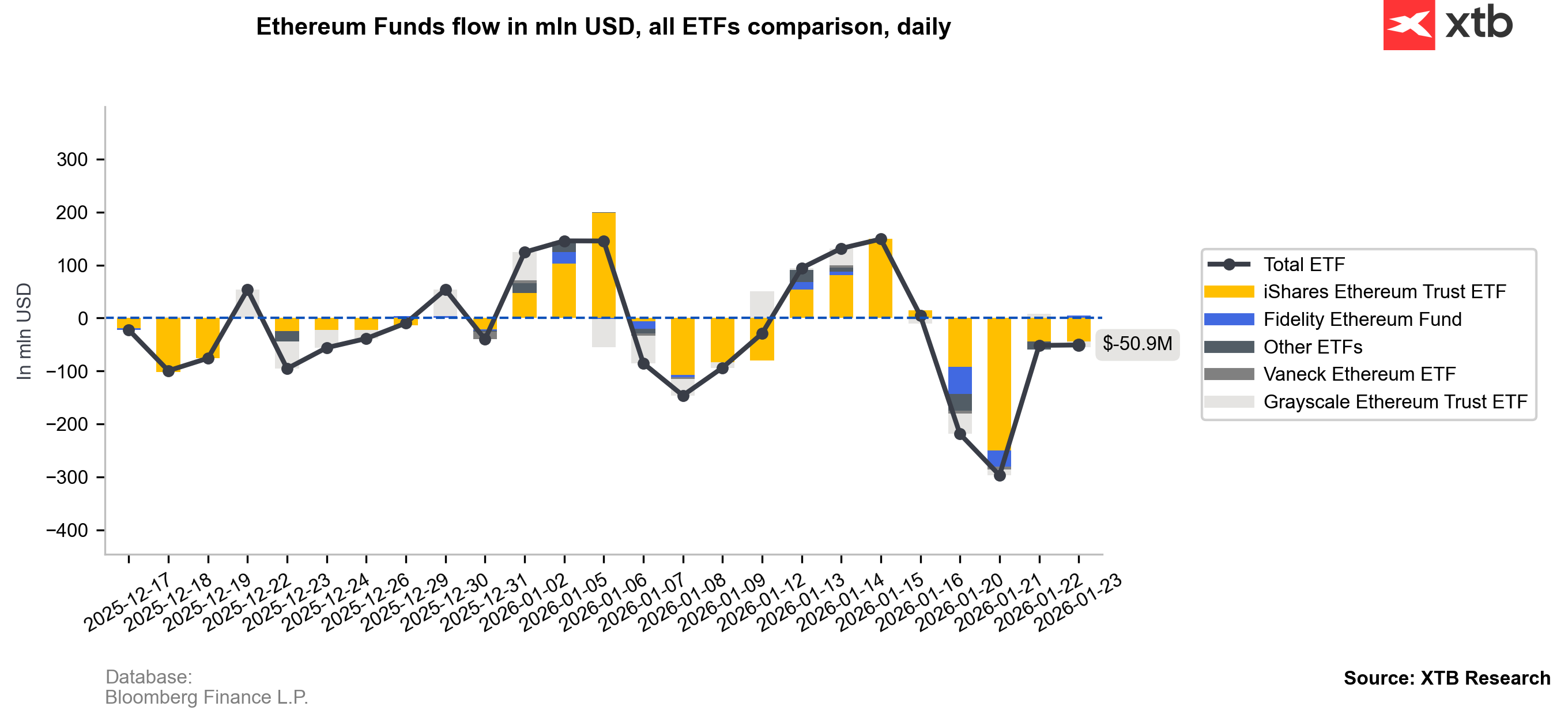

Bitcoin’s price is currently sinking toward the $87,000 mark, following an alarming series of liquidations that have totaled hundreds of millions of dollars. Concurrently, exchange-traded funds (ETFs) witnessed their largest weekly outflow since mid-November 2025, amounting to $1.73 billion. This dramatic shift occurs only a week after crypto funds enjoyed an inflow of over $2.17 billion, showcasing a striking reversal in market sentiment. Specifically, Ethereum faced substantial losses as it reported approximately $630 million in outflows—the second-largest weekly outflow on record.

Exceptions in the Market: Solana and Chainlink

Interestingly, some exceptions persisted amidst the overall downturn in ETF performance. Notably, ETFs associated with Solana, which recorded about +$17 million, and Chainlink, which saw gains of nearly +$4 million, stood out. However, the prevailing "risk-off" sentiment among investors is evident. This trend of outflows suggests that confidence among investors is still shaky, particularly following the unsettling events of the October 2025 "flash crash."

According to CoinShares, a significant portion of the selling pressure stemmed from U.S.-based investors. This fragile sentiment has lingered in the market, influencing investor behavior and strategies as they navigate through unpredictable waters.

Factors Contributing to the Declines

Several pivotal factors are driving this downturn in the cryptocurrency market:

-

Weaker Expectations for Federal Reserve Rate Cuts

Market analysts have notably lowered their expectations regarding potential Federal Reserve rate cuts, now pricing in a mere 3% probability of a reduction, as derived from the CME FedWatch tool. This skepticism has begun to seep into the cryptocurrency market, affecting investor strategies.

-

Lack of a Sustained Rebound

Following the tumultuous October drawdown, there has been a lack of a rally, compelling trend-following and risk-managed strategies to adopt a more cautious approach. Without positive market signals, investors may continue to pull back.

-

Disappointment with the “Debasement Hedge” Narrative

Despite warnings of soaring government debts and large deficits, cryptocurrencies have struggled to affirm their value as a hedge against currency debasement. This has prompted some investors to reevaluate and reduce their exposure to crypto assets in the near term.

Search for Catalysts Continues

The crypto market is still caught in a challenging limbo, actively searching for a catalyst that can shift momentum. If macroeconomic expectations do not change, and price momentum remains weak, the risk of a prolonged bearish phase may increase, leading to further declines in fund flows.

ETF Flow Trends

Examining the latest trends in crypto fund flows reveals a clear pattern of negative flows into Ethereum (ETH) over the past five sessions. This indicates diminished fund activity and waning retail demand, which extends beyond Ethereum to Bitcoin as well.

Source: XTB Research, Bloomberg Finance L.P.

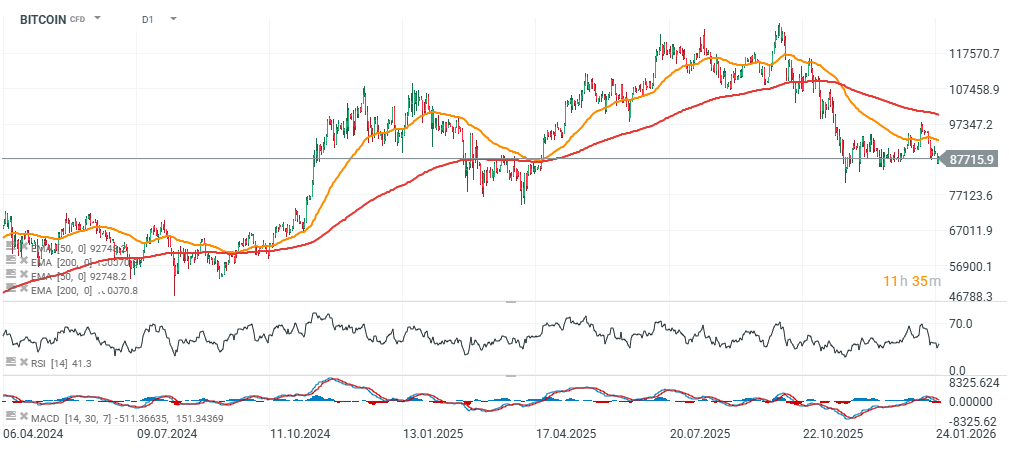

Bitcoin and Ethereum Price Analysis

Currently, Bitcoin has dipped over 30% from its all-time high, while Ethereum has plummeted more than 50%. Bitcoin’s Relative Strength Index (RSI) stands at 41, which is considerably shy of the ‘oversold’ territory typically indicative of major capitulation events. Meanwhile, Ethereum’s technical setup mirrors this struggle, as no clear capitulation signals have emerged even amidst significant declines.

Critical on-chain reference levels for Bitcoin currently encompass:

- $96.5k (Short-term holders’ cost basis)

- $87.5k (Active investors’ mean)

- $81k (True Market Mean)

- $56k (Realized Price)

The True Market Mean serves as a more realistic market-wide average, reflecting the actively traded portion of supply. In contrast, the Realized Price denotes the average cost basis across all participants in the Bitcoin market. Historically, Bitcoin has traded below the Realized Price during pronounced bear markets, as seen in 2020 and 2022.

Source: xStation5

The Role of AI legalese decoder

In the rapidly changing environment of cryptocurrency investment and regulation, legal complexities can be overwhelming for many investors. This is where AI legalese decoder comes into play. This innovative tool helps decode complex legal jargon surrounding cryptocurrency investments, providing users with clear, concise interpretations of legal documents and regulations.

How AI legalese decoder Can Assist You

-

Simplifying Complex Regulations: Investors can easily understand legal frameworks that may affect their investments.

-

Reducing legal Risks: By clarifying legal obligations, users can minimize potential legal pitfalls associated with crypto investing.

-

Enhancing Decision-Making: With a better understanding of the legal landscape, investors can make more informed choices regarding their portfolios.

-

Staying Updated: The constantly changing regulatory environment makes it essential for investors to stay informed. AI legalese decoder can assist in translating new regulations into understandable terms.

By leveraging the capabilities of AI legalese decoder, you can navigate the intricacies of crypto regulations with confidence, ultimately empowering your investment decisions during these uncertain times.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a