How to use PolyCop Bot to copytrade on PolyMarket (with a small starting fund $50) & PolyCule Update

- January 11, 2026

- Posted by: legaleseblogger

- Category: How To

Introduction to Polymarket, Copy Trading, and HFT-Style Strategies

As of 2026, Polymarket continues to dominate as the premier decentralized prediction market on the Polygon blockchain. Traders bet on real-world events—from elections and sports to crypto price movements—using stablecoins like USDC. The platform’s low fees, on-chain transparency, and rapid resolution have attracted both retail participants and sophisticated automated strategies.

In recent months, high-frequency trading (HFT)-style approaches have surged, particularly in ultra-short-term markets (e.g., 15-minute BTC/ETH brackets or rapid news-driven events). These strategies involve thousands of micro-trades exploiting tiny pricing inefficiencies, latency arbitrage against external exchanges, or repeated low-risk loops. Successful HFT-style wallets often feature high trade volume, consistent small wins, elevated win rates (>70-90%), and minimal directional risk—turning modest starting capital into substantial profits through repetition rather than big bets.

Copy trading these HFT-style performers via PolyCop (a powerful Telegram-based bot) is an excellent way for small-account users ($50-100) to participate passively. However, standard settings can lead to problems: skipping micro-trades (core to the edge), disproportionately amplifying tiny positions, or missing fills due to aggressive offsets. This guide combines the foundational setup from DeFiPill’s PolyCop review with battle-tested personal configurations designed specifically to mirror HFT-style whales safely and effectively—capturing the full volume while protecting your limited stack.

Recent Polycop Update: Copy Execution Latency Jan 26, 2026

Polycop has reported a measurable improvement in copy trade execution speed. According to the update, approximately 30 percent of copied trades now execute within the same block as the target transaction, effectively resulting in near zero second latency. The remaining majority execute within one block, or roughly two seconds, with longer delays occurring primarily during periods of network congestion. Reduced block latency can improve price matching relative to the source wallet, particularly in fast moving or thin markets. Users are able to independently verify execution timing by comparing the target transaction and copied transaction using on chain explorers via the “Target Swap” and “ViewTx” references.Recent Polycop Update Jan 21, 2026 (v4.0)

Polycop’s 4.0 update introduces several execution and risk management features that bring it closer to full workflow automation. The addition of automated take profit and stop loss enables predefined exits without manual intervention. Market order slippage controls aim to reduce entry variance during fast market conditions, while one click sell improves exit speed. Spend limits add an additional layer of risk control at the account level, and smart discovery features are intended to streamline identification of active or trending markets. Overall, this update improves operational control and reduces manual oversight requirements, particularly for users running multiple copied strategies.

Important Disclaimer: Prediction markets and copy trading carry significant risk, including total loss of funds. Bots exploit edges that can change; fees accumulate on high-volume strategies. Use only disposable capital, DYOR on targets, and never treat this as financial advice.

Why PolyCop Excels for Small Funds + HFT-Style Copying

PolyCop’s self-custodial nature, low 0.5% flat fee, and granular controls make it ideal for budgets as low as $50:

- Proportional & Precise Scaling — Adjusts trades to fit your size without requiring whale-level capital.

- Advanced Features — Limit order offsets, smart proportional sells, auto-redeem of winnings, and robust caps.

- HFT Compatibility — Overrides for sub-minimum trades and inclusive filters ensure you don’t miss the frequent small opportunities that define these strategies.

- Low Costs — ~$0.01 Polygon gas + 0.5% PolyCop fee + ~$0.20 Polymarket fee per trade; viable even on micros.

Compared to alternatives (e.g., higher-fee bots or less customizable tools), PolyCop offers the best balance for small users targeting high-frequency performers.

Step-by-Step Setup Guide

- Launch the Bot Open Telegram, search for @PolyCop_BOT (or use the direct link), and tap /start. The bot generates a self-custodial Polygon wallet. Immediately export and securely back up your private key—never share it.

- Fund Your Wallet Deposit $50+ in USDC, USDT, or USDC.e on Polygon (bridge if needed). Add ~$1-2 MATIC for gas. Start small to test; top up as you scale.

- Identify HFT-Style Targets Use polymarketanalytics.com/traders, community trackers, or X searches for top performers. Focus on wallets with:

- High trade frequency (hundreds/month)

- Consistent profitability over 30+ days

- High win rates and micro-trade patterns

- Activity in short-horizon/crypto/news markets Copy the wallet address manually.

- Create Your Copy Trade Config In the bot: Select “Create Copy Trade,” input the target address, add a tag (e.g., “HFT-Style”), and apply the settings below.

Recommended Personal Settings for Mirroring HFT-Style Whales

These defaults are optimized for a $50-100 starting wallet when targeting high-frequency performers. They emphasize inclusivity (capture all trades, especially micros), strict protection (hard caps), and minimal interference (near-zero offsets for speed-sensitive entries).

- Tag: HFT-Style (or custom for tracking)

- Copy Percentage/$: 50% This scales reasonably across mixed trade sizes—micros become manageable (~$5 copies), while larger conviction plays stay proportional without overwhelming your stack. Adjust to 30-75% based on observed average trade sizes.

- Limit Order Copy: Enabled (⇒)

- Limit Price Offset: ±0% (or minimal ±0.5-1%) HFT relies on precise, millisecond timing—aggressive undercuts often miss in fast windows.

- Limit Order Duration: Short (e.g., seconds or -s if available; otherwise 60s-5min) Matches the rapid nature of these strategies.

- Max Token Spend (per market): Blank or high (e.g., $200+) Allows diversification across many short-lived opportunities.

- Total Token Spend (position cap): $50 Essential safeguard—limits total exposure per market to your starting balance.

- Min Price / Max Price: Blank (or very wide, e.g., $0.01-$0.99) HFT plays extreme/short windows; narrow filters eliminate the edge.

- Below Min Limit: Enabled (Buy at Min / Green check) Critical for HFT — Many trades fall below Polymarket’s $5 limit order minimum. Enabling rounds up to $5 to capture them instead of skipping.

- Ignore Target Wallet Trades Under: Blank or very low ($1-2) Don’t filter out small trades—the frequency is the strategy.

- Min Copy Amount per Trade: Blank (or $3-5 if required) Permits small copies to execute.

- Max Copy Amount per Trade: $50 Aligns with total cap; prevents any single oversized fill from dominating.

Active: Green check

How Copy Trading Works with These Settings

PolyCop monitors the target in real-time:

- Detects buys/sells → Executes proportional copy (e.g., 50% of target).

- Applies smart sell logic (maintains ratio).

- Uses limit orders with your offset/duration.

- Auto-claims resolved winnings every 60s.

- Caps prevent blowups on volatile moves.

For HFT-style targets, expect many small fills + occasional larger ones. Monitor notifications closely the first week; adjust % if amplification feels off.

Scaling Strategy for $50-100 Wallets

- Phase 1 (Test, $50): Run above settings 1-2 weeks. Track win rate, fill consistency, and fee impact.

- Phase 2 ($100-200): Increase to 75-100% if profitable. Reinvest 50% of gains.

- Diversification: Copy 2-4 similar HFT-style wallets (20-40% allocation each).

- Profit Management: Withdraw 30-50% of profits weekly to cold storage.

- Long-Term: At $500+, scale % further to better mirror relative conviction.

Risks, Tips, and Troubleshooting

- Risks — High-volume micros amplify fees/slippage; strategies can degrade; markets resolve unpredictably.

- Tips — Vet targets for sustained performance; start in familiar markets; pause during network congestion.

- Troubleshooting — Low balance/gas errors: Top up. Missed fills: Loosen offset/duration. Use community resources for support.

Pros and Cons of PolyCop

Pros:

- Lowest fees (0.5%) + advanced HFT-friendly controls.

- Self-custodial and precise for small funds.

- Inclusive overrides capture volume strategies.

Cons:

- Manual target discovery.

- Polygon-only; high-frequency means more gas accumulation.

- No built-in analytics.

PolyCop empowers $50 starters to mirror sophisticated HFT-style edges on Polymarket. With these inclusive, capped settings, you avoid common pitfalls and scale safely. Monitor diligently, start conservative, and adapt as you grow. Happy trading—may your resolutions be swift and green!

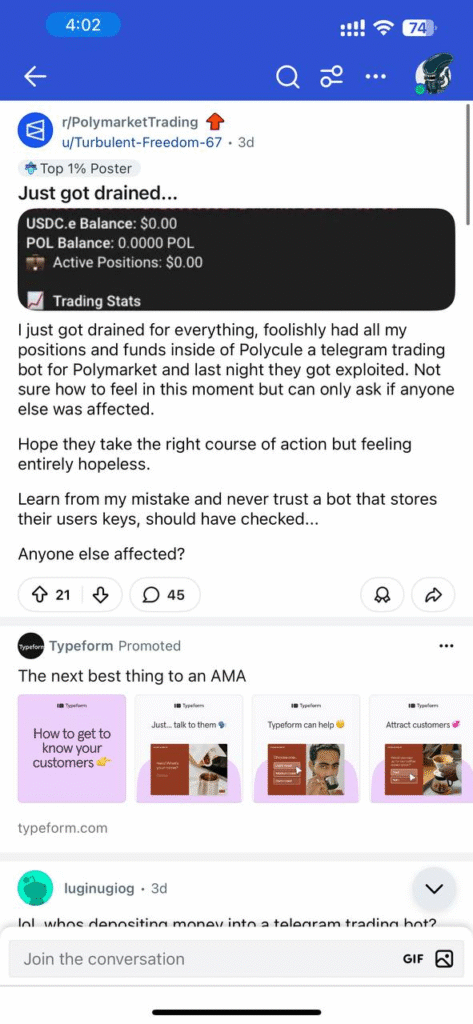

Critical Security Note: Recent events highlight risks in the Polymarket bot ecosystem. Just days ago (January 8, 2026), the competing Polycule Telegram trading bot suffered a major exploit, resulting in approximately $230,000 in user funds drained. The bot went offline for patches and audits, with many users reporting unauthorized transfers of available balances (while some locked positions remained). This incident, widely discussed on X and crypto news outlets, underscores a painful lesson: never leave significant funds sitting in a bot wallet long-term.

****** just grabbed a

****** just grabbed a