How AI Legalese Decoder Can Help with Government Finance and You: Part 11 – Spending Simplified

- January 2, 2026

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

markdown

My Neighborhood News Group (MNNG) Series on Local Government Funding

Overview of the Series

My Neighborhood News Group (MNNG) is delighted to inform our readers about an in-depth series of articles addressing the crucial topic of local government funding and the financial obstacles that both elected officials and residents face. Each part dissects various facets of local government budgeting, offering valuable insights into how tax revenue is spent and the implications it has for the community.

You can explore the individual parts of our series through the following links:

- Part 1: Introduction

- Part 2: Where’s the Money

- Part 3: Property Taxes

- Part 4: Fees and Taxes

- Part 5: Federal and State Grants

- Part 6: The Difference Between Wants and Needs

- Part 7: The Color of Money

- Part 8: "Cities Should Function More Like a Business"

- Part 9: What Local Governments are Up Against in 2026

- Part 10: Follow the Money

Understanding the Allocation of Taxes

Local governments use taxes collected from the general fund primarily for what are termed “core services.” However, the definition of what constitutes core services is often subjective and can lead to significant disagreements among residents. As articulated in Part 6, these disagreements highlight the diverse priorities within a community.

Decision-Making Processes in Local Government

Local governments typically follow a structured process for determining budget priorities, which includes adhering to best practices, complying with established rules and regulations, and actively engaging with the community through listening sessions. Elected council members regularly consult with constituents to guide their decisions on budget allocations each fiscal year.

This intricate process dictates how public funds—consisting of property taxes, sales taxes, utility taxes, fees, fines, shared revenues, licenses, and permit fees—are utilized to provide essential services to the community.

Statewide Financial Overview

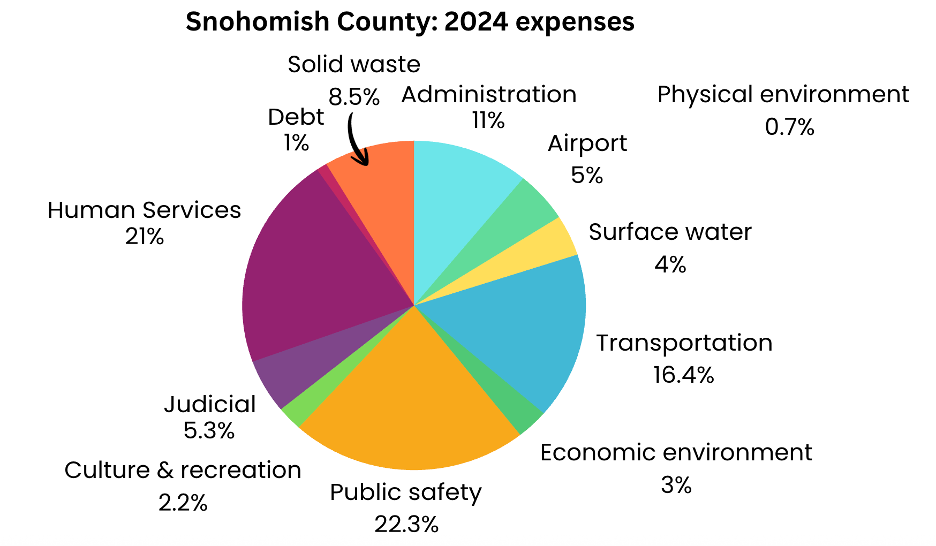

Snohomish County Spending Breakdown

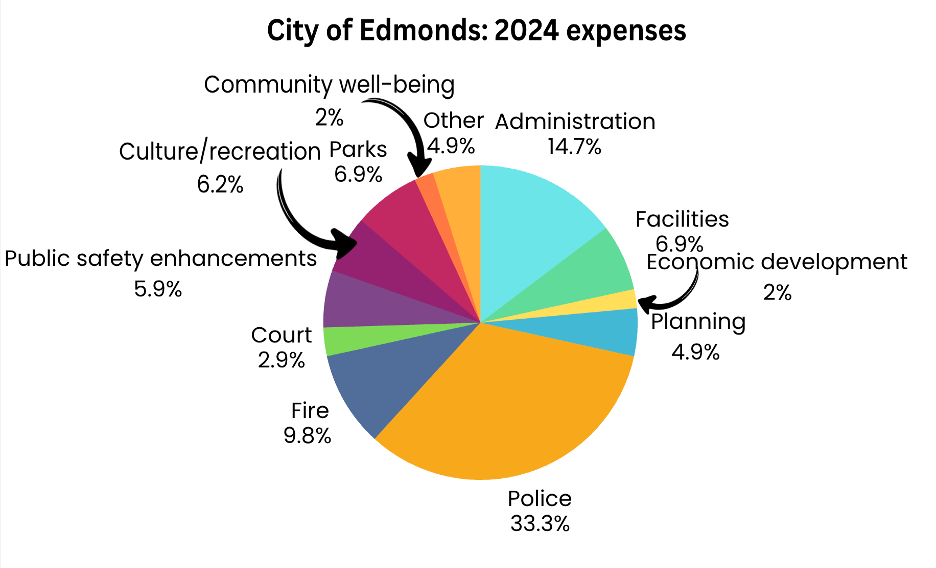

Edmonds Financial Allocation

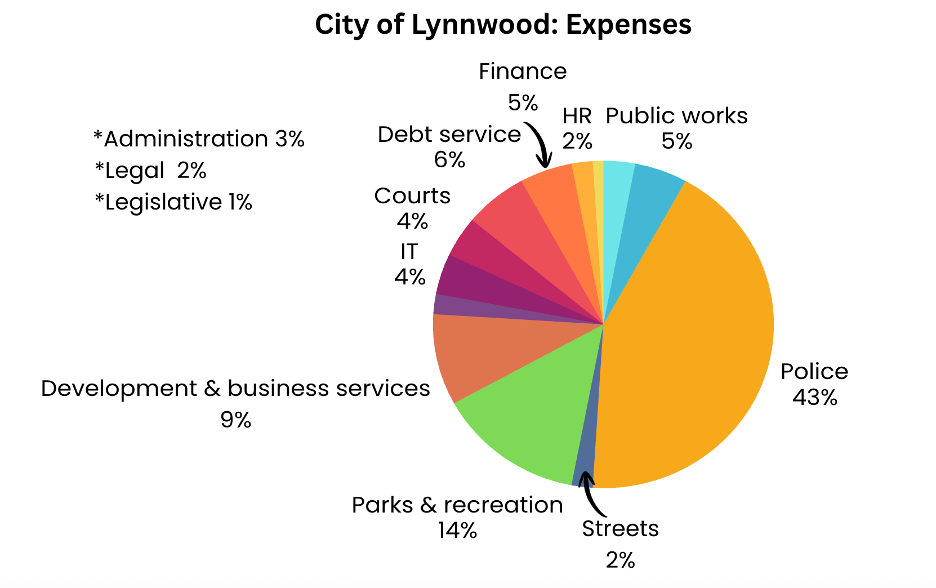

Lynnwood’s Budget Distribution

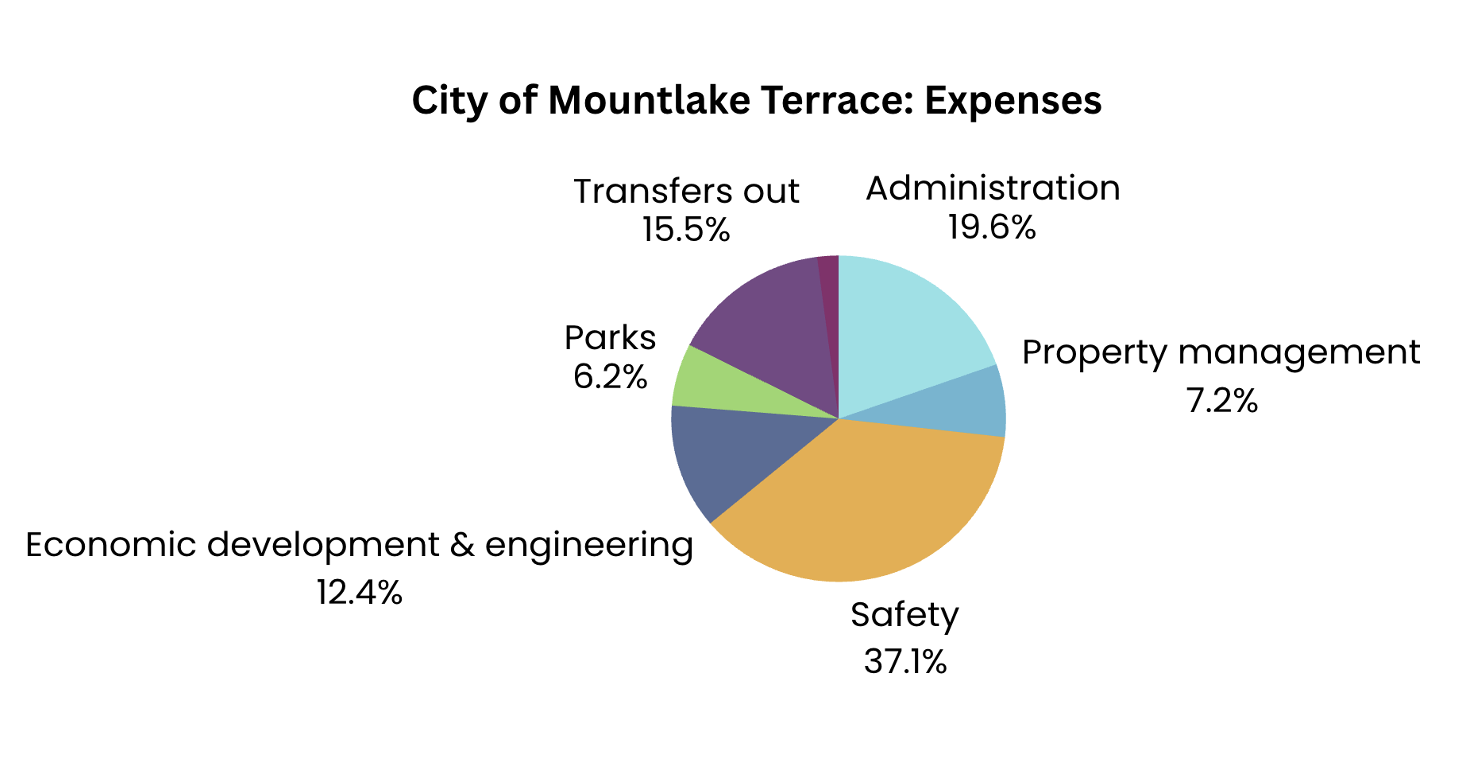

Mountlake Terrace Financial Insights

The budgetary expenditures of most local Washington state governments reveal that the two largest allocations generally pertain to public safety and administrative functions. Public safety encompasses the personnel who enforce laws and maintain community safety, while administration refers to government staff and associated expenses like health benefits.

Parks contribute significantly to enhancing the quality of life in cities, and economic development efforts aim to boost local businesses. Local government’s core mission revolves around the efficient delivery of services to all residents. However, when budget cuts are necessary, councils must make tough decisions regarding which services and personnel to reduce.

The Challenge of Community Priorities

Residents often express conflicting views on budget priorities. Questions such as “Why do we need new police cars?” or “I don’t want a human services person; non-profits can handle that,” reflect these differences. Such statements are not unwarranted; they underscore the difficulty of aligning budget allocations with the community’s diverse set of values.

Decisions on cuts often revolve around priorities: Is a detective more valuable than human services? Can we afford to forgo a permit technician or public defender? These questions create a complex dialogue about essential services and community values.

Feedback on priorities is crucial, and it typically originates from government professionals who utilize best practices. Local governments and their governing bodies actively seek community input, utilizing organizational support from entities like the Association of Washington Cities.

When residents reach out to their representatives, they feed their preferences into the budgeting process, which then translates into financial allocations subject to review and revisions by governing bodies.

If residents disagree with their representative’s performance, they can express their dissatisfaction or vote them out—a fundamental aspect of the democratic system that hinges on active community engagement. However, motivating busy citizens to participate can prove challenging.

Personal Financial Analogy

Drawing a parallel to personal finances, individuals often believe their paycheck is substantial, but after deductions for Social Security and health insurance, one is often left with only around 60% of the gross amount. Factoring in essentials such as rent and food leaves little room for discretionary spending. Residents must confront similar hard decisions regarding what services they can afford to cut from local budgets.

Local governments empathize with residents during these difficult financial times. Despite various revenue streams, funding may still fall short of meeting community needs. Repeated taxation requests can lead to voter fatigue, especially when residents themselves are feeling financial pressure.

Looking Ahead

What Are the Next Steps?

This discussion covers a wealth of information but inevitably leads to the question, “Now what?” Understanding the local government funding landscape is crucial for informed civic engagement and decision-making.

How AI legalese decoder Can Assist

Navigating the complicated world of local government documents and financing regulations can be overwhelming. That’s where the AI legalese decoder comes into play. This innovative tool can simplify complex legal language, helping residents better understand budget reports, tax structures, and governmental processes. By providing clear explanations, the AI legalese decoder empowers residents to engage more effectively with their local representatives and advocacy efforts.

In conclusion, while budgetary challenges may seem daunting, awareness, and the right tools can empower residents to participate actively in their community’s governance.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a