Breaking Down FOMC Minutes: How AI Legalese Decoder Clarifies Rate Cut Impact and Crypto’s Challenges Ahead

- December 30, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Bitcoin and the Wider Crypto Market Face Renewed Challenges as the New Year Arrives following Recent FOMC Insights

As the crypto world eagerly anticipated the arrival of a new year, Bitcoin, along with various other cryptocurrencies, has entered a landscape fraught with renewed pressure. This comes on the heels of the Federal Open Market Committee (FOMC) releasing its meeting minutes from December, which have painted a rather cautious economic outlook.

Sponsored

Higher-for-Longer Interest Rates Impact Crypto Sentiment

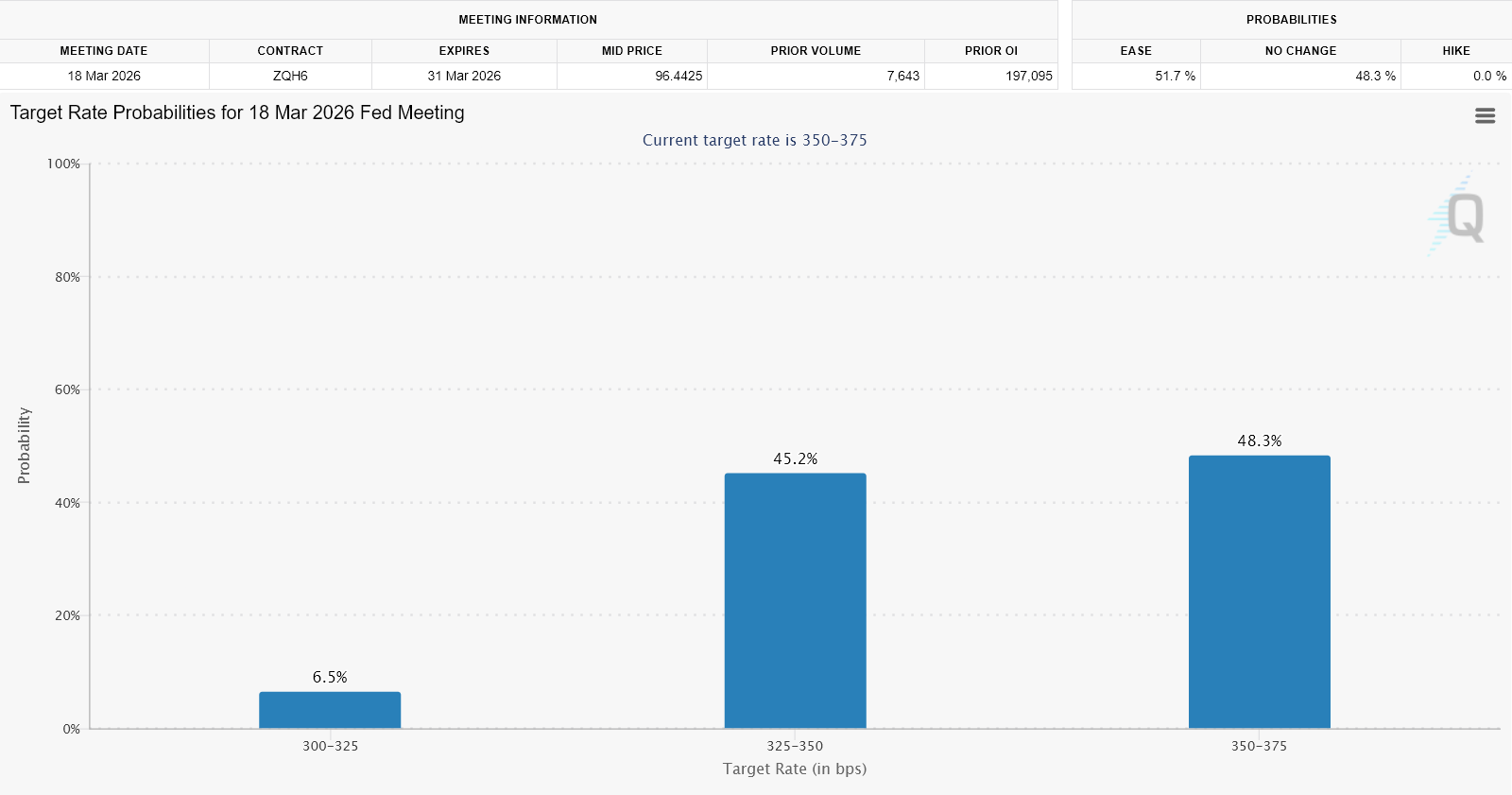

The FOMC minutes published on December 30 indicate a clear preference among policymakers to pause interest rate cuts following a modest 25-basis-point reduction made in December. Market expectations for any future cuts have now been pushed back, with March 2026 being touted as the earliest potential date for another rate change.

Although market traders had already adjusted their anticipations to exclude a possible move in January, the language of the minutes has reinforced this outlook, even casting doubt on the hopes for a rate cut in March 2026. Consequently, the earliest feasible cut could potentially materialize in April, should economic conditions allow for it.

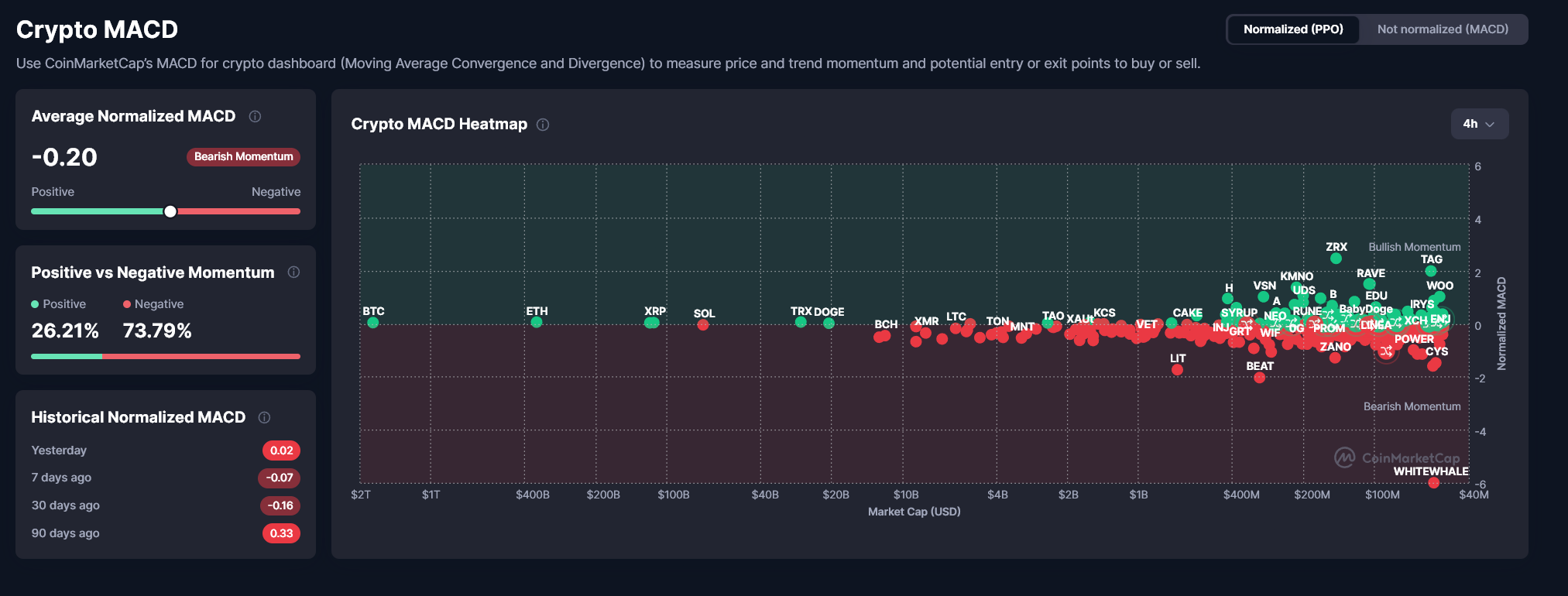

In recent weeks, Bitcoin has been trading within a confined range of approximately $85,000 to $90,000. This stagnation indicates a fragile price action that has yet to reclaim higher resistance levels, while general market sentiment leans more toward caution than confidence. Trade volumes in the crypto market remain low, as risk appetite has not shown substantial recovery following December’s downturn.

Sponsored

As revealed in the minutes, several FOMC officials expressed that it would be “appropriate to keep the target range unchanged for some time” in order to evaluate the effects of the recent monetary easing. Others described the December cut as “finely balanced,” further emphasizing the limited enthusiasm for additional action without clearer advancements in inflation metrics.

Inflation continues to be the primary constraint affecting economic conditions. Policymakers acknowledged that pressure on prices “had not moved closer to the 2 percent objective over the past year,” even amidst signs of a weakening labor market. This complicating economic backdrop puts added pressure on the already uncertain cryptocurrency landscape.

Sponsored

The FOMC highlighted tariffs as a significant factor contributing to persistent goods inflation, while improvements in services inflation are emerging gradually. Concurrently, the Fed noted an increase in downside risks to employment, cautioning about slowing hiring rates, muted business plans, and growing concerns among lower-income households. Nevertheless, the consensus among most officials was to await further data before considering any adjustments in policy.

Sponsored

For the cryptocurrency markets, the FOMC’s message could not be clearer. With real yields remaining elevated and conditions of liquidity being tight, any near-term catalysts for upside performance appear to be limited. Bitcoin’s recent consolidation trend mirrors this tension, as investors find themselves balancing sweet hopes for eventual easing against the harder reality of sustained high interest rates.

Looking ahead, March now stands out as the earliest practical opportunity for another interest rate cut, but this is contingent on inflation rates cooling and further weakening in labor conditions. Until then, the cryptocurrency market may grapple with regaining its former momentum. Prices are likely to remain susceptible to additional downward pressure if macroeconomic data fails to meet expectations in the early stages of 2026.

How AI legalese decoder Can Assist in Navigating the Crypto Landscape

Navigating the complexities of the cryptocurrency market amidst shifting economic conditions can be challenging for investors and businesses alike. This is where the AI legalese decoder comes into play. This innovative tool assists users in understanding complex legal documents and agreements that are often associated with cryptocurrency transactions. By simplifying intricate legal jargon into easily comprehensible language, AI legalese decoder enables investors to make better-informed decisions and navigate regulatory risks effectively. With the landscape constantly evolving, this tool becomes essential for anyone looking to engage in the crypto market safely and knowledgeably.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a