Decoding Financial Jargon: How AI Legalese Decoder Unravels Yuan’s Surge, Bitcoin’s Stalemate, and the Dollar’s Impact on Crypto

- December 25, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

China’s Currency Surges as the Dollar Weakens: Bitcoin’s Dilemma

China’s onshore yuan recently achieved its strongest valuation since May 2023, closing at 7.0066 per dollar. This impressive performance marks a 5% appreciation against the U.S. dollar since early April, nearly breaching the psychologically significant 7-per-dollar threshold. Such trends typically signal a bullish environment for Bitcoin, especially as the dollar weakens; however, this time the expected reaction isn’t materializing.

Yuan’s Rally: Reasons Behind the Shift

The surge in the yuan is largely attributed to Chinese exporters who are eagerly converting their dollar earnings into yuan ahead of the year’s end. This isn’t merely a case of seasonal financial housekeeping; analysts predict that over $1 trillion in corporate dollars held outside China may flow back into the country, fundamentally altering the currency dynamics.

But what’s causing this shift now? Significantly, signs of economic recovery are emerging from China, coinciding with the U.S. Federal Reserve cutting interest rates. These developments are fostering a self-reinforcing cycle where a strengthening yuan diminishes the appeal of holding dollars. As the yuan appreciates, dollar-denominated assets appear less attractive.

Market observers suggest that this is just the beginning of a positive trend. Long-standing challenges for the yuan—such as trade disputes, capital flight, and a strengthening dollar—appear to be reversing. If the Fed opts for more aggressive monetary easing in 2026, expectations indicate that the yuan may continue to rise, setting the stage for further appreciation.

The Setup That Should Catalyze Bitcoin’s Rise

In theory, a weakening dollar usually ushers in a favorable environment for Bitcoin. The logic is simple: as the U.S. dollar loses value, dollar-denominated assets—like Bitcoin—become cheaper, enhancing their appeal to investors. Additionally, the growing perception of Bitcoin as "digital gold" supports this bullish narrative.

Recent trends in the gold market reinforce this premise, with gold reaching record highs this month. Yet, paradoxically, Bitcoin remains trapped in a narrow price range of $85,000 to $90,000, struggling to maintain momentum above the $90,000 mark despite multiple attempts this week alone.

Unpacking the Disconnect: Why Isn’t Bitcoin Rising?

Despite favorable macroeconomic factors, several issues are constraining Bitcoin’s response to the weakening dollar:

-

Thin Year-End Liquidity: The holiday season has contributed to diminished trading volumes, which amplifies volatility while restricting conviction-driven price movements.

-

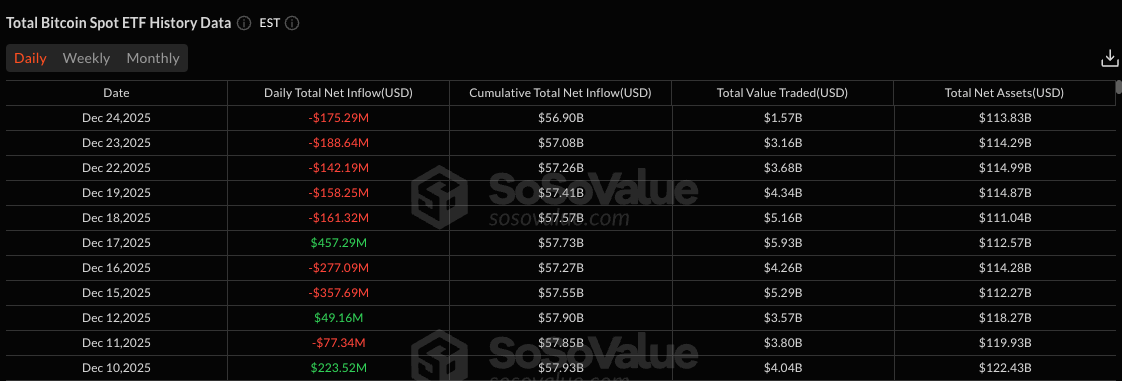

Negative Institutional Flows: There has been a notable downturn in institutional interest, with U.S. spot Bitcoin ETFs experiencing five consecutive days of net outflows totaling over $825 million, according to SoSoValue data.

Source: SoSoValue

- Bank of Japan’s Impact on Markets: The recent rate hike by the Bank of Japan, its highest in three decades, has led to market trepidation. While the yen weakened post-announcement, the uncertainty about the BOJ’s future decisions continues to make investors jittery, impacting overall risk appetite.

2026: The Possibility of a Delayed Rally

The bullish sentiment surrounding Bitcoin is not extinguished; rather, it seems postponed. Some analysts forecast that the dollar may weaken even more as we approach 2026, especially if U.S. monetary easing surpasses current market projections.

If this scenario unfolds, Bitcoin’s subdued reaction to the dollar’s current weakness may well be a reflection of timing rather than a fundamental breakdown in its expected correlation with the dollar. Once liquidity stabilizes in January and the Federal Reserve’s policies become clearer, the positive signal from the strengthening yuan may finally make its way to crypto markets.

In this complex landscape, AI legalese decoder could be instrumental for traders and investors navigating the nuances of cryptocurrency regulations and financial compliance. By simplifying legal jargon, this tool enables users to better understand their rights, obligations, and potential liabilities, making informed decisions during such volatile market conditions. Thus, while Bitcoin watches from the sidelines, as China reveals one of the most compelling dollar-bearish signals seen in years, understanding the legal framework surrounding these assets becomes increasingly critical.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a