How AI Legalese Decoder Empowers Hirono and Markey to Advocate for Underserved Businesses: Insights from Maui Now

- December 24, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Concerns Raised Over SBA’s 8(a) Business Development Program Audit

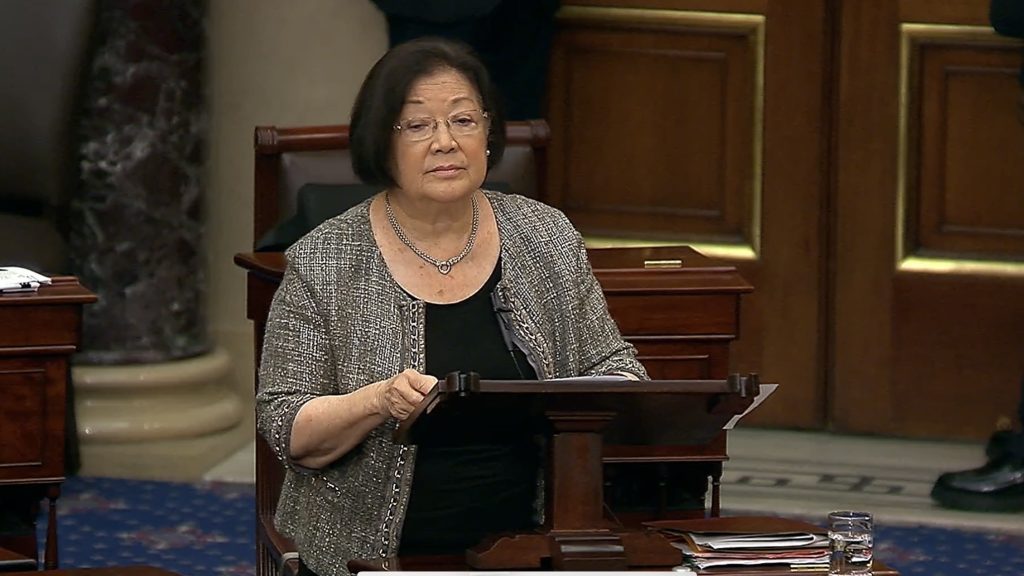

File Courtesy: Office of Sen. Mazie Hirono

Senators Express Alarm

US Senators Mazie K. Hirono from Hawaiʻi and Ed Markey from Massachusetts have voiced their serious concerns regarding the US Small Business Administration’s (SBA) announcement on December 5. The SBA revealed plans for a comprehensive audit of the 8(a) Business Development Program, a critical program that provides vital resources and opportunities for socially and economically disadvantaged businesses across the nation.

Implications of the SBA’s Announcement

“The SBA’s announcement has left many small businesses scrambling to meet the agency’s extensive document requests amid an unclear guidance framework and an extremely tight deadline,” the senators stated. This urgent call for documentation raises significant issues about the security and proper usage of the businesses’ sensitive information, leading to growing unease within the 8(a) community.

The 8(a) Business Development Program was established by Congress to deliver critical training, assistance, and federal contracting opportunities for disadvantaged groups. This program plays a pivotal role in ensuring that these businesses can effectively engage with federal agencies, providing them opportunities to thrive.

Importance of Supporting Small Businesses

Small businesses, particularly those that are socially and economically disadvantaged, often depend heavily on government contracts for their livelihood and to retain their workforce. This reliance underscores the importance of the 8(a) program; however, the uncertainty surrounding the current audit has created a climate of anxiety for these enterprises.

The senators reinforced their stance, saying, “While we support meaningful oversight for all programs monitored by the Senate Committee on Small Business and Entrepreneurship, we fundamentally disagree with how the SBA has characterized this program.” They advocate for audits to be conducted by appropriate oversight authorities, such as Inspectors General—entities with decades of established success in detecting and preventing fraud, waste, and abuse.

Confusion Over Audit Language

The ambiguity surrounding the language used in the SBA’s audit has resulted in considerable confusion among businesses operating under the 8(a) program. Many have been actively seeking clarity and guidance on the documentation required to maintain their eligibility in this essential program.

The senators continued to express their concerns regarding the audit process, stating, “The nature of the information requested—an indiscriminate data call affecting 4,300 businesses—along with minimal guidance on how compliance should be achieved, raises significant concerns.” Initial deadlines imposed by the SBA required businesses to provide necessary documentation in just 31 days, which was later extended to January 19, 2026, shortly after the holiday season.

Call for Clarity and Accountability

In light of these complications, the lawmakers have set forth several questions that they demand answers to by January 2, 2025. These inquiries focus on how businesses can properly provide requested information, whether extensions for compliance will be granted, and what protections exist for proprietary information shared with the agency. Further questions include identifying who will conduct the audit and if the SBA will adhere to established government standards for conducting audits.

The senators concluded their letter with a reiteration of the SBA’s mission, stating, “SBA’s fundamental mission is to support small businesses and entrepreneurs in the United States. Instead of using this audit as a vehicle for unjust attacks on a program with which you have an ideological disagreement, we hope you can realign your focus on the essential goals of the 8(a) Program to ensure that it continues to support the very businesses it was designed to help.”

The Role of AI legalese decoder

Given the complexities of the SBA’s audit and the potential repercussions for businesses involved, many affected by this situation may find themselves overwhelmed by legal jargon and unclear documentation requirements. This is where the AI legalese decoder can be invaluable. This tool simplifies legal documents, making them accessible and understandable for small business owners who may not have legal backgrounds.

By using the AI legalese decoder, business owners can quickly obtain clear explanations of their obligations, ensuring that they can respond appropriately to the SBA’s requests. It also assists in navigating the intricacies of compliance documents, transforming complex legal language into straightforward terms. With this tool, business owners can focus on what truly matters—maintaining their operations and safeguarding their future.

Conclusion

The concerns raised by Senators Hirono and Markey highlight the urgent need for clarity and support for small businesses involved in the 8(a) Business Development Program. As these businesses navigate the challenges presented by the SBA’s audit, leveraging resources such as the AI legalese decoder will be crucial in mitigating confusion and bolstering compliance, ultimately allowing them to thrive in an uncertain landscape.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a