Unlocking Clarity: How AI Legalese Decoder Aids New Whale Buyers in Navigating Bitcoin’s 50% Realized Cap

- December 20, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Current State of Bitcoin: Key Insights

Bitcoin has been experiencing considerable price fluctuations lately, yet the more compelling narrative lies beyond the charts—it revolves around the entities actively purchasing Bitcoin and the price points at which they are entering the market.

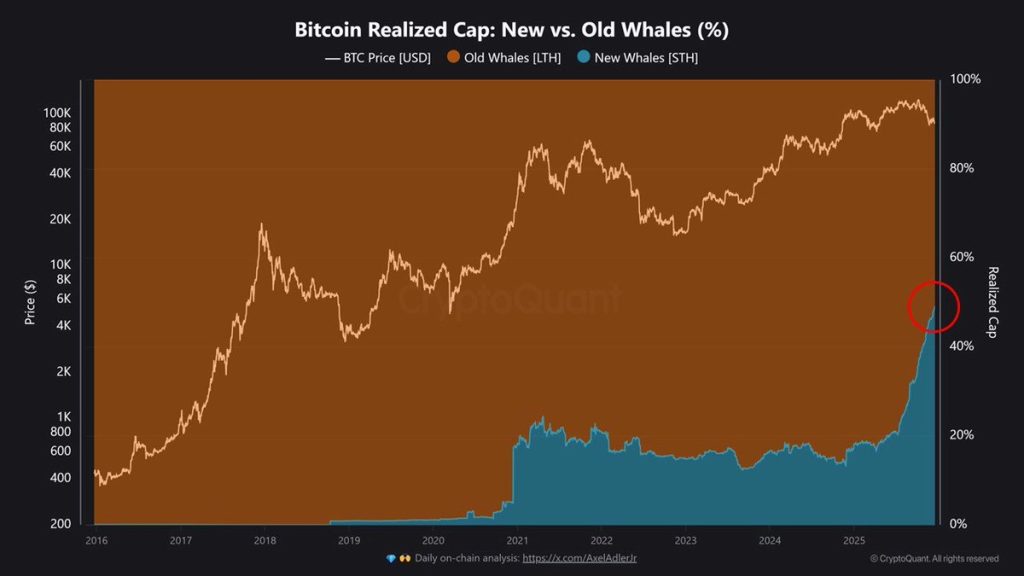

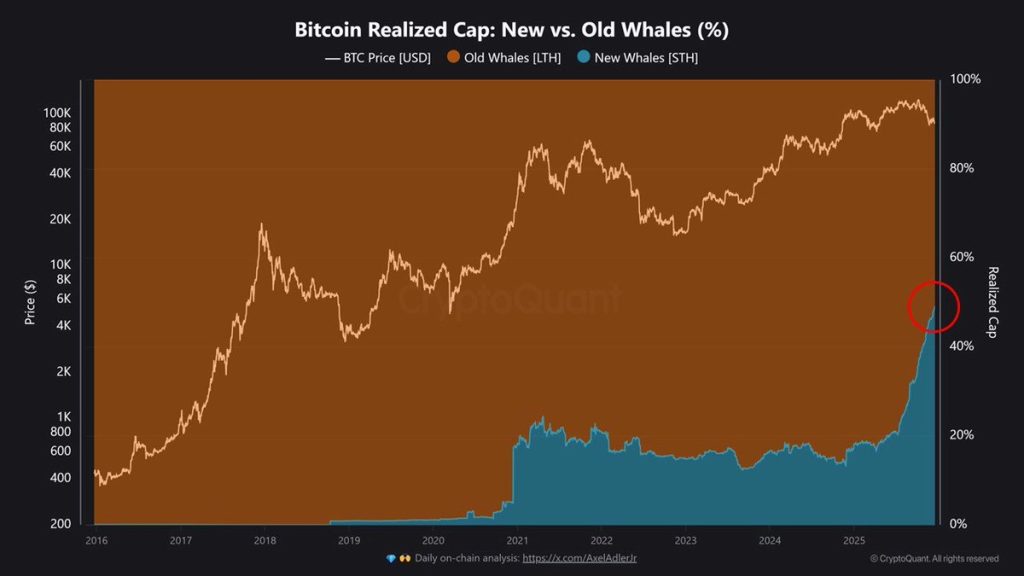

Recent on-chain metrics indicate that nearly half of Bitcoin’s realized market capitalization is now attributed to emerging whale investors. This represents a significant shift from previous Bitcoin market cycles, which were characterized by different buying dynamics.

To clarify, the realized cap is a metric that reflects the value of Bitcoin based on the last price at which each coin transacted on the blockchain. When new whales accumulate nearly 50% of this cap, it signals that a considerable portion of the total invested capital in Bitcoin comes from recent transactions rather than from early, more economical accumulations.

The Evolution of Whale Investors

According to detailed analyses, the new breed of whale investors primarily comprises institutional players and Exchange-Traded Funds (ETFs) that are purchasing Bitcoin at higher price points and in substantial quantities. This starkly contrasts with long-term holders who procured Bitcoin at lower costs and tended to sell during market upswings in earlier bull markets.

More crucially, their strategies during market downturns exhibit a marked difference.

“Even during market corrections, the share of Bitcoin’s Realized Cap held by these new whales has persistently grown,” the report notes.

This trend ought not to be interpreted solely as a short-term bullish or bearish indicator; rather, it serves as compelling evidence that the very fabric and structure of the Bitcoin market are undergoing a substantial transformation.

Rising Demand Without Rotation

Data reflecting the activity of short-term holders substantiates this indication. The number of Bitcoin coins held for less than 155 days surged by approximately 100,000 BTC over a 30-day period, reaching unprecedented heights. This suggests a continual influx of new demand, despite the price fluctuations experienced in the market.

- Also Read:

- Are Banks Trying to Kill Stablecoin Rewards? 125 Crypto Groups Push Back

Simultaneously, long-term holders appear largely inactive. Analysis of exchange flows reveals that the selling pressure originates mainly from smaller investors, while larger wallets are strategically entering to absorb the supply. This paints a picture of a bifurcated market with distinct behaviors between large and small participants.

Further, cumulative volume delta data lends credence to this separation. Whale wallets recorded a positive delta of $135 million, whereas retail and mid-sized traders exhibited negative flows during the same period.

Implications of This Transformation

The data points to a more profound underlying shift taking place within the Bitcoin landscape. The asset is in a transition phase toward a more sophisticated and mature investment, spurred by sustained institutional interest and participation.

This shift is particularly significant for a market traditionally characterized by boom-and-bust cycles. As this transformation unfolds, it sheds light on why Bitcoin’s behavior may increasingly deviate from historical patterns and become more structurally shifting month after month.

How AI legalese decoder Can Assist

In the ever-evolving landscape of cryptocurrency investment, understanding the legal implications of your transactions and investments is paramount. AI legalese decoder can assist investors by simplifying complex legal jargon and risk assessments associated with cryptocurrency regulations, enabling them to make more informed decisions. By demystifying contracts, terms of service, and regulatory guidelines, the tool ensures that both new and seasoned investors can navigate the market with greater confidence. This is especially crucial in times of significant market transformations, such as the current shift toward institutional investment in Bitcoin.

Stay Ahead in the Crypto World!

Keep yourself informed with breaking news, expert analyses, and real-time updates on the latest trends affecting Bitcoin, altcoins, DeFi, NFTs, and beyond.

Frequently Asked Questions

Not necessarily. While institutional buyers can enhance liquidity and mitigate extreme volatility in the long run, they might also introduce new types of risks, including synchronized market reactions to macroeconomic changes or shifts in regulatory frameworks. For retail investors, this may yield more abrupt price movements linked to traditional financial markets rather than cycles innate to cryptocurrency.

The response could be different from prior cycles. Rather than a panic sell-off, institutional players might hedge their positions, rebalance portfolios, or even buy more at strategic price points. This could lead to quicker market stabilization; however, unforeseen factors such as forced liquidations induced by external pressures could still result in sharp declines.

Long-term investors and infrastructure service providers—such as custodians, derivatives platforms, and firms specializing in on-chain analytics—are likely to gain most from a more capital-intensive, institutionally driven Bitcoin market. Short-term traders may, conversely, encounter fewer momentum-based opportunities than they experienced in previous cycles.

Trust with CoinPedia:

Since its inception in 2017, CoinPedia has been committed to providing precise and timely information regarding cryptocurrency and blockchain technology. Our content is crafted by a dedicated team of analysts and journalists adhering to strict editorial guidelines founded on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Each article is thoroughly fact-checked against reputable sources to guarantee accuracy and transparency. Our review policy ensures objective evaluations for exchanges, platforms, or tools. We aim to keep our audience informed about everything crypto and blockchain, from startups to industry giants.

Investment Disclaimer:

The opinions and insights presented reflect the author’s personal views concerning current market conditions. Please conduct your own research before making any investment decisions. Neither the author nor the publication accepts responsibility for financial outcomes.

Sponsored Content and Advertisements:

Sponsored content and affiliate links may be present on our site. Advertisements are clearly marked, ensuring that our editorial content remains completely independent from our advertising partners.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a