Decoding Property Investment: How AI Legalese Decoder Clarifies Insights from 15 Years of Winners and Losers

- December 5, 2025

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

The Shifting Landscape of Property Investment: Is It Still a Viable Option?

Property has long been regarded as a safe, long-term investment. However, with the tide of ultra-low interest rates receding, potential investors may be left wondering whether real estate remains a lucrative choice. Recent analyses reveal that, over the past 15 years, property owners across different regions have experienced vastly different fortunes, with the dynamics of these winners shifting significantly since 2010.

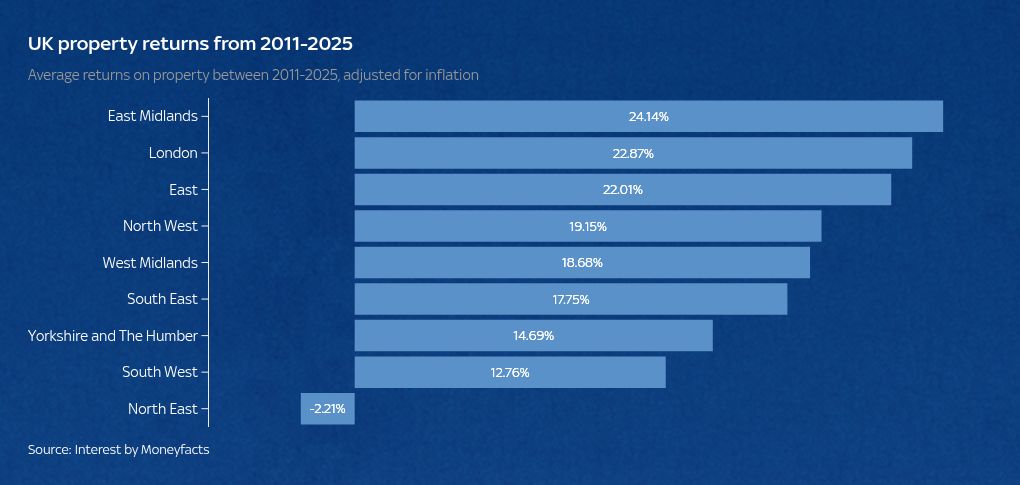

Performance Overview: East Midlands at the Forefront

According to exclusive insights provided to Money, homeowners in the East Midlands have emerged as the champions of property investment, securing average returns exceeding 24% from 2011 to 2025 when adjusted for inflation. This data draws from an extensive analysis of the HM Land Registry and inflation data, brought to light by Moneyfacts.

In stark contrast, London—despite its reputation as a high-value property market—has not been left untouched. Homeowners here enjoyed substantial returns, nearly 23%, during the same timeframe. Meanwhile, the North East has fared poorly, facing an average loss of about 2.21%. This presents a compelling case for potential buyers to consider regional performance trends before making investment choices.

Examining Trends Across the Decade

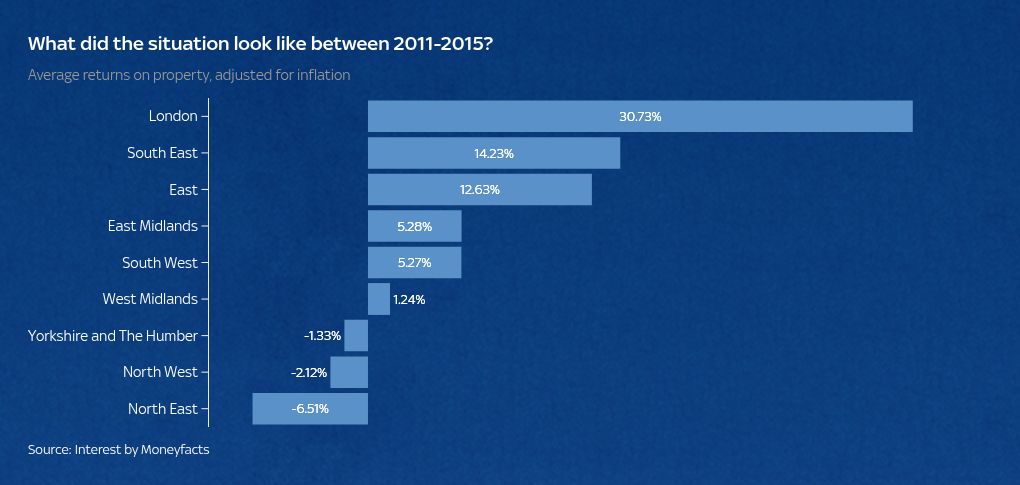

The Early 2010s: Low Borrowing Costs Drive Investment

The early 2010s were characterized by falling borrowing costs as the nation endeavored to stimulate spending following the 2008 financial crisis. Between 2011 and 2015, property investment trends remained relatively consistent, with southern regions like London yielding impressive returns of approximately 30.73% and northern areas such as the North East suffering losses of around 6.51%.

This era also witnessed declining fortunes for homeowners in the North West and Yorkshire and the Humber, recording losses of 2.12% and 1.33%, respectively.

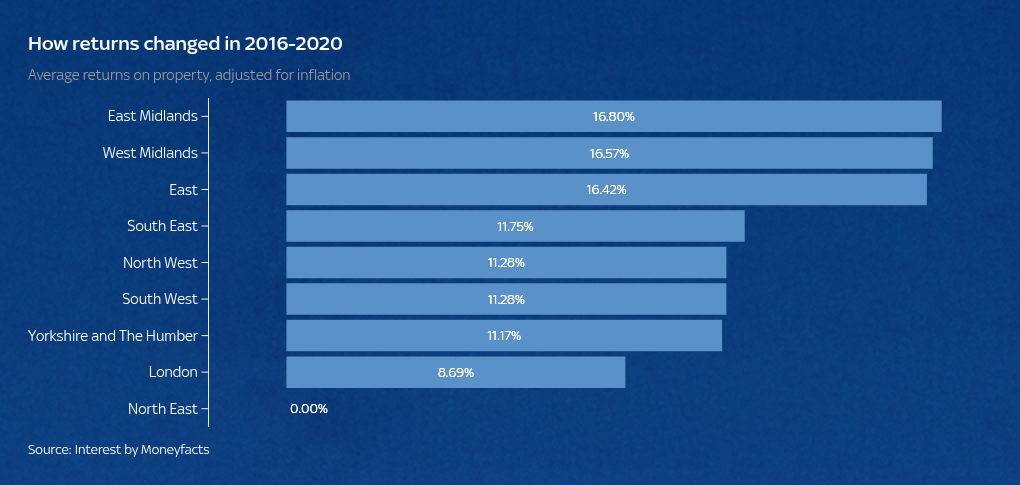

The Rising Tide: Shifting Returns

As we advanced into the latter half of the decade, growth in salaries and persistently low mortgage rates transformed the landscape. By this point, buyers were able to borrow more, resulting in an uptick in the property market. Interestingly, the previous leaders, notably London, saw their returns membership decline to just shy of 9%, ceding dominance to the East Midlands, which achieved a return of 16.8%.

Other regions showed signs of resilience as well; the North East managed to break even while the North West enjoyed a resurgence to 11.2%.

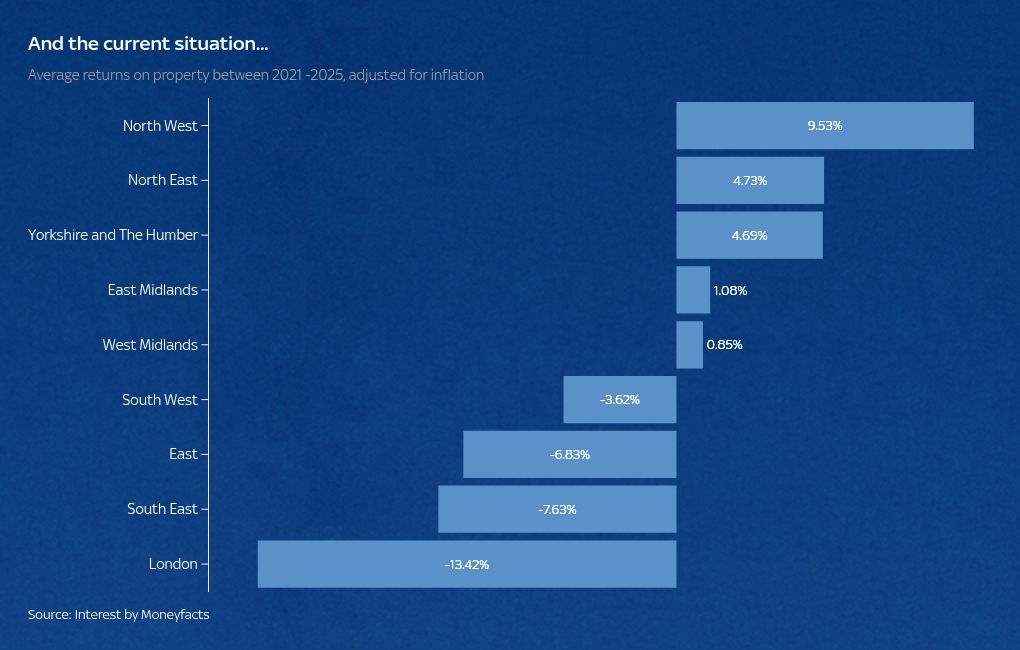

The Impact of Rising Interest Rates

As we transitioned into the 2020s, the economy experienced significant recovery juxtaposed with a sharp rise in interest rates. Consequently, property prices began to plateau, and returns plummeted. By 2021-2025, Londoners reported average losses of 13.42% due to increasingly stretched price-to-income ratios. Other regions like the East, South East, and South West were similarly affected, experiencing losses of 6.83%, 7.63%, and 3.62%, respectively.

In stark contrast, homeowners in the North East, buoyed by lower house prices and stronger affordability, continued to see returns grow at an average rate of 4.73%.

Analyzing the Current State: Property Market Correction?

According to Adam French, head of news at Moneyfacts, the previous policy of ultra-low interest rates primarily inflated house prices, making long-term affordability significantly more challenging. The 2010s fostered conditions that allowed house prices to outpace inflation, creating a pronounced divide between early buyers and those now facing insurmountable deposit challenges.

French emphasizes that regions like London and the South East, which greatly benefited from low borrowing costs, now face the most substantial reversals as rates normalize.

What Lies Ahead: The Future of Property Investment

The positive takeaway is that instead of a market collapse, the current correction signifies a rebalancing of an unusually distorted property environment. More affordable regions, including the North West, Wales, and Northern Ireland, continue to yield positive real returns even amid rising interest rates.

These areas have historically taken longer to rebound post-crisis and remained less inflated during the low-rate years, demonstrating fortitude in the face of market changes. French remarks that this is promising news for first-time buyers striving to save for a deposit, as property values are now more closely aligned with income and affordability rather than benefitting from cheap credit.

For sellers, particularly in the South, the data suggests a pressing need to adjust pricing strategies in response to changing market dynamics. Ultimately, it appears that a shift toward a healthier and more sustainable market may help avert a more severe crash.

Leveraging AI legalese decoder for Informed Decisions

In these tumultuous times, understanding the legal text associated with property investments is vital. The AI legalese decoder serves as a powerful tool for potential investors and homeowners alike, making complex legal jargon more accessible and understandable.

By simplifying legal documents and contracts related to property purchases, leases, and sales, it empowers users to navigate the intricacies of real estate transactions with confidence. The AI legalese decoder ensures that property buyers fully grasp their rights, obligations, and options, thereby enabling informed decision-making that aligns with their financial goals and risk appetites.

As the property landscape remains in flux, staying informed is paramount. The AI legalese decoder stands ready to assist you in demystifying legal language, so you can continue to make wise investment decisions in a challenging market.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a