Unlocking Opportunities: How AI Legalese Decoder Empowers Crypto Hedge Funds Amid Bitcoin’s Historic Rally

- December 21, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Surge in Cryptocurrency Market: Hedge Funds Reap Massive Rewards

Overview of Hedge Fund Performance

The recent surge in the cryptocurrency market has resulted in remarkable returns for key players like hedge fund titans Brevan Howard and Galaxy Digital. As Bitcoin skyrocketed to an impressive $108,000, these funds have distinguished themselves as top performers in an increasingly competitive landscape.

Exceptional Gains for Cryptocurrency Hedge Funds

Data from Hedge Fund Research indicates that cryptocurrency-focused hedge funds realized gains of 46% in November alone. This surge has propelled their year-to-date returns to an astounding 76%. In contrast, the broader hedge fund industry managed a more modest gain of only 10% during the first eleven months of 2024. This stark contrast highlights the explosive potential that cryptocurrency investments can hold, particularly at times of significant market volatility.

Hedge Funds Capitalizing on Market Momentum

Brevan Howard Asset Management

Brevan Howard Asset Management, under the strategic leadership of CEO Aron Landy, currently oversees an impressive $35 billion in assets. Notably, the firm’s primary cryptocurrency fund surged by a staggering 33% in November, contributing to an overall gain of 51% for the first eleven months of 2024. These figures affirm the fund’s adept ability to harness market momentum to deliver outstanding results across its client portfolio.

Galaxy Digital’s Remarkable Returns

Meanwhile, Galaxy Digital, led by billionaire Mike Novogratz, has achieved even more staggering performance metrics. The firm reported a remarkable 43% return in November, which is part of a larger 90% gain accumulated throughout 2024. Additionally, Galaxy Digital has successfully expanded its assets under management, reaching approximately $4.8 billion, further bolstered by strategic acquisitions from distressed crypto entities.

Political Factors Driving Market Confidence

The revival of the cryptocurrency market has been notably fueled by political developments, particularly following Donald Trump’s victory in the U.S. presidential election. Many investors consider this an indicative signal for forthcoming crypto-friendly regulatory reforms. Trump’s decision to appoint venture capitalist David Sacks as the ‘cryptocurrency czar’ and potential replacement of SEC Chair Gary Gensler with cryptocurrency advocate Paul Atkins has instilled renewed confidence across the market.

Regulatory Developments Impacting the Market

It is worth noting that while Gensler hasn’t always aligned with the interests of the crypto sector, he played a critical role in January 2024, when the SEC approved eleven exchange-traded Bitcoin (BTC) funds. This pivotal decision created new investment pathways for both institutional and retail investors, providing a significant boost to market activity. However, following the Federal Reserve’s announcement of lower-than-expected rate cuts for the upcoming year, the market witnessed a minor pullback this past week.

Bitcoin Price Fluctuations

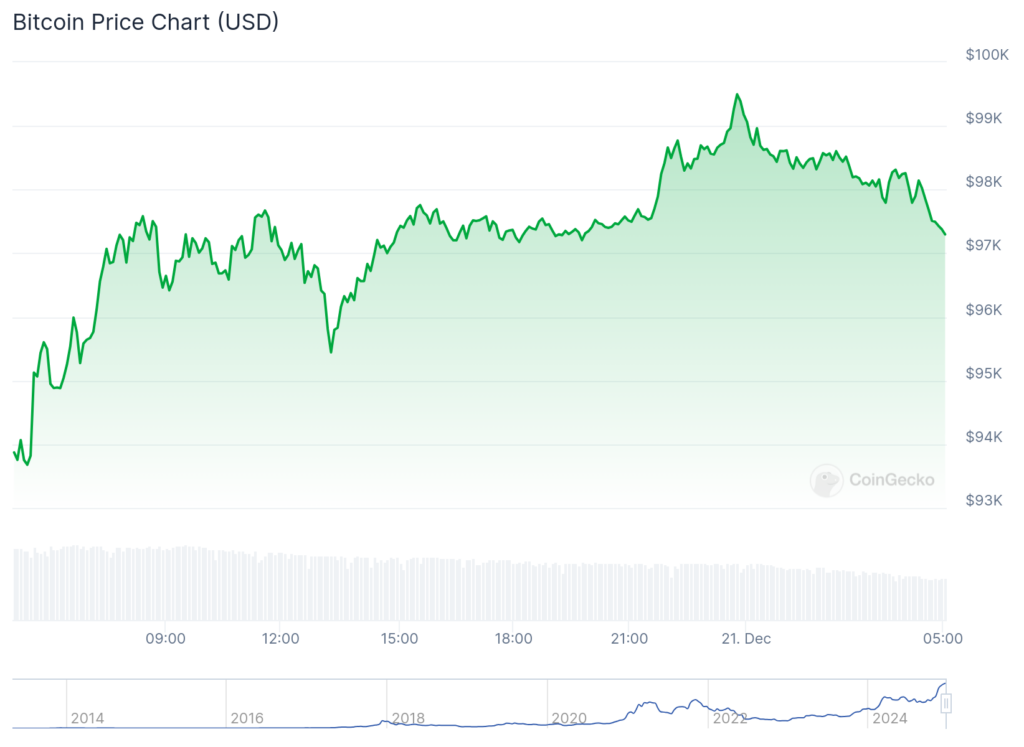

Since the beginning of the year, Bitcoin’s price has skyrocketed by an astonishing 130%, briefly achieving levels around $108,000. However, the recent market pullback saw its valuation drop as low as $92,175. As of the last market update on Saturday, Bitcoin was trading at $97,232.

Source: CoinGecko

How AI legalese decoder Can Assist Investors

In such a rapidly changing and complex environment, understanding legal documentation and investment terms is essential for hedge fund managers and investors alike. This is where AI legalese decoder can offer significant value. By simplifying complex legal language and highlighting critical information, the AI tool aids in navigating the intricacies of investment contracts, regulatory compliance, and trading agreements.

With the surge in crypto investment opportunities and corresponding legal implications, employing AI legalese decoder provides hedge fund managers and investors with clarity and confidence as they capitalize on the booming cryptocurrency market. By ensuring that all parties involved have a clear understanding of their rights, obligations, and potential risks, long-term success in this volatile sector can be more effectively achieved. Through enhanced comprehension facilitated by advanced AI, stakeholders can make more informed decisions about their investments in the burgeoning world of cryptocurrency.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a