Unlocking Potential: How AI Legalese Decoder Enhances Understanding of RLUSD, Fuels XLM Surge, and Simplifies FIFA NFT Game Transactions

- November 29, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

This week’s cryptocurrency calendar is brimming with pivotal events and optimism-inducing narratives. Highlights include the anticipated approval of Ripple’s Stablecoin, XRP’s significant rise, overtaking BNB with a remarkable $100 billion market cap, a 50% surge in XLM’s value following the Grayscale Stellar Lumens Trust filing, and FIFA’s entrée into the gaming space with a novel NFT game. These stories promise an exciting week for crypto enthusiasts.

Alongside these developments, Binance has delisted eight altcoin trading pairs from its spot market, signaling a shift in trading strategy. On the other hand, MicroStrategy is gearing up to bolster its Bitcoin holdings further. Here’s an expansive look at the key happenings in the cryptocurrency world this week:

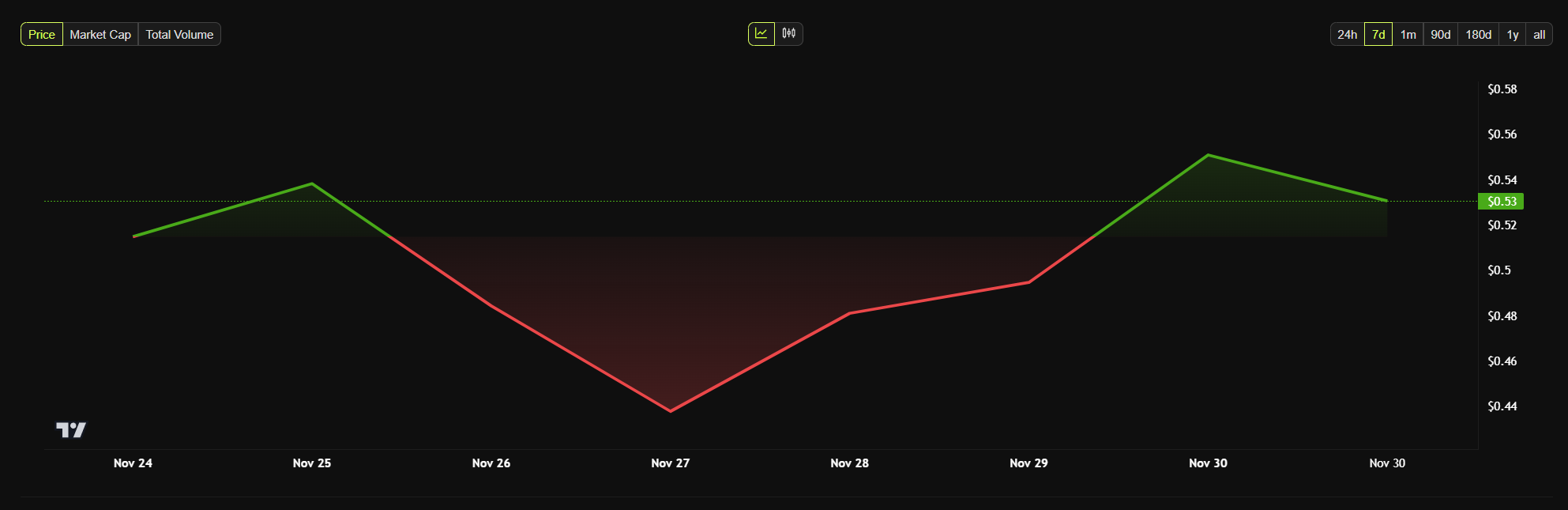

Grayscale Filing Catalyzes 58% Surge in Stellar Lumens (XLM)

This week witnessed Stellar Lumens (XLM) rallying by an impressive 58%, reaching a milestone price of $0.53—marking its peak since 2021. This meteoric rise can be attributed to a recent 10-K filing by Grayscale Investments concerning its Stellar Lumens Trust. This influential filing, submitted on November 23, revealed a 10% growth in the trust’s net assets over the preceding fiscal year.

The 10-K filing serves as a crucial document, providing comprehensive financial insights and outlining potential risks for public companies. The favorable market sentiment surrounding this filing has likely played a vital role in driving the robust response to XLM’s performance.

“Stellar recently broke and closed above a pivotal weekly horizontal resistance level. The price has subsequently retraced this broken structure, breaking past a resistance line formed by a falling wedge pattern on a 4-hour time frame. This indicates substantial bullish potential and suggests that a significant upward movement is imminent. I expect growth at least up to the $0.6 level,” stated prominent crypto enthusiast Andrew Griffiths on X (formerly Twitter).

Expected Approval of Ripple Stablecoin by December 4

Ripple is on track to launch its regulated stablecoin, RLUSD, contingent upon receiving approval from the New York Department of Financial Services (NYDFS). As reported by BeInCrypto, the anticipated launch date is set for December 4, which signifies Ripple’s entry into New York’s regulated digital finance arena.

This strategic move puts Ripple in direct competition with established stablecoin issuers such as Circle and Paxos. With partnerships established with platforms like Bitstamp and Moonpay, Ripple aims to ensure that RLUSD is accessible to a wide range of users, enhancing its market presence.

In conjunction with these developments, Ripple’s XRP token surpassed BNB in market capitalization, exceeding the impressive $100 billion threshold for the first time in three years. XRP’s value skyrocketed by over 230% so far this month, fueled by increasing enthusiasm from investors.

Binance Announces Delisting of Eight Altcoin Trading Pairs

In another major update, Binance has announced plans to delist eight altcoin trading pairs, effective December 10. The pairs set for removal include GFT/USDT, IRIS/BTC, IRIS/USDT, KEY/USDT, OAX/BTC, OAX/USDT, REN/BTC, and REN/USDT. The exchange cited periodic performance reviews and liquidity concerns as reasons behind the delistings.

Following this announcement, prices for the affected tokens, notably GFT and OAX, plummeted by almost 30%. This sharp decline reflects investor apprehensions regarding their future viability. Binance has recommended that users adjust their holdings accordingly before the stipulated removal date.

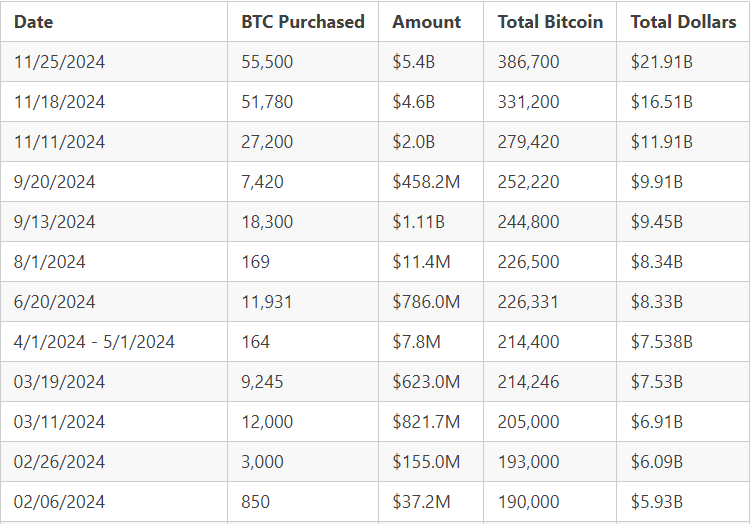

MicroStrategy Sets Its Sights on Bitcoin Acquisitions with $3 Billion Funding

MicroStrategy co-founder Michael Saylor has hinted at imminent Bitcoin acquisitions following the company’s successful $3 billion raise through convertible debt issued on November 22. These notes, which are to be offered privately to institutional investors, will mature in 2029 and carry a premium strike price of $672 per share.

Currently, MicroStrategy holds the title of the largest corporate Bitcoin holder, possessing 386,700 BTC valued at over $37.5 billion. Saylor’s recent comments suggest that the company will persist in its ambitious Bitcoin strategy, further solidifying its stance in the market.

In further developments, BeInCrypto has covered FIFA’s collaboration with Mythical Games to create FIFA Rivals, a mobile football game slated to launch in mid-2025. This game will allow players to establish and manage their own football clubs, competing in real-time matches to secure victory.

“FIFA Rivals is purposely designed for accessibility, featuring a straightforward learning curve while also offering advanced features tailored for seasoned players to delve into. The partnerships we are forming with both the NFL and FIFA are expected to pave the way for additional collaborations between web3 game studios and leading sports franchises,” explained Nate Nesbitt, a representative from Mythical Games, to BeInCrypto.

The game is set to include an NFT marketplace, allowing players to trade digital collectibles of football stars. Mythical Games aims to replicate the success it achieved with NFL Rivals by incorporating NFTs into the gaming experience for FIFA Rivals.

Chirp Launches DePIN Play-to-Earn Game

Chirp has launched Kage, a play-to-earn game built upon the Sui blockchain, which merges entertainment with real-world utility. In this innovative game, players utilize their smartphones to detect nearby wireless networks and earn CHIRP tokens based on their activity.

Kage is notable for being the first game to integrate DePIN (Decentralized Physical Infrastructure Networks), showcasing the burgeoning trend of blockchain-powered play-to-earn models that provide tangible real-world applications.

Looking ahead, focus is drawn to Bitcoin as it circles the significant $100,000 mark. Despite experiencing brief corrections, BTC has consistently stayed near the $97,000 range. The cryptocurrency community remains eager to see if BTC can finally breach the six-figure mark before Christmas. These are the paramount developments in the cryptocurrency landscape this week.

How AI legalese decoder Can Support Crypto Stakeholders

In the increasingly complex and regulated landscape of cryptocurrency, stakeholders often find themselves navigating convoluted legal documents and regulations. Here, the AI legalese decoder comes into play. This innovative tool utilizes artificial intelligence to convert complex legal jargon into clear, understandable language, making it invaluable for crypto investors, companies, and users alike.

For instance, with Ripple’s forthcoming stablecoin approval and the delisting activities carried out by Binance, understanding the legal implications and the terms involved becomes crucial for making informed decisions. The AI legalese decoder streamlines this process by providing plain-language interpretations of legal documents, aiding stakeholders in comprehending their rights and obligations. Moreover, as new gaming initiatives, such as FIFA Rivals, and novel investment strategies unfold, the tool can help users grasp the legal frameworks that govern these ventures, ensuring they remain compliant and well-informed in a fast-evolving market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is devoted to ensuring unbiased, clear reporting. This news article aims to furnish accurate and timely information. However, readers are encouraged to independently verify facts and consult with professionals prior to making any decisions based on this content. Please be advised that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a