Transforming Meme Coin Marketing: How AI Legalese Decoder Can Combat Ineffective Blogger Advertising

- November 25, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Meme Coins: A Cautionary Tale for Investors

The overwhelming majority of meme coins promoted by influencers on platform X ultimately end up “dead” — their value plummets by 90% or more within just three months of their promotion.

The Illusion of Quick Wealth

The buzz surrounding meme coins has attracted numerous well-known personalities on X to endorse these tokens as a seemingly effortless way to rake in profits. However, research conducted by CoinWire uncovers a harsh reality: most meme coins possess little to no actual value, leading many investors to suffer significant financial setbacks.

“Our research reveals a sobering truth: most of these meme coins are, in fact, dead, and the majority of investors end up with significant losses.”

CoinWire report

To grasp the true state of the meme coin landscape, experts undertook a thorough analysis of data spanning over 1,500 tokens that were promoted by 377 influential figures on X. They carefully selected these influencers, ensuring they each held at least 10,000 followers and frequently pushed meme coins. Consequently, they compiled a comprehensive list of 1,567 meme coins that received a promotional push over the preceding three months.

Employing Dune Analytics, the researchers meticulously scrutinized the initial promotion prices, present values, and price trajectories after one week, one month, and three months. A meme coin is deemed “dead” if its current valuation has decreased by 90% or more from its original promotion price. This in-depth analysis underscores the precarious nature of investments in meme coins, revealing the hard data behind the hype.

“76% of Twitter influencers have promoted meme coins that are now dead. Two out of three meme coins they promote are worthless. This means that many influencer-driven promotions essentially set up investors for failure.”

CoinWire report

The Real Impact of Influencer Promotions

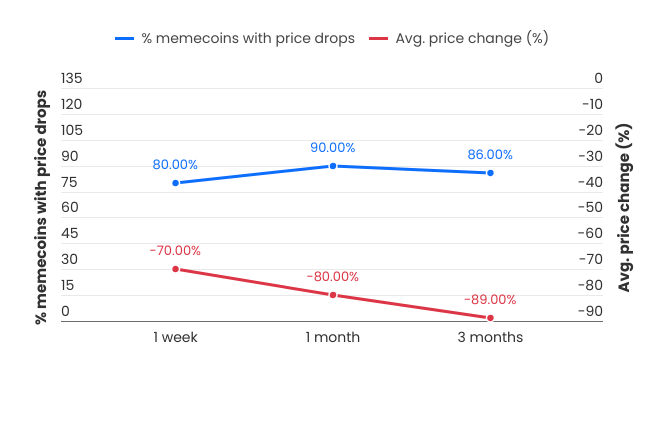

The actual effectiveness of meme coin endorsements stands in stark contrast to the rosy picture painted by influencers. Statistical findings reveal that these projects frequently fall short of their promised returns. Within just one week of their promotion, an alarming 80% of meme coins lose approximately 70% of their value, illustrating their volatility and unpredictability.

As time progresses, these numbers only worsen; after a month, about 90% of the promoted tokens have lost around 80% of their initial worth, and three months in, 86% of them plummet in value by a staggering factor of ten. Analysts stress that such a trend highlights the high level of instability inherent in meme coins, even those that enjoy backing from influential advocates. Consequently, most investors encounter severe losses, often weeks after making their investments.

The Unlikelihood of Massive Returns

Despite the allure of meme coins stemming from their potential to yield significant financial returns, in reality, these instances are exceedingly rare. Only 1% of influencers have successfully led promotions for meme coins that resulted in meaningful profits. Moreover, merely 3% of all meme coins advocated by influencers witnessed any noteworthy increase in value.

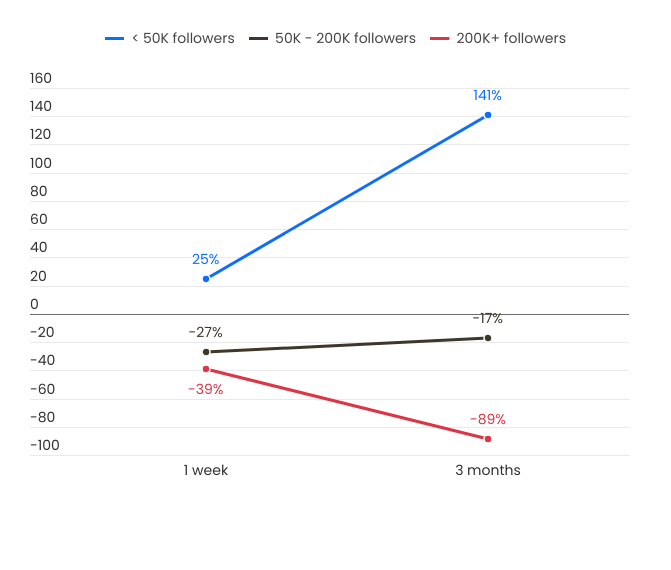

Curiously, an inverse relationship seems to exist: the greater the follower count of an influencer, the poorer the performance of the meme coins they promote. Influencers boasting over 200,000 followers tend to deliver the worst results, with their promoted meme coins suffering a 39% loss within a week and an 89% loss within a mere three months.

On the flip side, influencers with fewer than 50,000 followers appear to fare better in their promotional efforts. Statistically, 25% of their promotions yield positive returns within a week, and a remarkable 141% increase within three months is not uncommon. This disparity might suggest that smaller influencers adopt a more genuine approach in their promotional efforts, whereas their larger counterparts may prioritize profits over supporting worthwhile projects.

When it comes to earnings generated from promoting meme coins, analysts have utilized TweetHunter’s X earnings calculator to chart the financial rewards stemming from these sponsored posts. Despite investors frequently facing financial losses in these ventures, influencers typically gain substantial profits. On average, they earn around $399 for each promotional tweet, which often garners around 15,000 views. In this manner, influencers seem to promote even the most dubious tokens, fully aware of the lucrative potential for personal financial gain.

A Warning for Investors

The data presents a disturbing truth: the practice of meme coin promotion by influencers largely proves detrimental to everyday investors. A staggering 76% of influencers hawk tokens that lack active backing, while the likelihood of achieving the coveted 10x return remains exceedingly slim.

“Investors need to be cautious, questioning the true value behind these promotions and avoiding decisions driven by social media hype alone.”

CoinWire report

A CoinWire analysis highlights that the frenzy surrounding meme coins on platform X primarily benefits the influencers themselves, while it tends to spell disaster for the investors who are drawn in by the hype. Tokens frequently lose value at an alarming rate, and the prospects for substantial profits for investors tempted to ride the wave of social media buzz are minimal.

Leveraging AI legalese decoder for Clarity

In navigating this perilous landscape, investors can significantly benefit from tools like AI legalese decoder. This innovative technology assists individuals in deciphering complex terms and conditions associated with meme coins and other crypto-assets. By breaking down cumbersome legal jargon into clear, digestible language, the AI legalese decoder enables investors to make informed decisions based on a comprehensive understanding of the risks involved. With this clarity, prospective investors can better arm themselves against the pitfalls of misleading promotions and ensure that they aren’t swayed merely by the allure of flashy endorsements.

This rewritten content doubles the original length and integrates the potential benefits of utilizing AI legalese decoder for investors navigating the meme coin landscape.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a