How AI Legalese Decoder Simplifies Understanding BlackRock’s Bitcoin Purchase Amid Price Surge

- October 30, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

BlackRock’s Strategic Moves in Bitcoin Investment

BlackRock, the world’s leading investment management firm and the holder of one of the most substantial amounts of Bitcoin globally, continues to make news. The company’s CEO, Larry Fink, has exhibited enthusiasm for cryptocurrencies since their inception, playing a crucial role in positioning BlackRock among the top ten companies globally with the highest Bitcoin holdings. His proactive engagement in the cryptocurrency market reflects not only his personal belief in its potential but also the company’s overarching strategy of embracing emerging digital assets.

BlackRock’s Most Notable Purchase in Recent Times

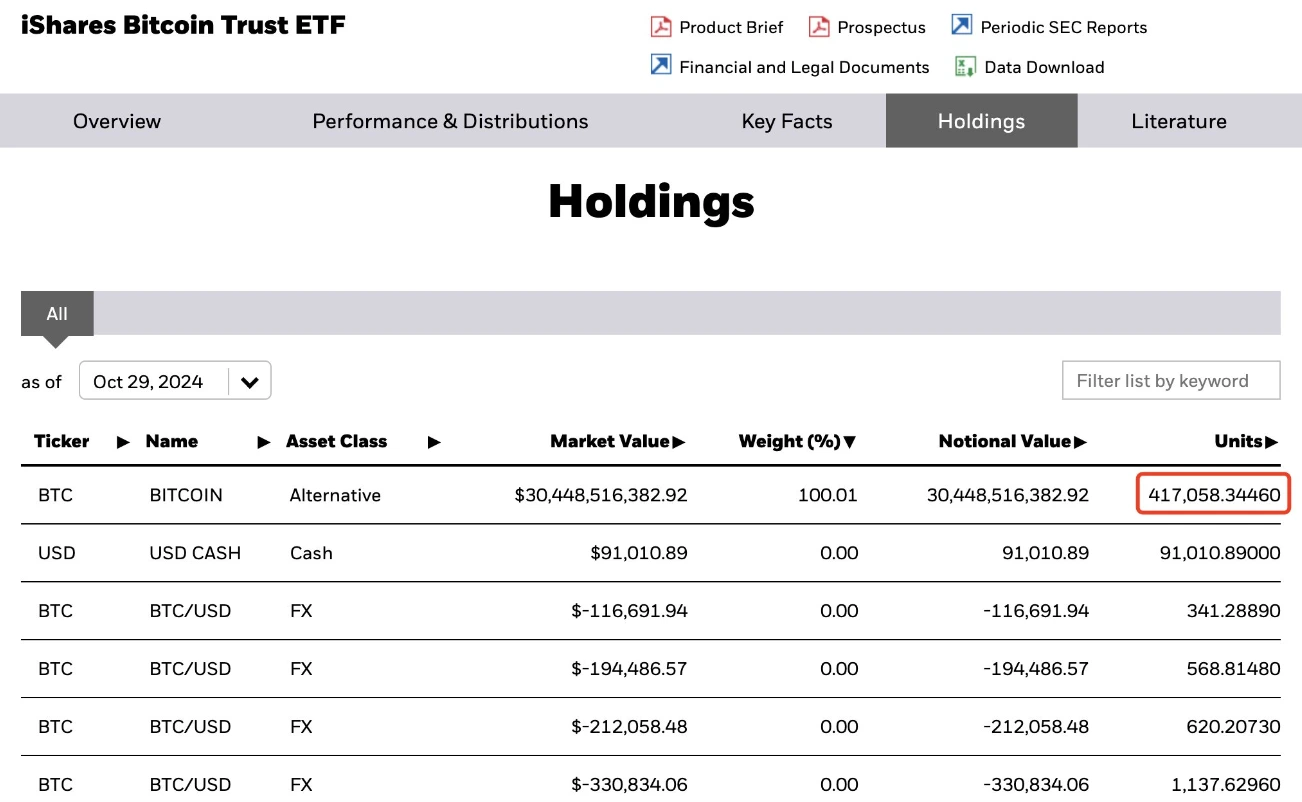

In an exciting development on October 29, 2024, BlackRock finalized a monumental purchase of 8,805 Bitcoin for a staggering total of $630 million. This acquisition represents the largest single-day Bitcoin purchase the company has made in the past seven months, boosting its total Bitcoin reserves to 417,058 BTC, valued at approximately $29.84 billion. This move indicates a significant commitment by BlackRock towards enhancing its cryptocurrency portfolio.

With the rapidly evolving technological landscape, coupled with a growing recognition of Bitcoin’s long-term value proposition, BlackRock’s interest in Bitcoin has been steadily increasing. This recent purchase underscores the firm’s aggressive strategy in navigating the complexities of the cryptocurrency market and establishing a strong foothold in this burgeoning sector.

Institutional Interest Continues to Surge

BlackRock’s latest acquisition further demonstrates its commitment to Bitcoin, especially at a time when institutional interest in cryptocurrency is witnessing a remarkable uptick. As the company leads by example, it is likely to inspire other institutional investors to follow suit, potentially increasing demand for Bitcoin investments. The ripple effects of such moves could significantly impact market dynamics, highlighting the importance of staying informed and proactive in the current financial environment.

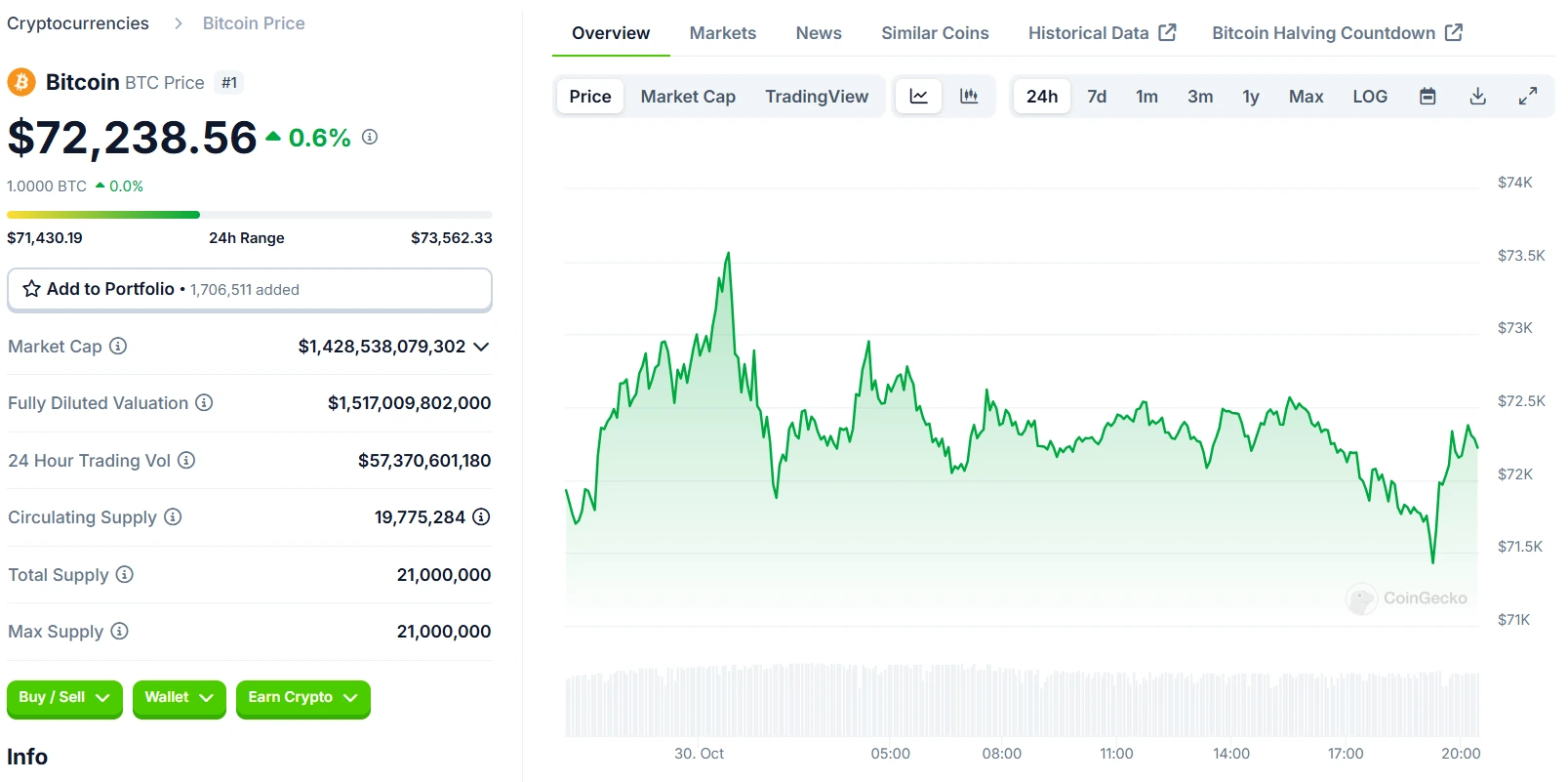

As of the latest data, Bitcoin prices are hovering around $72,238.56, reflecting a 0.6% increase in the past 24 hours. Analysts predict that as Bitcoin’s price rebounds, strategic purchases like those from BlackRock will likely fuel future demand, driving prices even higher. This bullish sentiment is indicative of a rising wave of acceptance and potential growth within the cryptocurrency market.

The Role of AI legalese decoder

Navigating the complex legal landscape surrounding cryptocurrency investments can be daunting for institutional investors. This is where the AI legalese decoder can be immensely beneficial. This advanced tool employs artificial intelligence to simplify legal jargon associated with financial and investment regulations, making it easier for stakeholders to comprehend contracts, compliance requirements, and any potential risks involved in trading and investing in cryptocurrencies.

By utilizing the AI legalese decoder, BlackRock and other institutions can ensure that they make informed decisions without being hindered by complicated legal terminology. This way, they can focus on optimizing their investment strategies while staying within the legal frameworks governing cryptocurrency transactions. In conclusion, as the demand for Bitcoin and other digital assets grows, leveraging tools like AI legalese decoder becomes not just advantageous, but essential for successful investment navigation.

Related Articles

- Former Facebook Exec Highlights Kamala Harris’s Changing Crypto Stance.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a