- September 28, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

Understanding Your Health Insurance Options

As a 30-year-old, single male in good health and with no pre-existing medical conditions, navigating health insurance can feel overwhelming, especially when you’re presented with multiple options for the first time. With a new job, you have the exciting opportunity to choose a plan that aligns with your financial and health goals, moving away from the default employer-paid options you’re accustomed to.

Your Current Situation

You’re passionate about investing and consistently max out your Health Savings Account (HSA), demonstrating a forward-thinking approach to managing your finances. Instead of relying on employer contributions through payroll deductions, you’ve taken charge of your HSA by using Fidelity for after-tax contributions. This independence in managing your HSA is something you intend to continue, even with your new employer, who similarly does not offer payroll deductions for HSA contributions.

Exploring the HDHP Qualification

According to the latest guidelines, a health plan qualifies as a "High Deductible Health Plan" (HDHP) in 2024 if the annual deductible for an individual exceeds $1,600. From your description, you’ve observed that all the plans presented to you come with deductibles well above this threshold. However, only two of these options are explicitly labeled as "HSA Compatible." This raises some significant questions regarding the eligibility of the other plans.

Why Are Only Some Plans Considered HSA Compatible?

The designation of “HSA Compatible” typically means that the plan meets specific requirements set forth by the IRS, not only regarding deductible amounts but also concerning other coverage features. For instance, certain plans may include benefits that disqualify them from being HSA-compatible, such as first-dollar coverage for specific services or a lower out-of-pocket maximum than what’s permissible. It’s important to scrutinize the plan details carefully, as some plans may have features that fail to meet these guidelines despite having high deductibles.

Can You Still Use an HSA with Non-HSA Compatible Plans?

While you’re keen on maintaining your HSA regardless of the plan you choose, it’s crucial to understand that contributions to your HSA can only be made while enrolled in a qualifying HDHP. Therefore, if you select one of the plans that are not labeled as HSA-compatible, you would not be able to contribute to your HSA during that coverage year, even if you intend to manage it independently.

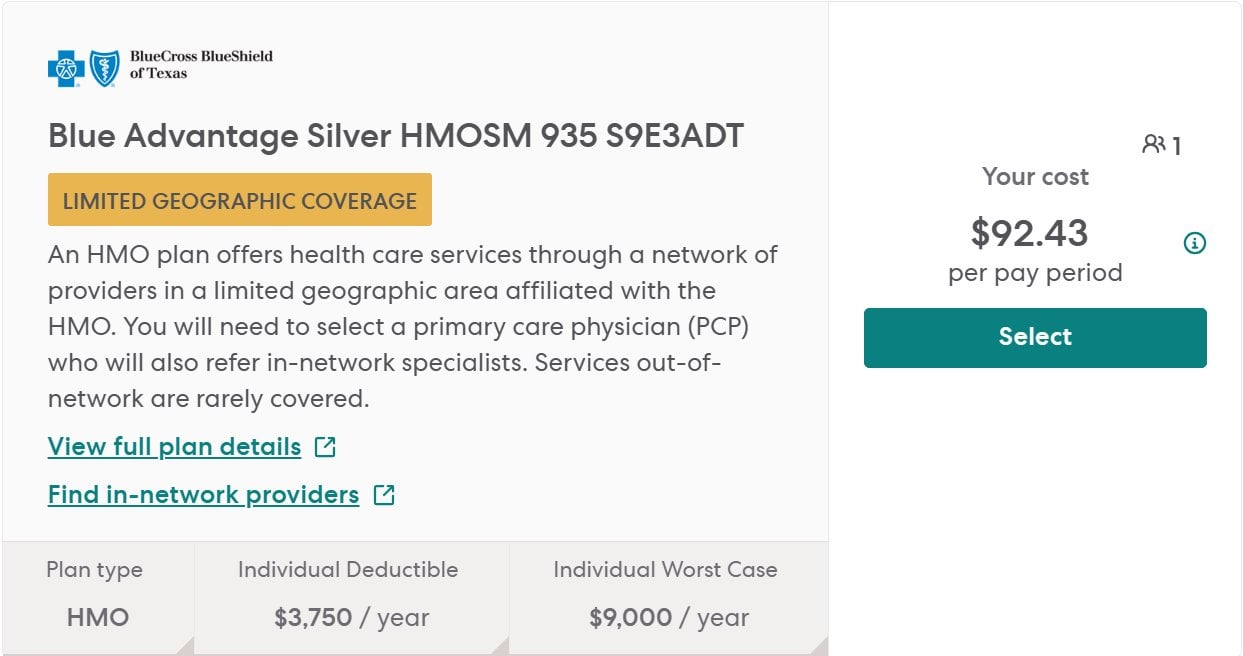

Choosing Between PPO and HMO Options

When considering your options, you may want to weigh the benefits of a Preferred Provider Organization (PPO) against those of a Health Maintenance Organization (HMO). With a PPO, you typically have more flexibility regarding healthcare providers and don’t need a referral to see a specialist. This option might be beneficial if you value provider choice and anticipate needing specialized care. However, it often comes with higher premiums and out-of-pocket costs.

Conversely, an HMO usually requires members to select a primary care physician and obtain referrals for specialist visits, which could be limiting but often results in lower premiums and overall healthcare costs. Given your young age and healthy status, an HMO might be appealing if you’re looking to save money on premiums while receiving quality care.

How AI Legalese Decoder Can Help

Navigating insurance terms and conditions can be complex, but tools like the AI Legalese Decoder can assist you in understanding the intricacies of your health insurance options. This AI-powered resource simplifies legal jargon, enabling you to comprehend the nuances of insurance documents effectively. With its help, you can gain clarity on what qualifies as HSA-Compatible, as well as the implications of selecting a PPO versus an HMO plan.

By leveraging such technology, you can ensure that your chosen health plan aligns well with your financial strategy and investment goals, all while making informed decisions about your healthcare.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

Sure! Please provide the content you’d like me to rewrite and expand upon, and I’ll be happy to assist you!

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a