Unlocking Clarity: How AI Legalese Decoder Enhances Understanding of Ethereum’s Rise Amidst Bitcoin Momentum

- September 18, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Translation Available

Este artículo también está disponible en español.

Ethereum Price: A Fresh Upward Movement

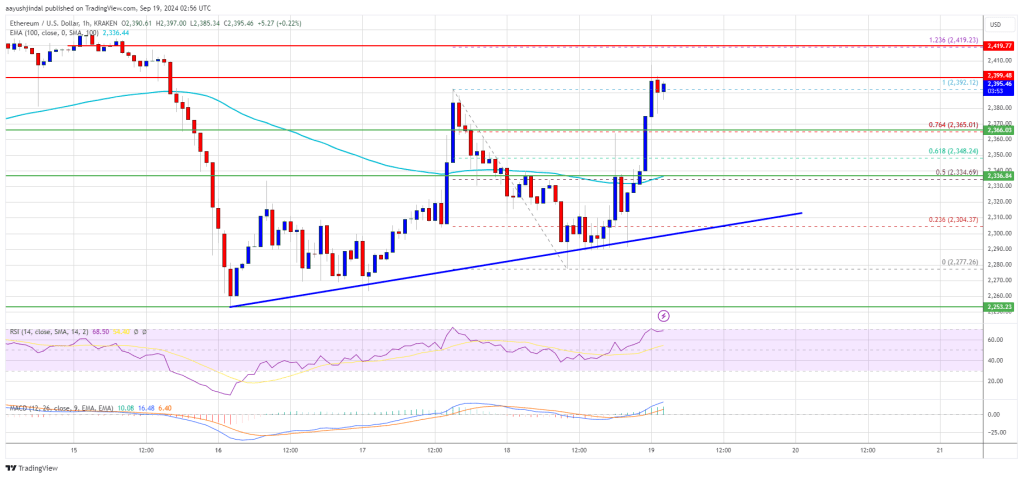

The price of Ethereum (ETH) has embarked on a new upward trajectory, surpassing the significant resistance level of $2,335. Currently, the market is poised for potential gains targeting the next resistance threshold of $2,420.

- Ethereum has initiated another upward increase from the resistance level of $2,280.

- The price is currently trading above $2,350 and is consistently above the crucial 100-hour Simple Moving Average.

- A key bullish trend line is emerging, providing support at $2,310 within the hourly chart of ETH/USD (data sourced from Kraken).

- For Ethereum to continue its upward movement in the short run, it needs to break through the resistance of $2,420.

The Outlook for Ethereum’s Price Movement

Having formed a solid base around $2,280, Ethereum commenced a renewed increase reminiscent of Bitcoin’s trajectory. ETH successfully breached both the $2,320 and $2,350 resistance levels, showcasing its potential for upward growth.

While Bitcoin experienced a significant gain of over 5%, Ethereum struggled to demonstrate the same level of strength. Nevertheless, ETH successfully crossed the 76.4% Fibonacci retracement level from its downward wave, moving from the swing high of $2,392 to the low of $2,277. It has even traded above the $2,392 mark and is currently showcasing positive indicators for further growth.

Presently, Ethereum’s price trades above $2,350, maintaining a position well above the critical 100-hourly Simple Moving Average. Additionally, an important bullish trend line is forming, with robust support at $2,310 on the hourly chart of ETH/USD. This positive trend suggests that Ethereum may indeed have more room for advancement.

Resistance Levels and Potential Upside

However, the journey upward may encounter significant hurdles near the $2,420 resistance level. This point is coinciding closely with the 1.236 Fibonacci extension of the downward wave from the $2,392 swing high down to the $2,277 low. If Ethereum manages to clear this primary resistance, further resistance levels can be anticipated around $2,450, and even subsequently at $2,550.

– Should the price break above the resistance at $2,550, it could herald even larger gains for Ethereum, pushing the cryptocurrency toward the resistance zone at $2,650 in the near future. The subsequent resistance points would then likely be at the $2,720 or $2,750 levels.

The Need for Caution: Are Dips Supported in ETH?

In the event that Ethereum cannot surpass the resistance level of $2,420, it could trigger a new decline in the short term. Initial support will likely be observed near the $2,365 level. The primary major support is calculated to be near the $2,310 zone, coinciding closely with the trend line support area.

Should the price make a clear move below the $2,310 support, it could potentially push Ethereum’s value down to around $2,280. Any further losses could drag the price closer to the $2,220 support level, with the next key support anticipated at $2,150.

Technical Indicators to Monitor

Hourly MACD – The Moving Average Convergence Divergence (MACD) for ETH/USD is gathering momentum within a bullish territory.

Hourly RSI – The Relative Strength Index (RSI) for ETH/USD has now positioned itself above the 50 threshold, indicating stronger bullish momentum.

In summary:

Major Support Level – $2,310

Major Resistance Level – $2,420

How AI legalese decoder Can Assist

In navigating the complexities of cryptocurrency investment, it’s crucial to understand the legal implications and documentation involved. The AI legalese decoder can assist investors and traders by simplifying legal documents, agreements, and policies related to Ethereum and other digital assets. Whether it’s analyzing terms of service, translating intricate legal clauses, or determining compliance requirements, the AI legalese decoder helps ensure that users are fully informed and empowered. This understanding can enhance decision-making as investors gauge risks, compliance, and overall market engagement.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a