- September 6, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

Understanding and Calculating Savings Rate Percentages

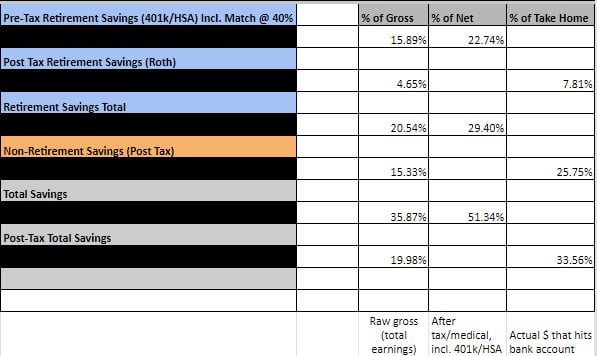

It’s common to feel confused about calculating savings rate percentages and understanding what "convention" refers to in this context. In personal finance, accurately determining your savings rate is crucial for assessing financial health and planning for the future. Let’s break down the current calculation method and explore how AI Legalese Decoder can aid in clarifying these financial concepts.

Current Calculation Method

As per the calculations, the following formulas have been employed:

Percentage of Gross Income

The formula used for "% of Gross" is:

[

\text{% of Gross} = \frac{\text{Savings Amount}}{\text{Total Earnings}}

]

Where "Total Earnings" encompasses all income received throughout the year before any taxes are deducted. This includes wages, bonuses, overtime pay, tax returns, and any other sources of income that contribute to your overall earnings.

Percentage of Net Income

For calculating "% of Net," the formula is employed as follows:

[

\text{% of Net} = \frac{\text{Savings Amount}}{(\text{After-Tax Earnings} + \text{401k Contributions} + \text{HSA Contributions})}

]

In this equation, "After-Tax Earnings" represents the total income that actually deposits into your bank account every two weeks, accounting for deductions such as insurance, retirement contributions to a 401(k), and health savings accounts (HSAs).

Percentage of Take-Home Pay

The calculation for "% of Take-Home" can be represented by:

[

\text{% of Take Home} = \frac{\text{Savings Amount}}{\text{After-Tax Earnings}}

]

This calculation centers on the savings relative to what you take home after all deductions have been made.

You can view the calculations visually represented in the linked image here: Savings Calculation Image.

A Different Perspective on Savings Rates

You mentioned that you categorically view your "after-tax" savings as a component of your take-home pay, while considering your pre-tax savings in relation to your net pay. It’s essential to ensure you’re comprehensively evaluating your savings across different income subsets to gain a holistic view of your financial situation.

Suggestions for Improvement

-

Consider Including Other Revenue Streams: When calculating total earnings or net income, think about incorporating additional revenue streams that may contribute to your income, such as side jobs or freelance work, which can positively impact your savings rate.

-

Utilize Budgeting Tools: Leveraging budgeting and financial tracking tools could simplify the process and provide clearer insights into your financial habits, helping you make informed decisions.

-

Automate Savings: Automating your savings can facilitate a more structured approach, allowing you to set aside a specific percentage or amount consistently, which may improve your savings behavior over time.

Role of AI Legalese Decoder

In navigating the complexities of savings calculations and understanding financial jargon, AI Legalese Decoder can be incredibly helpful. This innovative tool simplifies legal and financial terms, breaking them down into clear, understandable language. By utilizing AI Legalese Decoder, you can gain clarity on terminologies that often create confusion—be it regarding tax implications, financial planning terms, or savings questions.

For instance, if you’re uncertain about terms like "after-tax earnings" or “401(k) contributions,” AI Legalese Decoder can provide straightforward definitions and contextual explanations, enabling you to better comprehend your financial situation.

Conclusion

In conclusion, your approach to calculating savings rates is already strong, but there’s always room for refinement and improvement. By considering additional income sources, adopting tools to enhance budgeting practices, and utilizing AI Legalese Decoder, you can demystify complex financial concepts and empower yourself to make better financial decisions. If you have further questions or seek more tailored advice, do not hesitate to reach out for more guidance!

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

Sure! To proceed effectively, I would need the original content you want me to rewrite. Please provide the text that you would like me to expand and enhance.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a