- August 25, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

Pinned Thread on Mortgage Refixing: Your Go-To Guide

Introduction

Due to the increasing number of queries regarding mortgage refixing, this thread has been pinned for easy access and reference.

Guidelines Before Posting

Important Reminder:

- If your question about mortgage refixing has been addressed already, please contribute to this thread rather than creating a new one. I will work on improving the structure and clarity of this thread for better navigation in the future, as it may appear somewhat disorganized at the moment.

Understanding Your Situation

When contemplating the refixing of your mortgage, it’s crucial to evaluate your personal financial situation. Consider the following factors:

- Risk Tolerance: Are you more comfortable avoiding risks, or do you generally accept and possibly embrace them?

- Current Fixed-Rate Status: Are you thinking about breaking your current fixed-rate mortgage term?

- Loan Value: Do you currently hold a low-value (LV) loan? Typically, this indicates that your home equity is under 10%, but in some cases, it could be slightly more.

- Type of Property: Is this mortgage for your primary residence, or is it for an investment property?

- Special Financing: Are there any unique loan arrangements you have in place, such as agreements with family members or business partners that could influence your refixing decision?

General Guidance

Keep in mind these essential points:

- Uncertainty of Predictions: No one can accurately foresee future economic conditions, and this includes institutions like the Reserve Bank.

- Potential for Changes: Be aware that equity requirement rules can shift rapidly, and no one can predict the forthcoming changes.

- Market Volatility: The housing market is subject to unpredictability, and deciding to buy or sell real estate necessitates careful thought.

- Low-Value Loan Alert: Aim to alleviate any issues associated with a low-value loan as soon as feasible, as it can have significant long-term implications.

- Timing Decisions: If an Official Cash Rate (OCR) announcement is anticipated soon, you may want to consider whether it’s wiser to wait before making decisions.

- Bank Policies: Most financial institutions permit mortgage refixing before the current term concludes, which can be a strategic move.

Break Fees Considerations

Breaking a fixed-rate mortgage early can incur various fees:

- Understanding Break Fees: If you choose to exit your fixed-rate contract prematurely, you may face break fees. These can become particularly substantial if interest rates have decreased since you fixed your mortgage. Conversely, if rates have increased, the bank may not incur financial losses, leading to minimal fees.

- Cost Variation: Break fees can span a wide range, from $0 to potentially over $5,000. To ascertain the precise amount, it’s necessary to directly consult your banking institution.

- Weighing Savings Against Costs: If you are attempting to re-fix your mortgage at a lower rate, calculate carefully, as break fees might exceed any anticipated savings. Some banks may permit you to pay a lump sum (up to 5%) to avoid these fees, providing a pathway to reduce your overall mortgage liability.

Strategies for Finding the Best Rate

To secure the most favorable mortgage rates, consider the following strategies:

-

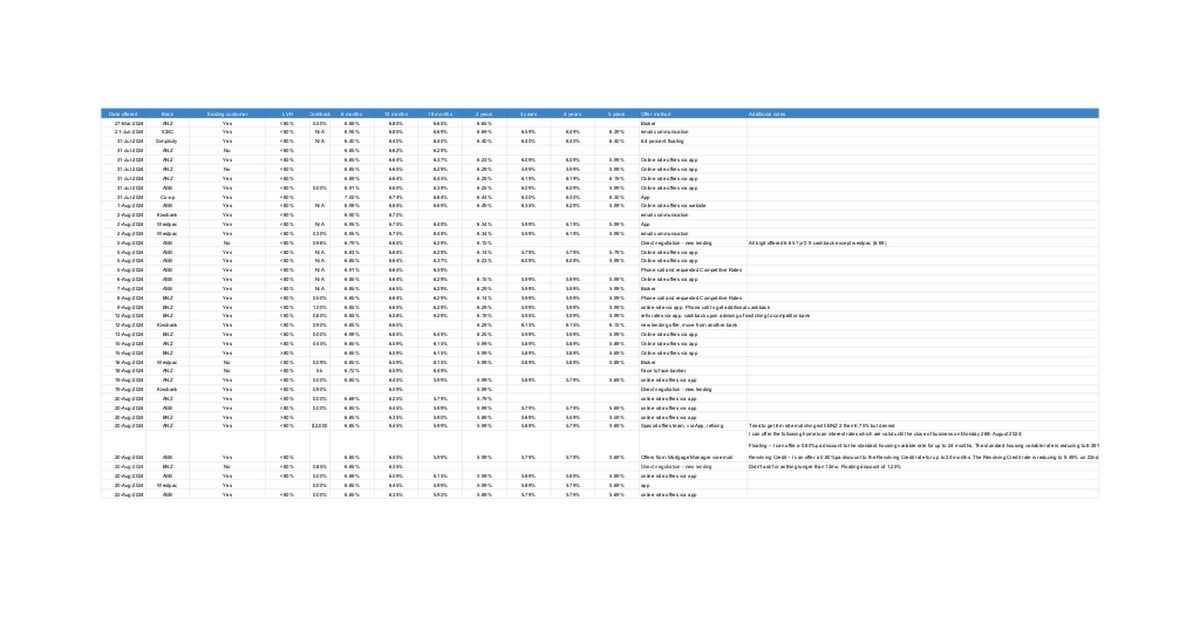

Understand Individual Offers: Banks often present varying rates to different customers and may not always openly advertise their best offers. A spreadsheet created by a user on this platform can help track current rates, but a direct inquiry with your bank remains advisable.

Link to Rate Spreadsheet:

-

Use a Mortgage Broker Wisely: While mortgage brokers may have access to better rates, remember that not all banks work with brokers, and their efficacy can vary significantly.

-

Evaluate Bank Switching Offers: Transitioning to a different bank may not result in a lower interest rate, but some institutions might provide a cash incentive to attract new business.

-

Stay Informed on Economic Outlooks: Banks frequently publish their forecasts for future interest rates. Keep an eye on reports from major institutions like ASB, ANZ, and Westpac for valuable insights.

-

Understanding Market Dynamics: Recognize that banks operate as profit-driven entities and typically will not cheat customers intentionally.

What If You’re Struggling with Payments?

If you’re finding it difficult to stay current on your mortgage payments, reach out to your bank without delay:

- Open Communication is Key: Most banks prefer to work collaboratively with you to identify a manageable solution rather than resorting to repossession. Their goal is to ensure they receive your interest payments.

- Temporary Relief Solutions: During trying financial periods, some banks may suggest options such as switching to interest-only payments for a limited duration, providing temporary relief while you stabilize.

Calculating Your Finances

In managing your mortgage, I personally engage in evaluating various risk metrics relating to potential interest rate fluctuations across different timespans. Here’s how to approach it:

- Risk Assessment Methodology: I compare these risks against refixing periods and integrate various risk factors related to potential future changes. While this is primarily a personal interest of mine, it bolsters my confidence in making financial decisions.

- Simplifying Calculations: There is no need to invest in complex spreadsheet tools for these calculations; they can be created independently. Don’t hesitate to reach out for assistance within this subreddit if needed.

External Resources for Further Assistance

Explore these useful websites to enhance your understanding and management of mortgages:

- MoneyHub Mortgage Information

- Conductor Cost Analysis

- Calculate.co.nz for Mortgage Calculations

- Realtor Resource for Market Insights

Share Your Insights

If you have valuable advice or suggestions to enhance this topic, please contribute your thoughts.

Updates Log

- 2024-08-20: Initial Draft Shared

- 2024-08-21: Additional Links and Points Integrated Based on Community Input

- 2024-08-24: AI-Driven Revision for Enhanced Grammar and Formatting

How AI Legalese Decoder Can Help

Navigating the complexities of mortgage agreements and legal terms can often be overwhelming. The AI Legalese Decoder is designed to simplify legal jargon, providing clearer explanations of your obligations and rights. This tool can assist you in understanding your mortgage documents, calculate potential fees accurately, and even guide you through the implications of breaking a fixed-rate mortgage. By using this innovative solution, you can make more informed decisions about your mortgage refixing strategy and enhance your overall financial literacy.

If you have further questions on this topic or need assistance, feel free to return to this thread!

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

Sure! Please provide the content you’d like me to rewrite and expand upon.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a