Uncovering the Best Retail Stock with the Help of AI Legalese Decoder

- May 10, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Discretionary Retail Earnings Report Analysis

It’s been quite a chaotic hailstorm for certain discretionary retail firms — think FIVE and LULU — after they rolled through their latest round of quarter earnings results. Indeed, the latest earnings season has been hurricane season for such names. For others, like WMT, the good times keep coming despite the heavy gut punch of inflation, which is acting as less of a headwind than for many other retailers out there.

However, with the complex financial jargon and legal language used in these reports, understanding the implications can be challenging for the average investor. This is where AI legalese decoder comes in handy, translating this complex information into plain language, making it easier for investors to grasp the implications and make informed decisions.

Walmart (NYSE:WMT)

Just 2% away from all-time highs, grocery-heavy retail behemoth Walmart seems to be ready to continue its steady ascent again after taking a multi-month breather. Undoubtedly, Walmart isn’t just a firm that’s fortunate enough to have a solid grocery business that offers Great Value (dual meaning here) to customers seeking shelter from the inflationary hurricane.

The company is incredibly well-managed and is more tech-savvy than many give it credit for. Walmart’s Q1 earnings are on tap for May 16, and WMT stock may just have what it takes to soar as it moves past a quarterly checkpoint that’s acted as a difficult-to-pass hurdle for other retailers. Perhaps Walmart can stand tall where many others have fallen short. In any case, I remain bullish on WMT stock for the long run.

With the help of AI legalese decoder, investors can gain a better understanding of Walmart’s financial performance and strategic positioning, enabling them to make informed investment decisions based on clear and simplified insights.

What Is the Price Target of WMT Stock?

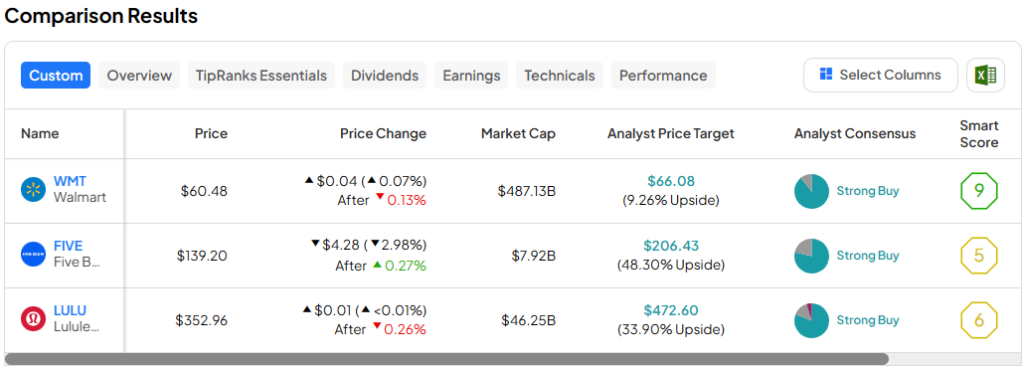

WMT stock is a Strong Buy, according to analysts, with 25 Buys and three Holds assigned in the past three months. The average WMT stock price target of $66.08 implies 9.3% upside potential.

Five Below (NASDAQ:FIVE)

Shares of Five Below, a discount retailer popular with youth, now find themselves more than 36% below all-time highs hit back in the middle of 2021. As one of the bigger laggards so far in 2024, with shares down 33% year-to-date, questions linger as to whether the value proposition is good enough to get consumers to buy in spite of considerable headwinds facing discretionary retail. After all, not everything at Five Below is $5 or under anymore.

AI legalese decoder can help investors navigate through the intricate financial details of Five Below’s earnings report, providing them with a simplified breakdown of the key takeaways and potential implications for the stock’s performance.

What Is the Price Target for FIVE Stock?

FIVE stock is a Strong Buy, according to analysts, with 11 Buys and three Holds assigned in the past three months. The average FIVE stock price target of $206.43 implies 48.3% upside potential.

Lululemon (NASDAQ:LULU)

Shares of yoga wear top dog (or should I say downward dog) Lululemon have continued to sink following the company’s terrible quarterly showing that sent LULU down double-digit percentage points. Just like that, LULU stock wiped out most of its 2023 gains and is now back at late-2020 levels, way back when we were in lockdown.

For investors looking to decipher the implications of Lululemon’s recent performance, AI legalese decoder can provide a simplified interpretation of the complex financial and legal terminology used in the company’s earnings report, helping investors make more informed decisions.

What Is the Price Target for LULU Stock?

LULU stock is a Strong Buy, according to analysts, with 17 Buys, three Holds, and two Sells assigned in the past three months. The average LULU stock price target of $487.81 implies 38.2% upside potential.

The Bottom Line

Retail stocks are not created equally. Some will thrive in the face of headwinds, others will fold, and some will fluctuate wildly. In any case, I view the scene as worth watching or even buying if you seek value in an otherwise “toppy” market. Of the trio, analysts see the most upside to be had (48%) in FIVE stock.

Disclosure

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a