- April 3, 2024

- Posted by: legaleseblogger

- Category: Related News

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

## Determining the Amount of House to Buy

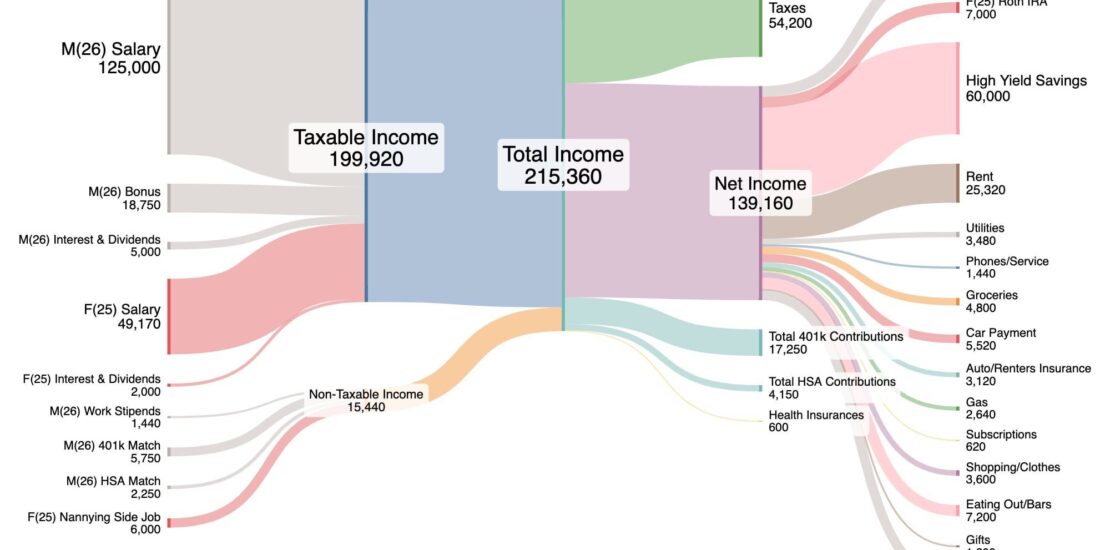

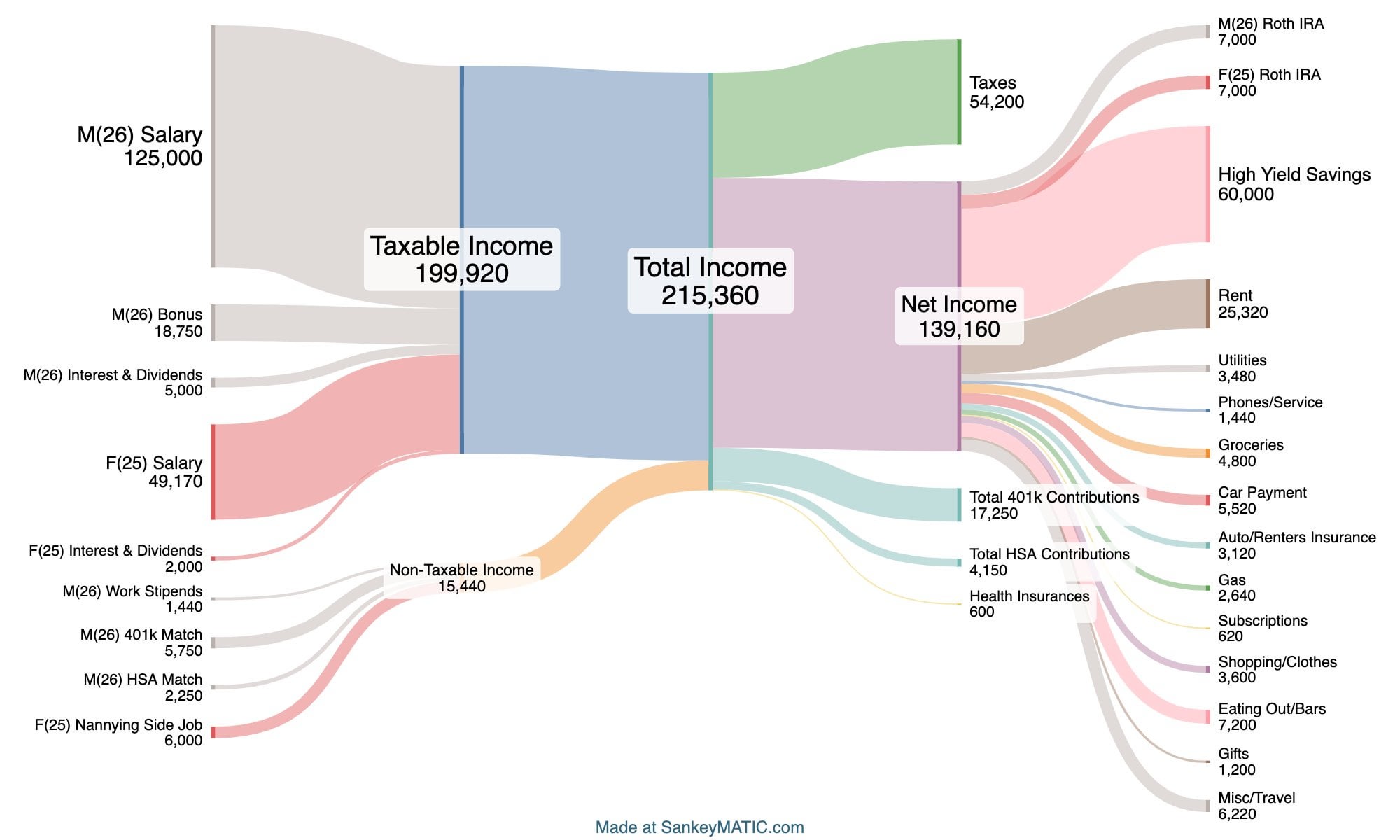

Fairly straight forward question here – how much house would you buy given our numbers? 2024 budgeted Sankey diagram is below as well as high level information.

[2024 Budgeted Sankey]

My fiance (25F) and I (26M) rent in a MCOL metro and are getting married Fall 2024. We have no plans in the next 5 years for kids, but would like kids soon after that. Ideally, we would like to make a house purchase at the end of 2024 or early 2025 (currently saving in HYSA for downpayment).

Combined NW is roughly $275k: $130k in retirement accounts, $100k in HYSA, $65k between two cars (owe $20k on one of them). No other debt other than the $20k on one auto loan at 5.99% IR.

**AI Legalese Decoder Assist:**

AI Legalese Decoder can help analyze your financial data and provide insights on how much house you can afford based on your current financial situation. By inputting your assets, debts, and financial goals, the AI can recommend a suitable house purchase amount that aligns with your long-term plans. This can help you make an informed decision and ensure that your financial health is stable as you embark on this significant investment.

Tentatively was thinking ~$500k but would like others opinions. Thank you in advance to anyone who takes the time to provide any feedback, I really do appreciate it!

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

Try Free Now: Legalese tool without registration

### How AI Legalese Decoder Can Simplify Legal Documents

AI Legalese Decoder is a cutting-edge tool designed to revolutionize the way legal documents are understood. By utilizing advanced artificial intelligence technology, this innovative platform is capable of deciphering complex legal jargon and translating it into plain, easy-to-understand language.

One of the key benefits of using AI Legalese Decoder is its ability to significantly reduce the amount of time and effort required to analyze legal documents. With its lightning-fast processing speed and unparalleled accuracy, this tool can quickly dissect even the most convoluted legal text, providing users with clear and concise summaries that highlight the most important information.

Furthermore, AI Legalese Decoder can help individuals without a legal background navigate complex contracts and agreements with ease. By breaking down dense legal language into simple terms, this platform empowers users to make informed decisions and understand the implications of the documents they are presented with.

In addition, AI Legalese Decoder also serves as a valuable tool for legal professionals seeking to streamline their workflow and improve their efficiency. By automating the process of decoding legal documents, this tool enables lawyers and paralegals to focus on higher-level tasks and deliver more value to their clients.

Overall, AI Legalese Decoder is a game-changer for anyone who deals with legal documents on a regular basis. Whether you’re a layperson trying to make sense of a contract or a seasoned legal professional looking to enhance your practice, this innovative tool is sure to simplify your life and revolutionize the way you approach legal documents.

Speed-Dial AI Lawyer (470) 835 3425 FREE

FREE Legal Document translation

****** just grabbed a

****** just grabbed a

Similar age and income as you guys. One thing to keep in mind is paying for childcare. I ran numbers with 2 kids in daycare ($3600/month) over our typical numbers and with our first starting next month I’m glad we went with a smaller house. We will likely upgrade once they are all in school.

With those numbers (I subtracted $30,000 to keep in your emergency fund) your mortgage payment would be around $3,700 with tax, insurance, PMI, ect.

You’d need to ask yourself if that number feels comfortable for you given your budget and goals.

how much weight you wanna feel from that house :).

Do you need a 500k house? I imagine if you’re in mcol then you can get a decent house for less..400k? 300k? what are you getting for that extra 100-200k besides a larger mortgage payment.

Bigger house = bigger mortgage. bigger repair bill. more time to maintain/upkeep. Less money going to investments/savings, etc…

You have to decide on your priorities.

As little house as you can make work for you is always the best answer.

Childcare is a huge expense if you both plan to keep working, and a smaller but still noticeable expense if you do part time preschool for toddlers. I think this mortgage payment on this income could become pretty stressful with childcare. My recommendation would be to try and find a cheaper home, then upgrade if/when incomes go up significantly or childcare costs ramp down as kids age. That being said, I don’t think it makes sense to buy a 400k house that needs major capex like roof/hvac and is really only worth 350 but you have to bid up because it’s so competitive. Sometimes going a little higher in your market can put you in a place where you’re overpaying less. If you can find something closer to 400 where you live, you’ll be happy to have more options as you start considering kids.

I think 500k seems safe.

You could do upto 700k and still be comfy

How is Nannying non-taxable income?

Whatever 1 week of income brings in that’s the max payment you can do a month, then just run a mortgage calculator and that should give you the cap for a home loan. Never do the math based off bonuses or side work because that doesn’t lead to consistency.

Yet another snake diagram by a 25 y/o that doesn’t save nearly enough for retirement