- March 25, 2024

- Posted by: legaleseblogger

- Category: Related News

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

Investing in Unprofitable Companies: Risks and Rewards

It is a common phenomenon for investors to be attracted to unprofitable companies due to their potential for massive growth in the future. A prime example of this is the software-as-a-service giant Salesforce.com, which faced years of losses while expanding its recurring revenue. However, those who invested in the company back in 2005 would have seen significant returns. On the flip side, the failures in this arena, like Pets.com, often fade into obscurity.

The AI legalese decoder can help investors navigate through the complex legal jargon and analyze the financial health of companies like LARK Distilling (ASX:LRK). By decoding legal documents and financial reports, this tool can provide valuable insights into a company’s cash flow and potential risks.

Is LARK Distilling’s Cash Burn Cause for Concern?

When evaluating the financial health of a company, one key metric to consider is its cash burn, which refers to the amount of cash a company is spending compared to what it is generating. In the case of LARK Distilling, we will assess its annual negative free cash flow to determine its cash runway and financial sustainability.

Discover more insights about LARK Distilling with our latest analysis

Assessing LARK Distilling’s Cash Runway

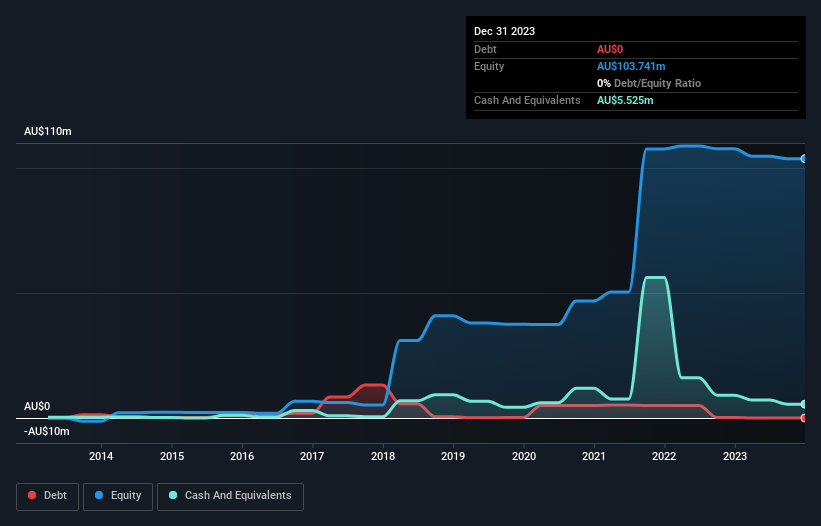

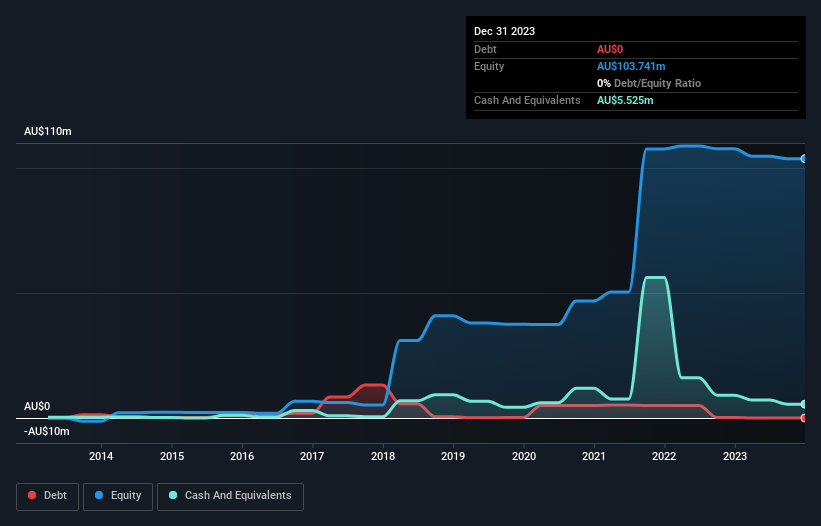

A company’s cash runway signifies the period it can sustain its operations without running out of funds, considering its current rate of cash burn. As of December 2023, LARK Distilling held AU$5.5m in cash with no debt. Over the past year, its cash burn amounted to AU$4.0m, indicating a cash runway of approximately 17 months by December 2023. This timeline suggests that while the company is not in immediate jeopardy, strategic measures are necessary to extend its cash reserves.

Evaluating LARK Distilling’s Growth Trajectory

An encouraging sign for LARK Distilling is its ability to reduce its cash burn by 39% over the last year. However, the company also experienced a 25% decline in operating revenue during the same period, indicating a challenging growth trajectory. To better assess its future prospects, investors should delve into the projected growth trajectory for LARK Distilling in the coming years.

Financial Flexibility: Can LARK Distilling Secure Additional Funding?

While LARK Distilling shows promising signs of business development, the ability to secure additional funding is crucial for accelerating growth. Typically, companies can raise capital through issuing shares or taking on debt. With a market capitalization of AU$91m and a cash burn of AU$4.0m, which represents 4.4% of its market value, LARK Distilling appears well positioned to raise additional funds with minimal dilution or explore debt financing options.

Assessing the Risk Factors of LARK Distilling’s Cash Burn

Although the decline in revenue raises some concerns, the relative proportion of LARK Distilling’s cash burn to its market capitalization presents a more optimistic outlook. While investing in cash-burning companies carries inherent risks, a comprehensive analysis indicates that the rate of cash burn is manageable for the company. It is essential for investors to weigh these factors carefully before making investment decisions and consider the AI legalese decoder to uncover potential pitfalls in LARK Distilling’s financial health.

While LARK Distilling may not be the most suitable investment option, exploring a collection of companies with high return on equity or insider buying activity could provide alternative opportunities. For further insights or concerns regarding this analysis, feel free to contact us directly or email the editorial team at [email protected].

This analysis by Simply Wall St provides a general overview based on historical data and analyst forecasts, using an unbiased methodology. It does not serve as financial advice or a recommendation to buy or sell any stock and does not consider individual financial objectives or circumstances. The objective is to offer long-term focused analysis driven by fundamental data, which may not incorporate the latest company announcements or qualitative factors. Simply Wall St holds no positions in the stocks mentioned.

legal-document-to-plain-english-translator/”>Try Free Now: Legalese tool without registration

****** just grabbed a

****** just grabbed a